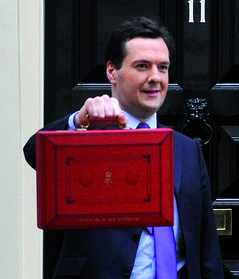

Chancellor George Osborne announced the Help to Buy scheme in The Budget to help potential borrowers who only have a 5 per cent deposit

Chancellor George Osborne announced the Help to Buy scheme in The Budget to help potential borrowers who only have a 5 per cent deposit

Osborne declared: “This is a Budget for people who aspire to own their own home” during a rowdy Budget speech with plenty of jeering from the House of Commons.

The Help to Buy scheme has two components – an equity loan and a mortgage guarantee. Osborne described the equity loan as “a great deal for homebuyers”. He said the mortgage guarantee element “has not been seen before” and the Treasury has worked with the biggest mortgage lenders to get the scheme off the ground.

Osborne said: “Help to Buy is a dramatic intervention to get the housing market moving. For newly built housing, government will put up a fifth of the cost. And for anyone who can afford a mortgage but can’t afford a big deposit, our mortgage guarantee will help you buy your own home.”

Help to Buy – equity loan

The equity loan is for new build only valued at up to £600,000 and expands the existing First Buy scheme, which is now available to all, not just first-time buyers. The scheme is open to everyone on all incomes – previously eligible buyers could not earn more than £60,000.

Borrowers need a minimum 5 per cent deposit to qualify and the government will lend up to 20 per cent of the value of the property through an equity loan. The loan is interest free for the first five years and can be repaid at any time or on the sale of the property.

The expanded scheme is available from 1 April 2013 and will run for three years. The government is providing £3.5 billion of additional investment.

Help to Buy – mortgage guarantee

The mortgage guarantee scheme is also for borrowers with a 5 per cent deposit and is available to homeowners as well as first-time buyers on both new build and existing homes. It will be available from January 2014 and run for three years on a maximum home purchase of £600,000.

The government guarantee covers 20 per cent of the loan and is offering guarantees sufficient to support £130 billion of mortgages. This should encourage lenders to offer better access to low-deposit mortgages and lenders have welcomed the scheme.

Stephen Noakes, mortgage director at Lloyds Banking Group, commented: “We are very supportive of innovation in the housing market and believe that the mortgage guarantee scheme, will give a much needed boost to the housing market and most importantly address the issue of accessibility.

“Crucially, this scheme will not only help first-time buyers but also second steppers, a key segment of the housing market that is also in need of more support and attention. Raising a deposit has been cited as one of the key challenges.”

Other plans

Osborne also announced more plans for housing with the building of 15,000 affordable homes. There are also plans to increase five-fold the funds available for building for rent and to extend the Right to Buy so more tenants can buy their own home.