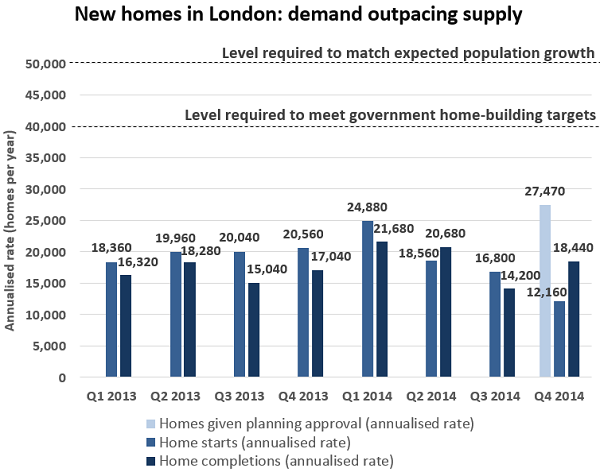

The London government has set a 40,000 target for building of new homes in the city but it could hardly be met given the current rates of planning permissions and building completions, new research shows.

London’s planning system is allowing new homes at an annualised rate of just 27,470 as of the fourth quarter of 2014 – or just over two thirds (69 per cent) the political target announced by both Chancellor George Osborne and Mayor Boris Johnson, according to new research from specialist London estate agents Stirling Ackroyd.

London’s planning system is allowing new homes at an annualised rate of just 27,470 as of the fourth quarter of 2014 – or just over two thirds (69 per cent) the political target announced by both Chancellor George Osborne and Mayor Boris Johnson, according to new research from specialist London estate agents Stirling Ackroyd.

The data shows that just 6,780 homes were given planning permission over the last quarter, spread across 826 different sites. These approvals represent 80 per cent of all potential homes receiving a planning decision in the last three months of 2014. This is out of plans for 8,632 possible homes in the fourth quarter. If all housebuilding plans had received approval, this could have allowed an annualised rate of up to 34,530 new homes, or 86 per cent of the rate targeted by the government.

However, the real number of homes reaching completion stage currently stands at an annualised rate of just 18,440, based on the 4,610 properties completed in the fourth quarter of last year.

Despite the low base, the improvement in the capital’s new build number has been considerably stronger than in the rest of England. The increase in new home completions in the fourth quarter of 2014 was 30 per cent as compared to the third quarter. For comparison, the increase in the rest of England was just 17 per cent.

However, new home starts were far lower during the last quarter of 2014. Their number was 3,040, which corresponds to an annualised rate of just 12,160 homes per year. If this pace of housing starts continues and is reflected in the annual rate of completed homes it would mean failing to reach even one-third of the government’s annual target.

“For culture, opportunities and sheer scale London now rivals any global megacity. But our capital must not become a victim of its own success – which means homes for everyone who can contribute to this city’s vibrant future. Homes have proved an excellent investment over previous decades, and today’s new Londoners demand the same opportunity. Planning must keep up,” Andrew Bridges, managing director of Stirling Ackroyd, said.