An accountancy firm has warned that the new stamp duty charge will hit married couples, civil partners buying their first home together and people that own property overseas. Stephen Barratt, private client tax director at accountants and business advisers James Cowper Kreston, said the 3% rise in stamp duty will “create uncertainty, introduce many anomalies […]

An accountancy firm has warned that the new stamp duty charge will hit married couples, civil partners buying their first home together and people that own property overseas.

An accountancy firm has warned that the new stamp duty charge will hit married couples, civil partners buying their first home together and people that own property overseas.

Stephen Barratt, private client tax director at accountants and business advisers James Cowper Kreston, said the 3% rise in stamp duty will “create uncertainty, introduce many anomalies and take a long time to fully bed-down.”

When the new legislation comes into force this April married couples and civil partners will be treated as one unit and this could trip some people up, Barratt said.

“If, as is quite common, one or both own a home before they marry/enter into a civil partnership and then buy a home together without selling their previous homes, say, for rental purposes, it seems that the surcharge will apply unless all existing residential property is sold,” said Barratt.

He also believes that the new charge rules will also catch out people that own property outside the UK.

“The surcharge will only apply to residential properties purchased in England, Wales and Northern Ireland, but if a property is already owned anywhere else in the world a new residential property will be considered an additional property and the surcharge will apply,” said Barratt.

Chancellor George Osborne announced a new additional 3% stamp duty rate for landlords and second home owners in the Autumn Statement as part of the government’s plan to boost home ownership by dampening the buy-to-let market.

With little time left until the consultation closes on 1 February, Barratt said that the government is unlikely to make any changes at this stage.

Barratt said: “And the fact that the new rules are intended to apply to completions on or after 1 April 2016 will mean that many purchasers will be exchanging contracts now without knowing what the final rules will be. This will create uncertainty.”

The surcharge will apply to the whole price payable for a property by joint owners even if the property is an additional property for just one of them, unless the replacement exemption applies.

“Until now stamp duty has typically been a straightforward matter to administer on residential property transactions as a one-off item. If these rules are implemented, and at this stage we only have a consultation document, they will represent a significant additional complexity to property taxation involving additional transaction costs as solicitors and accountants carry out additional due diligence to ensure that the correct rate is applied, and, where appropriate, refunds claimed,” Barratt said.

“All that said, whether these changes will do more than simply dent the British love affair with property remains to be seen,” he added.

The consultation about the higher rates of stamp duty was released in December and can be downloaded here.

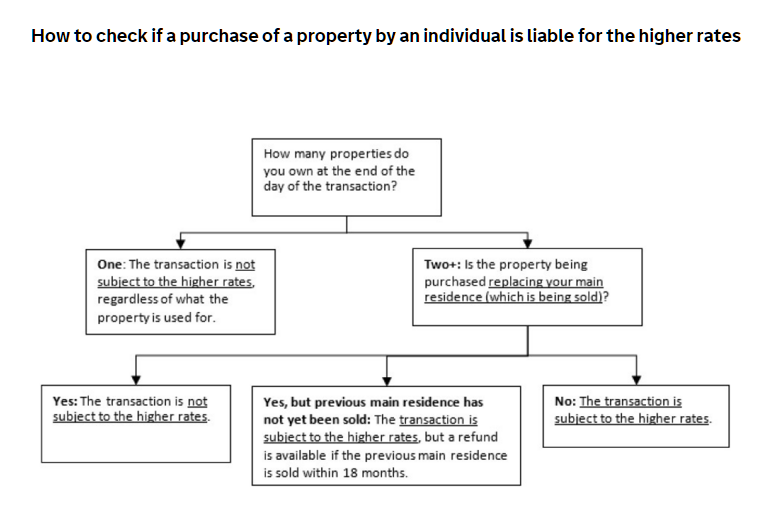

It contains a useful flow chart that can help buyers determine if they are liable to the new stamp duty charge.

I own two buy to let properties and live with my partner in my main residence. If we sell our main residence to buy another main residence are you saying that I will have to pay the additional 3% tax because I own two buy to let’s?

Please clarify.

Thanks

Can you please clarify what happens if following situation.

I currently own 1 house (main residence) and 1 buy to let flat.

I am currently in the process to buying a new house which will be my main residence and my current residence house will be re-mortgaged as a buy to let mortgage. So on the day of completion I will end up with 1 main residence and 2 buy to let properties.

So in this case do I need to pay additional stamp duty ? as technically I still only have 1 property as main residence?

Andy Smith:

Yes, if you buy your new home on or after the 1st April 2016 then the 3% additional stamp duty charge will apply under current plans. Unless you sell your second property in the meantime.

Lula:

If you complete your purchase on or after the 1st April 2016 then the 3% additional stamp duty charge will apply under current plans. Unless you sell your investment properties in the meantime. My advice is to do everything in your power to exchange & complete on your purchase before the new legislation comes in. You have two and a half months to avoid the charge.

Regards,

Tom

If I buy a house for my son to live in, do I still have to pay stamp duty?

thanks for your chart above, but can you also add a scenario, where the new property will be main residence and the existing residence property, is being re-mortgaged in to a buy to let, instead of being sold.

Thanks a lot for the feedback everyone. I will be doing a follow up article later in the month answering all of your queries.

I inherited a cottage nearly 30 years ago which is permanently let. I am looking to down size and buy a bungalow but am planning to sell my main residence after I buy the bungalow as I am sure I will want to update wha ever I buy before I move in. Will I be able to claim back the extra 3% stamp duty if I sell my main residence within the 18 month period?