Valuations done on behalf of first-time buyers (FTBs) and people moving home saw a huge annual drop in April 2015, the latest figures from Connells Survey and Valuation show. Compared to the previous month, valuation activity improved by just a few percent for both types of customer. All sectors of the market in April have […]

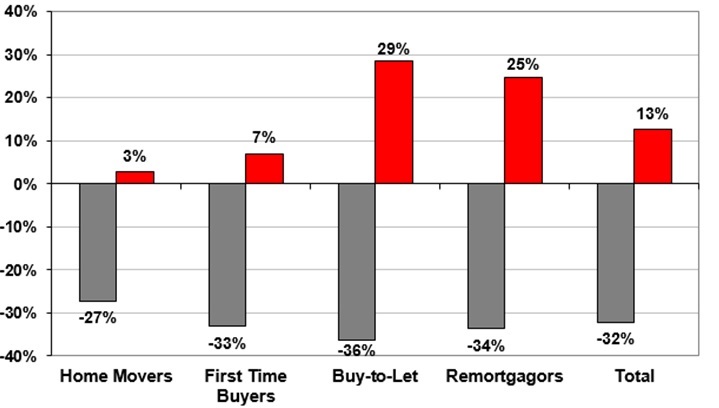

Valuations done on behalf of first-time buyers (FTBs) and people moving home saw a huge annual drop in April 2015, the latest figures from Connells Survey and Valuation show.

Compared to the previous month, valuation activity improved by just a few percent for both types of customer.

Compared to the previous month, valuation activity improved by just a few percent for both types of customer.

All sectors of the market in April have shown an increase on a yearly basis and a drop from the previous month. The growth on the 2014 figures is an indication that market momentum continues despite the election jitters, according to John Bagshaw, corporate services director of Connells Survey & Valuation.

“Britain’s property market is still marching ahead, even as we approach the closest General Election in a decade.

“The fact that all indicators – from first time buyers right through to remortgagers – are up on this time in 2014 demonstrates the broad momentum in the property market, which we expect to continue through into the new Parliament,” he explained.

Commenting on the slowdown in first-time buyer and homemover valuations, Bagshaw said:

“First time buyers have had bundles of extra support over the last five years – but still not quite enough to power any serious growth in the number stepping onto the property ladder for the first time. This might disappoint some, especially with the plethora of government schemes to boost first timers.

“Yet the greatest squeeze has been among those who already own their home – who simply aren’t looking to upsize in the same way as might have been the case a decade ago. Householders might have said goodbye to the recession years ago, but the crunch on disposable incomes and aspiration to move to a bigger home might well last a decade.”