Housing cost a little less in January 2015 as compared to the previous month, as the property market had a sluggish start to the new year. House prices in January went down by 0.2 per cent from December 2014, according to the latest ONS House Price Index. Prices in the year to January increased by […]

Housing cost a little less in January 2015 as compared to the previous month, as the property market had a sluggish start to the new year.

House prices in January went down by 0.2 per cent from December 2014, according to the latest ONS House Price Index.

House prices in January went down by 0.2 per cent from December 2014, according to the latest ONS House Price Index.

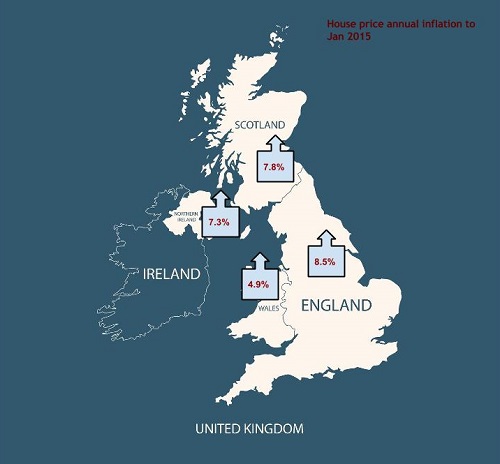

Prices in the year to January increased by 8.4 per cent, lower than the 9.8 per cent growth rate recorded for the year to December.

The annual house price growth is beginning to show signs of slowing across the majority of the UK, the ONS says.

Annual house price increases in England were driven by a 13 per cent annual rise in London and to a lesser extent increases in the East (9.9 per cent) and the South East (7.6 per cent).

First-time buyers had to pay higher prices on average than existing owners. In January 2015, house prices for first-time buyers were 9.7 per cent higher on average than a year ago, while existing homeowners face an annual price increase of 7.8 per cent.

Comment

Adrian Gill, director of Your Move and Reeds Rains estate agents, said:

“Rates of annual growth have slowed across the board in England and Wales, as the market mellows from the extraordinary noise of the past year. After storming ahead of the rest of the country in the whirlwind of 2014, conditions have calmed in London and the South East. The capital has already had the first taste of added pressure placed on prime property in the form of revised Stamp Duty, and the £1.5m to £5m slice of the market has also been hit by cold feet in the run up to the General Election, with the threat of a potential mansion tax. This let-up of high-end activity has brought down the average London house price, but it is regions with the lowest average property prices which are dragging their feet.

“The housing shortage may be propping up property price growth, but more needs to be done to stave off this winter lull and invigorate the property market recovery. Measures like the Help to Buy scheme and reforming Stamp Duty have airlifted support to the bottom end of the market, but unless more new homes are built, the government are practically playing a zero-sum game: reshuffling a deck doesn’t leave you with more cards.”

*

Peter Rollings, chief executive of estate agency Marsh & Parsons, said:

“A 0.2% reduction in house prices from December to January is nothing to scare the horses and the year-on-year improvement shows a market headed in the right direction, albeit taking a rather more scenic route.

“London is at the vanguard of these annual increases and has actually registered price improvements double that of the UK as a whole when the capital and the South East are removed from the equation. With some London properties for sale continuing to attract multiple potential buyers, the margin in house price growth between the capital and elsewhere is no surprise, but the gap continues to narrow which shows that London’s property market is now on a more sustainable path.”

*

Andy Knee, chief executive of outsourced property services provider LMS, said:

“With the inflation rate dropping to zero for the first time on record and house prices rises down from December of last year, we continue to see a cooling in the market prior to the election in May; a pause of uncertainty as consumers wait for an outcome. The market jitters are likely to fade towards the second half of the year, once an elected party is established, bringing with it its own set of agendas and a greater level of certainty.

“The figures also imply that changes in stamp duty haven’t had the impact predicted following the Autumn Statement, when it was expected that a flurry of owner-occupiers would drive a short-term rise in activity. There is a possibility that cautious homeowners are waiting for the election to pass before taking advantage of the reform.

“While owner-occupiers have seen prices rise, sadly, it is first-time buyers who have seen a sharper rise compared to January of last year, an indication that they are still far off from fulfilling their homeownership dreams; clearly, the cooling has not translated into a healthier first-time buyer market yet and even the Chancellor’s new help to buy ISA will not solve all their problems.”