There are options to owning a holiday home in this country – you can keep your dream getaway all to yourself, you could use it as and when you like but rent it out at other times or run it as a holiday let business. Joanne Atkin explores the finance behind these various options

Across England and Wales almost 1.6 million people own a second property in a different area to where they live. Around a tenth – 165,000 people – use these as holiday homes with the remainder being used for other purposes such as work, or accommodation for student children.

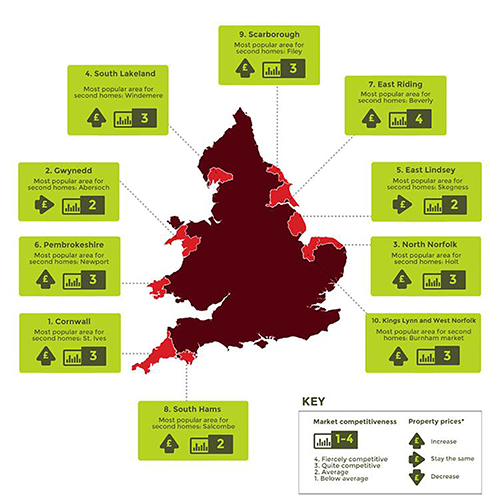

These figures come from Direct Line’s Select Premier Insurance, which found that Cornwall, with its 300 mile coastline, is the nation’s holiday home hotspot. There are 10,169 (6.2 per cent) of holiday properties located in this area. Gwynedd, home to Snowdonia National Park takes second place with 7,784 holiday homes (4.7 per cent) and North Norfolk with its sandy beaches and salt marshes, complete the top three with 4,842 homes (2.9 per cent).

Peter Olivey, resident partner at Cole, Rayment & White Estate Agents in Padstow, commented: “Cornwall ticks a number of important boxes for second homeowners with its coastal location and abundance of activities. It’s a true holiday haven without the hassle or cost of going abroad. The local property market here is competitive but with a number of new developments springing up and mortgage rates much lower than they have been, there’s still plenty of opportunity for prospective buyers.”

But what if you need to find the finance to buy your dream holiday home or holiday let?

David Blake from Which? Mortgage Advisers said: “The application process for a second mortgage is likely to be the same as when you’re getting any residential mortgage. You will be required to submit a standard application and often have a choice of mortgage products. The lender will look at the costs of your existing mortgage to determine how much you can borrow to fund your second purchase. In some cases you might need a larger deposit for the second mortgage, given that you already have a mortgage.”

[box style=”1″]

Top 10 holiday home hotspots

Direct Line interviewed local estate agents about the holiday home market in the top 10 areas to get their recommendations on where to buy and find out how competitive the local property market is at present. The image below outlines the results.

[/box]

Holiday lets

However, holiday homes and holiday lets are different. Only a few lenders operate in this niche area because there is not huge demand.

The main lenders that specifically lend on holiday lets are Leeds Building Society, Cumberland Building Society and Monmouthshire Building Society and a few others including some of the newer challenger banks. All these lenders will treat applications individually and design a mortgage to suit the borrower’s needs.

Lenders often ask applicants for a minimum income which usually ranges from £20,000 to £40,000, although some providers have no minimum income requirement. Self-employed applicants may need to show up-to-date accounts usually for the last three years as well as their SA302 tax calculation from HM Revenue and Customs.

The lender will want to know about the rental yield of the property, i.e. the letting income, after agent’s commission, which will generally equate to at least 125 per cent of the mortgage, assuming a mortgage interest rate of 5 per cent.

In addition, if the property has not been used as a holiday let before, a lender will want to know the opinion of a local letting agent.

Property restrictions

There are restrictions on the type of holiday homes, lenders will advance money on. For example, Monmouthshire will not lend on newly built properties (built within the last 12 months), shared ownership properties and homes situated on a holiday park.

Cumberland does not include properties located on holiday parks either or wooden lodge type properties. But it will consider holiday let mortgages on properties throughout mainland UK on a freehold basis and on long leasehold standard construction.

Applications from individuals and partnerships qualify for Cumberland’s standard holiday let products. It will also consider applications from limited companies, trusts and British citizens living abroad. However, these would not qualify for the society’s standard products, instead rates and fees would be individually agreed.

Other individually assessed situations would apply where the property is subject to an occupancy restriction and in those cases the maximum loan will be restricted to 60 per cent of the market value.

Apart from that Cumberland will finance up to 75 per cent of the market value of the property, which must have a minimum market value of £150,000. Minimum loan size is £75,000 and the maximum is £500,000.

Mortgage calculators

To get an idea of what you can borrow, check out the lenders’ websites and their mortgage calculators.

For example, Monmouthshire’s holiday let calculator allows you to enter the total loan amount you wish to borrow to work out the minimum annual amount of rent required from the property. Alternatively, you can enter the estimated annual rental income to calculate the maximum loan amount the society is likely to consider.

The society’s mortgage calculator bases its holiday let affordability criteria on payments calculated on an interest-only basis, irrespective of whether you opt for a repayment mortgage; but loans are available on an interest-only or a repayment basis. If the calculator shows that the maximum loan amount is insufficient for requirements, the society may be able to increase the amount by taking some of your income into consideration.

Monmouthshire’s holiday let mortgages are available to existing homeowners for purchasing or remortgaging a holiday let property in Wales and the South West of England. The minimum loan size is £30,000 and the maximum is £500,000.

Products

Leeds Building Society will lend in England, Scotland and Wales on holiday homes either for house purchase or for customers remortgaging from another lender. These mortgages are for owners of holiday homes who stay in the property themselves and/or who let out to holidaymakers.

Product details will depend on a number of criteria including the deposit you have and options for interest rates and fees will vary*. For example, at Leeds Building Society if you have a 40 per cent deposit, rates start at 2.64 per cent for a two-year fixed rate with a fee of £999. Alternatively, you could pay a lower fee of £199 but the two-year fixed rate is 3.04 per cent. If you have a 30 per cent deposit, the initial rate is 3.14 per cent with a £999 fee.

After the two-year fixed rate finishes on all these products, the rate moves to the society’s buy-to let rate (currently 5.99 per cent) minus 1 per cent for three years, taking the rate to 4.99 per cent. The rate then reverts to the buy-to-let rate.

As with residential mortgages, you can remortgage at the end of the term but if you redeem your mortgage early you may have to pay early repayment charges, so check with your lender what that might be.

[box style=”3″]

Case study: The Bartlet in Felixstowe

According to Suffolk estate agent Banham Dark Estates, the holiday homes market in Felixstowe is prospering and will continue to see growth over the coming years: “Felixstowe itself is very much an up and coming area which is slowly becoming more aligned (especially Old Felixstowe) with areas such as Woodbridge and Southwold – which are already booming. With the efforts that are being made to further transform Felixstowe, holiday homes and second homes are very much on the up.”

According to Suffolk estate agent Banham Dark Estates, the holiday homes market in Felixstowe is prospering and will continue to see growth over the coming years: “Felixstowe itself is very much an up and coming area which is slowly becoming more aligned (especially Old Felixstowe) with areas such as Woodbridge and Southwold – which are already booming. With the efforts that are being made to further transform Felixstowe, holiday homes and second homes are very much on the up.”

Felixstowe has a long promenade fronted with colourful beach huts and there are plans to renovate the Pier in 2016/2017. The town’s main retail area has a mix of boutiques and independent shops along with high street brands. There are also bars, cafes and restaurants.

The Bartlet is a Grade II* listed building overlooking the sandy beach. It was formerly a convalescent home constructed between 1923 and 1926 and commissioned by a local surgeon, Dr John Henry Bartlet. The NHS finally closed the convalescent home in 2008.

It is a unique building as it is built around a Martello Tower. This was one of 103 towers along the south and east coasts completed in 1812 to alert locals to potential invasion by Napoleon, and this particular tower is one of 30 left partly standing.

Local property developer Gipping Homes has been converting The Bartlet into 21 luxury one, two and three bedroom apartments. It has been working in close association with English Heritage to ensure original features are kept, such as the sash windows and beautiful tiles. The apartments have been built incorporating the remnants of the original tower, moat and moat wall.

Local property developer Gipping Homes has been converting The Bartlet into 21 luxury one, two and three bedroom apartments. It has been working in close association with English Heritage to ensure original features are kept, such as the sash windows and beautiful tiles. The apartments have been built incorporating the remnants of the original tower, moat and moat wall.

Heather Blemings of Gipping Homes showed me around the building, which is indeed impressive and the apartments are fabulous and designed to high specifications. A number of apartments have already been sold although the conversion won’t be fully finished until next spring, so who is buying them?

Heather says: “Some of the apartments have been bought as first homes and some as second homes, for example, a couple from Surrey recently bought the top floor sea view apartment as a holiday home.

“We are finding that buyers and potential buyers often have some sort of connection to Felixstowe. They may have moved away and want to return or perhaps have family here.

“Although Felixstowe is on the east coast, the sea front actually faces south as the coast bends around. This means that buyers of apartments facing the sea will get the sun all day long – as long as it shines of course.”

Each apartment comes with a parking space and there are options to rent storage facilities, which is handy if you are downsizing. Prices at The Bartlet start at just under £330,000 and go up to £750,000.

Gipping Homes is also creating apartments by renovating and rebuilding the site of the Bath Hotel next door to The Bartlet, which itself has an interesting history. Built in 1840, the hotel was infamously set on fire in 1914 by two suffragettes, Florence Tunks and Hilda Birkett, causing terrible damage.

House prices on the Suffolk coast have performed strongly and are 7.5 per cent above the peak in 2007/08, according to Savills. The estate agent says that downsizers have particularly been attracted to new build housing in the area due to “the prospect of lower maintenance and running costs, along with the peace of mind that comes from new, high spec appliances and a builder guarantee.”

Prices in the Suffolk area vary from £100,000 for a studio flat in Ipswich to more than £1 million for a large family house and grounds on the coast.

Savills predicts that in the mainstream housing market, the East of England will experience the highest growth of all regions in the five years to 2019, growing by 25 per cent compared to 19 per cent across the whole of the UK.

[/box]