The planning process for building and extending homes is to made easier under new government rules. ‘Fixing the Foundations: Creating a more prosperous nation’ is a report that outlines how this will happen. A new zonal system is to be introduced, which will give automatic planning permission on suitable brownfield sites. Business Secretary Sajid Javid […]

The planning process for building and extending homes is to made easier under new government rules.

‘Fixing the Foundations: Creating a more prosperous nation’ is a report that outlines how this will happen.

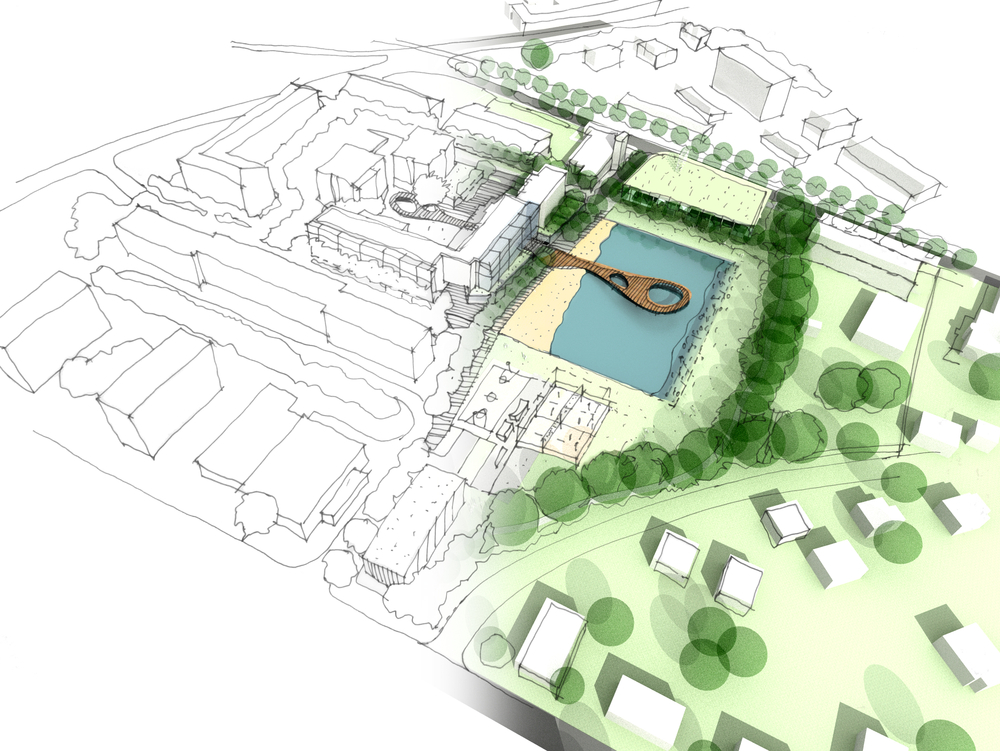

A new zonal system is to be introduced, which will give automatic planning permission on suitable brownfield sites.

Business Secretary Sajid Javid said: “We’ll make sure the homes that are needed get built – if a council fails to produce a suitable local plan, we’ll have it done it for them. And we’ll be devolving major new planning powers to London and Greater Manchester.

People living in London will no longer need planning permission for upwards extensions up to the height of an adjoining building, provided the neighbours don’t object.

Javid said: “It’s a simple step that, at a stroke, will take layers of bureaucracy and cost out of the planning system.”

Positive move

The report has been welcomed by the industry.

Andy Frankish, new homes director at Mortgage Advice Bureau (MAB), said current planning laws are ineffective and prevent healthy levels of housebuilding.

Frankish commented: “Proposals to bypass local council when granting planning permission for brownfield cites are long overdue. With such severe shortages of housing stock across the country, it is ludicrous that brownfields sites remain underutilised, and granting automatic permission is a common sense approach.

“The question over whether there is enough brownfield land to support Britain’s housing needs is a valid one. Although greenbelt land is rightly protected, in certain circumstances – such as when it is adjacent to brownfield sites – development on the greenbelt may be necessary.

Ben Thompson, managing director of estateagent4me.co.uk, welcomed the reform: “Demand for housing has pushed annual house price growth to just under 10% as buyers compete for the limited number of properties available.

“Our Estate Agent Performance Index highlights that the housing market is particularly buoyant in the south of the country. Houses in Bristol and Reading sold in an average of 26 days compared to the UK average of 53 days, as a shortage of supply meant buyers had to compete for properties.

“Making it easier and quicker to build houses will slow down price increases which will benefit first time buyers as well as those who are looking to move on from their current property.”