The Summer Budget is next Wednesday, 8 July, and in the run-up to the date there are many forecasts about what Chancellor George Osborne’s announcements would be. David Ingram, founder of mylocalmortgage.co.uk, a website that connects you to independent advisers working in your area, has made predictions on what he hopes to see announced when it […]

The Summer Budget is next Wednesday, 8 July, and in the run-up to the date there are many forecasts about what Chancellor George Osborne’s announcements would be.

David Ingram, founder of mylocalmortgage.co.uk, a website that connects you to independent advisers working in your area, has made predictions on what he hopes to see announced when it comes to housing and mortgage rates.

David Ingram, founder of mylocalmortgage.co.uk, a website that connects you to independent advisers working in your area, has made predictions on what he hopes to see announced when it comes to housing and mortgage rates.

He comments:

“The Market is looking rosy for housing since it was announced recently that construction output had increased for the first time in six months by 3.9%, recovering from the slump in March. Domestic housing construction itself was up by 1.3% and prices have also risen since the Conservative party came to power in May.

“Mortgage borrowing has jumped to a six-year high and while the average deposit is now 4% higher than this time last year, mortgage rates are at their lowest to compensate.

“So if this is the state of the market now, what can we hope for in the Summer Budget? The first phase of the Help to Buy scheme has seen much success thus far with 47,018 properties being purchased over the last two years. We are hoping to hear confirmation from George Osbourne that the Loan Equity part of the scheme will last until 2020, helping first-time buyers onto the property ladder by making ever-rising deposits more affordable.

“The new Help to Buy ISA is due to be launched soon and so clarification around how this will aid first-time buyers would be welcomed. The promise that up to £3,000 will be donated by the government to those who use the scheme is a promise which many feel will have to be seen to be believed, especially as welfare cuts and reduced spending are on top of the agenda.

“In the run up to the Election, David Cameron promised that he would do all he could to keep mortgage rates low, however, in the cold light of day, election promises find themselves unsustainable. Recently, concerns have been voiced regarding the continually low national cash rate as set by the Bank of England. Predictions that interest rates will soon have to rise will not be welcomed by those looking to move up the property ladder, especially in the light of rising deposit prices. We would be very interested to hear what Osbourne has to say about the future of mortgage rates on the 7th July, if they are mentioned at all.

“Finally, we will be interested in hearing what the chancellor has to say about the future of construction. While the rate of output is rising, the Tory Manifesto proclaimed that, if elected, they would be overseeing the building of 200,000 new starter homes to cater for ‘Generation Rent’, pushing them away from renting and towards ownership. We would love to hear progress on this and whether the increased output from construction is a result of this or of non-housing repair and maintenance work.”

*

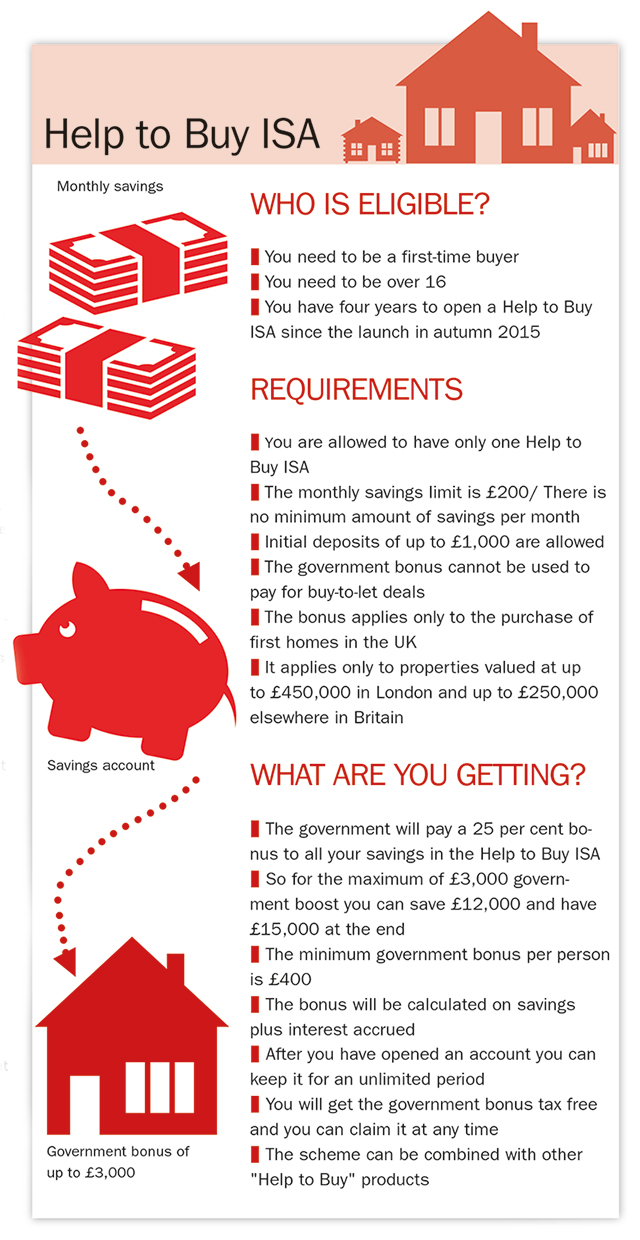

Wondering what the new Help to Buy ISA is? Check out our infographic:

The Help to Buy ISA scheme will launch this autumn and will run for four years, which means if you want to join the scheme you have to do it within this period. All customers who have opened this type of ISA over the set period can keep the savings accounts for as long as they like.