Halifax has launched the UK’s first smartphone app which offers a ‘one stop shop’ for UK house hunters. The app combines property search facilities, mortgage affordability calculators, local area information and property buyers’ guides. Available to download on iPhone, the free Halifax Home Finder app uses state of the art technology to revolutionise the way […]

Halifax has launched the UK’s first smartphone app which offers a ‘one stop shop’ for UK house hunters. The app combines property search facilities, mortgage affordability calculators, local area information and property buyers’ guides.

Halifax has launched the UK’s first smartphone app which offers a ‘one stop shop’ for UK house hunters. The app combines property search facilities, mortgage affordability calculators, local area information and property buyers’ guides.

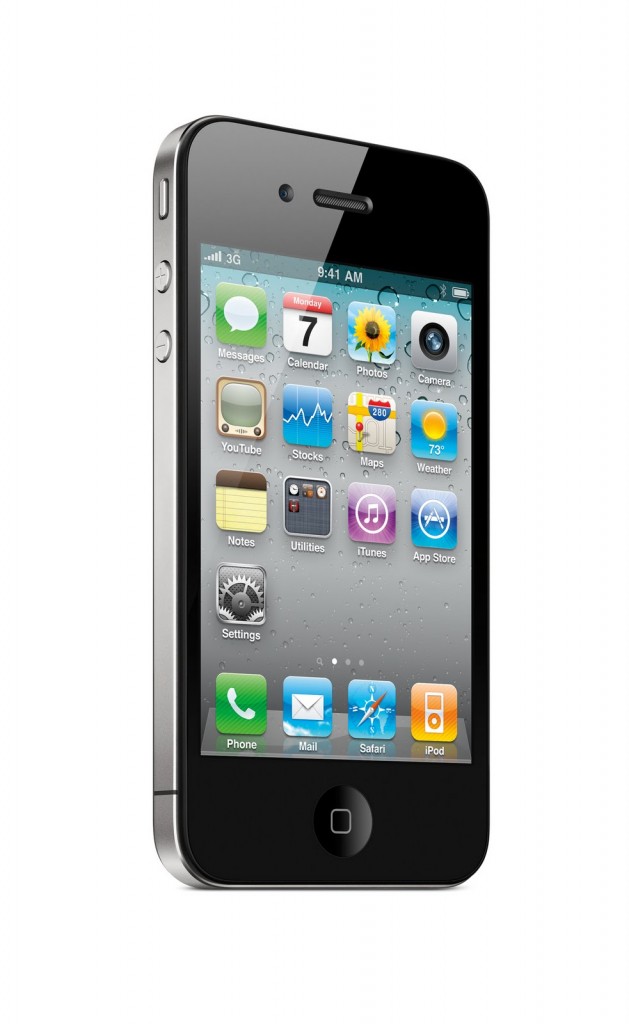

Available to download on iPhone, the free Halifax Home Finder app uses state of the art technology to revolutionise the way UK house hunters find and secure their dream home.

Offering more support to buyers than any other app, the Halifax Home Finder also incorporates the functionality of social media apps. The app allows users to manage the complex home buying process by enabling them to book viewings, rate properties, add comments and images of the property during viewings and subsequently share their thoughts with family and friends via an emailed PDF summary.

Other features of the Halifax home finder app include:

Advanced augmented reality – enables homebuyers to view properties currently for sale in the surrounding area, wherever they are, simply by holding up their smart phone

Built-in mortgage and repayment estimator – prospective buyers can work out how much they might be able to borrow and estimate their new monthly mortgage repayments

Access to Land Registry data – giving extra information about previous sold prices which supports the crucial buying decision

Local area guides – highlighting information such as distance from schools and train/tube stations in the local vicinity

Homebuyer guides – contain useful hits and tips to support buyers through the home buying process

Whether serious buyers or just property voyeurs, the way people search for properties over the last decade has changed extensively, with more and more people looking to access information on the move. Recent Halifax online research shows that 62 per cent of people who purchased a property in the last five years undertook their property search online, with 80 per cent of those looking to buy in the next five years likely to search for their next property in the same way. It also revealed that the percentage of buyers looking to use a smartphone to purchase their next property is expected to rise three-fold over the next five years compared to those who used a smartphone in the last five years.

The UK’s fascination with house prices and the desire to know what is happening on their doorstop remains high, with 31 per cent of respondents regularly (a minimum of once a month) searching properties for sale in their local area, with 18 per cent admitting to having no intention of buying them. Those aged between 25-34 (27 per cent were the most prolific, with the highest regional proportion (23 per cent) in the east of the country.

Managing finances and making purchases through online and web based technology is prevalent as almost one in five (17 per cent) adults have spent more than £500 on an item without seeing it in person. When looking to purchase a property in the future, 13 per cent of adults would initially use a mortgage calculator to estimate the maximum amount that they would be eligible to borrow from a bank/building society – this rose to 19 per cent of current smartphone users. Stephen Noakes, mortgages director at Halifax, comments: “We know that today’s house hunters want to be able to carry out their searches on a daily basis and when they are on the move. So the Halifax Home Finder app is perfect – it means that you can search properties, book viewings, rate properties and get an indicative mortgage calculation in one place.

“It’s a fantastic development which gives house hunters all the tools they need using the latest technology available. Using augmented reality means that all a house hunter needs to do is lift their handset to see the properties for sale in the streets around them. Our aim is to provide house hunters with information and guidance to help them make sense of the residential property market and make better-informed property decisions. With this new app, our services will be easily and readily accessible whilst on the move.”