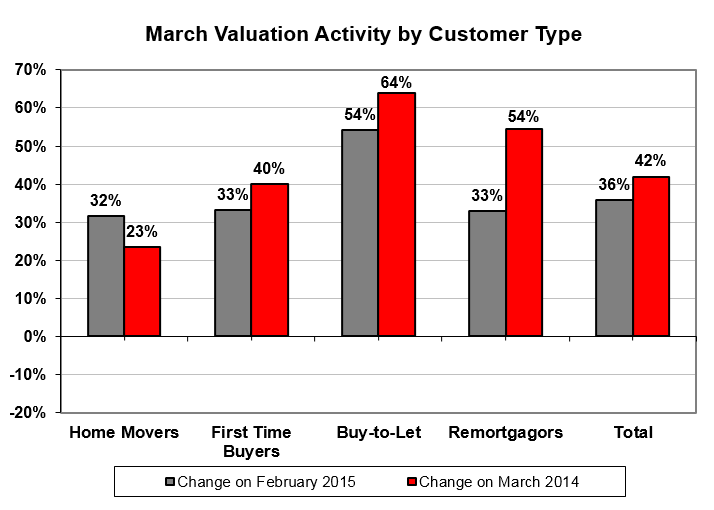

Home valuations on behalf of new buyers surged by a third (33 per cent) in March 2015 compared to the previous month, the latest research from Connells Survey and Valuation shows.

First-time buyer valuations were up by 40 per cent in comparison to March 2014, nearly matching the overall growth in activity.

First-time buyer valuations were up by 40 per cent in comparison to March 2014, nearly matching the overall growth in activity.

The total number of valuations carried out in March 2015 increased by 36 per cent month-on-month and by 42 per cent year-on-year.

John Bagshaw, corporate services director of Connells Survey & Valuation, commented:

“Optimism looks to be catching, seeping from the wider economy and jobs situation into the property market. Looking ahead, election uncertainty is a real factor and not to be underestimated, yet a wider trend of buoyancy is definitely emerging.

“For half a decade surprises have tended to be unpleasant ones – but this spring the housing market is now surprising on the upside.

“New announcements like the Help to Buy ISA have combined with existing government schemes to boost interest from first time buyers. In the short-term this is mainly about sentiment, but extra support has been consistently focused at this end of the market for years now, with a longer-term impact too.

“Whether this is a good thing demands a political answer – but the housing market has definitely felt the effect. For a considerable time, activity at the bottom of the property ladder has grown faster than activity among households who already own their home.”