Stephen Barratt, private client tax director at accountants and business advisers James Cowper Kreston, answers your questions on the forthcoming stamp duty changes. In his 2015 Autumn Statement, George Osborne dropped a bombshell introducing a 3% stamp duty land tax (SDLT) surcharge for those buying second homes or buy-to-let properties on or after 1 April 2016. The charge is part of […]

Stephen Barratt, private client tax director at accountants and business advisers James Cowper Kreston, answers your questions on the forthcoming stamp duty changes.

Stephen Barratt, private client tax director at accountants and business advisers James Cowper Kreston, answers your questions on the forthcoming stamp duty changes.

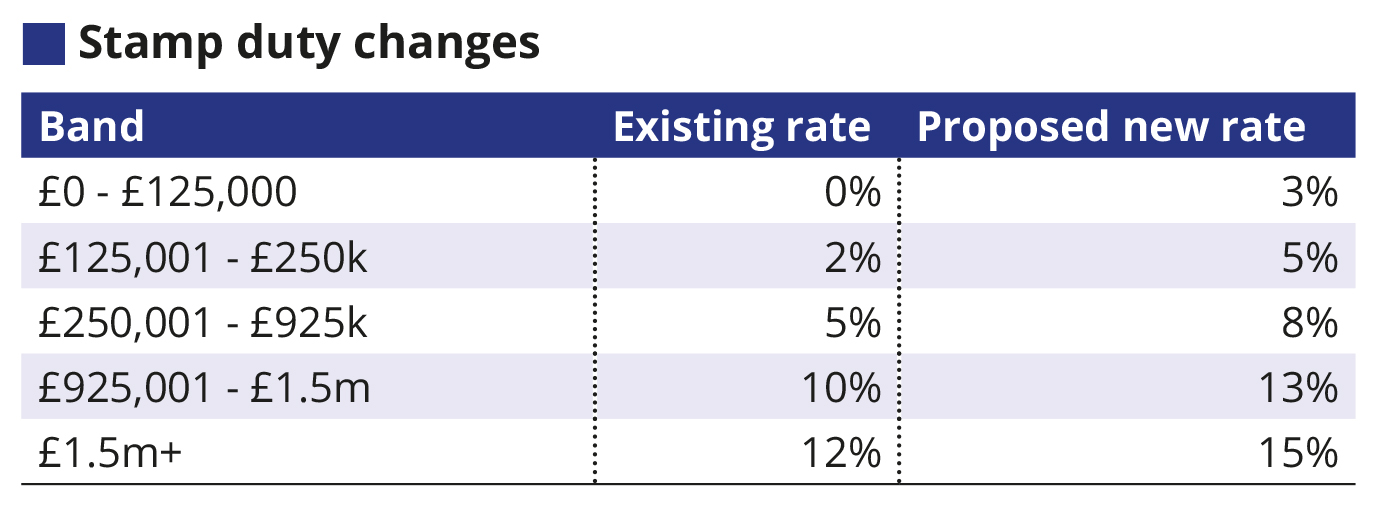

In his 2015 Autumn Statement, George Osborne dropped a bombshell introducing a 3% stamp duty land tax (SDLT) surcharge for those buying second homes or buy-to-let properties on or after 1 April 2016. The charge is part of the government’s efforts to dampen the buy-to-let market in order to make it easier for first-time buyers to get a foot on the housing ladder.

The consultation document issued on 28 December 2015 provides further detail on how the proposed new rules might operate.

At this stage we only have a consultation document, and so we will have to wait to see if the proposals are implemented.

Question: Will I have to pay more if I help my child with their mortgage and I’m named on the title deeds?

Yes, if you are a joint purchaser with your child and at the end of the day on which you complete the purchase and you own an interest in two properties, whether or not the property you already own is your main residence. It remains to be seen if the final rules provide an exclusion for cases where a parent is only named on the title deeds because the lender insists upon it for mortgage protection purposes.

Question: I currently own home as well a BTL property. If I sell my current house and move into a new one after April 2016, will I be hit by the 3% surcharge?

The 3% surcharge should not apply so long as the purchase of a property you intend to occupy as your main residence is acquired within 18 months of selling your previous main residence even though you will own two residences at the end of the day of completion of the purchase. This is a specific exclusion that is proposed.

Question: What if I’ve already exchanged contracts but my new-build home isn’t completed until June?

The analysis will depend upon the precise facts. For example, if the new home is a replacement main residence acquired within 18 months of the sale of the previous main residence, or at the end of the day of completion you only own one property, the surcharge will not apply.

If, however, the main residence replacement relief does not apply because there is no main residence sale within the preceding 18 months, and you do in fact own two residential properties at the end of the day of completion, the surcharge will apply unless contracts for the purchase were exchanged on or before 25 November 2015 but not completed until on or after 1 April 2016. This is notwithstanding the fact that the new-build is your main residence.

Question: I own two buy-to-let properties and live with my partner in my main residence. If we sell our main residence to buy another main residence will I have to pay the additional 3% tax because I own two buy-to-lets?

The main residence replacement exclusion should assist you. Although you will own more than one residential property at the end of the day of completion on the purchase of your new main residence, you will have sold a main residence and acquired a new property for occupation as your main residence. So long as the sale and purchase take place within 18 months the exclusion should apply so that you are not liable to the higher rate.

Question: I currently own one house (main residence) and one buy-to-let flat. I am in the process of buying a new house which will be my main residence and my current residence will be re-mortgaged as a buy-to-let mortgage. So on the day of completion I will end up with one main residence and two buy-to-let properties. Do I need to pay additional stamp duty as technically I still only have one property as a main residence?

The additional charge is likely to be payable to the purchase of the new main residence for the following reasons. At the end of the day of completion of the purchase you will own more than one residential property, and you will not have sold your existing main residence. The main residence replacement provisions cannot therefore apply because based on the question you will not have sold or be selling the current main residence.

Question: If I buy a house for my son to live in, do I still have to pay stamp duty?

This will depend upon the precise circumstances. If you acquire an interest in the property so that at the end of the day of completion you are a joint owner, the higher rate will apply on the purchase without reduction, even if you only own a percentage interest in the property.

If, on the other hand, you were not to become a joint owner, but give him cash to buy the property and stand as guarantor on the mortgage, then so long as it is your son’s only residential property, the higher rate will not apply.

Question: I inherited a cottage nearly 30 years ago which is permanently let. I am looking to downsize and buy a bungalow. I am planning to sell my main residence after I buy the bungalow as I am sure I will want to update whatever I buy before I move in. Will I be able to claim back the extra 3% stamp duty if I sell my main residence within the 18-month period?

If you acquire a new property (the bungalow) to be occupied as your main residence without selling your existing main residence you will need to pay the higher rate of SDLT, even without taking account of the let cottage.

That said, it is anticipated that if you sell your current main residence within 18 months of acquiring the bungalow, you will be able to claim a refund of SDLT so that the net SDLT paid on the purchase of the bungalow is at the ‘normal rate’. It will however place the onus on you to remember to do this and to complete on the sale in time.

Question: Will I have to pay stamp duty if the new property is the main residence and the existing property is being re-mortgaged to a buy-to-let instead of being sold?

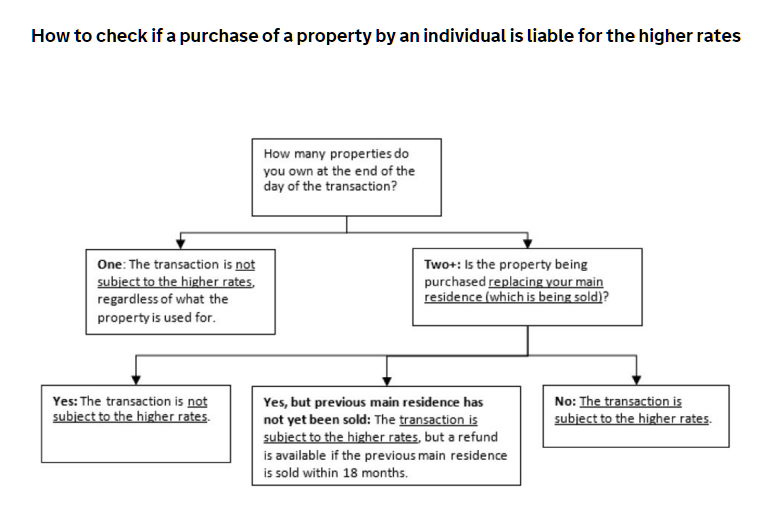

Working through the flowchart provided in the government consultation:

How many properties do I own at the end of the day of purchase? Two

Is the new property replacing my main residence which is being old? No

The higher rate will apply in these circumstances.

I keep seeing analysis based on their being a main residence.

I have three buy-to-let properties, but no main residence. I, simply, rent for myself in whatever country I happen to be staying in.

However, there’s a “what if”, namely, what if I decided to return to the UK and, rather than renting for my own needs, I decided to purchase?

I would have thought that quite a common situation. The workaround would be to return to UK, to one of my own flats (though they’re in high rent foregone areas, whereas I would rent in a cheaper area), issue a Section 21, take that place as indisputably my main residence, then sell it, splitting the high value to a cheap place for me to live and another cheap unit to rent out. That doesn’t, though, seem to me to be a great result for the tenant, albeit that I would issue the S21 under circumstance entirely within the law.

M

hi

is the stamp duty on buy to lets 3% over £125,000 or on any amount?

Do I assume that I will have to pay the 3% stamp duty (after 1 Apri) if I buy a second property to do up and sell on?

What do we, the purchasers get from paying stamp duty?

Do we get any services from the government in return for paying stamp duty?

What exactly is it for? It is just another way for the government to take more money from those that work hard to achieve a nice home?

Why is it linked to the price of the purchase?

Regards,

Dave

If I sell my main residence and move back to a property that was previously rented out with a residential mortgage that has consent to let. Will I pay 3% stamp duty on a new property which will be my new main residence?

If I buy properties which are restricted by local authority planning regulations to 10 month occupancy, therefore not residential and not available as buy-to-let but only as holiday cottages, will I still have to pay the increased stamp duty?

Is there anybody who can answer Jonathan Richards question above as I work for a developer of holiday homes that can be rented 12 months of the year, all of the properties cannot be occupied as residential homes because of the local authorities planning restriction.

I would also like to hear an answer to Jonathan Richards question as we had been thinking of buying a holiday cottage on a small development but confused if these rules will apply.

In response to your questions, if you are buying a second home or have any further queries about buy-to-let we recommend you speak to a professional adviser.

My partner moved in 3 years ago with me to a house that I own and pay the mortgage. His flat has been advertised for sale for the last year but in the meantime he rents it out. We are in the process of buying a new home together, we were due to complete before 1 April but now there’s a delay. Solicitors told us we will have to pay a higher rate of tax, is that right? We can’t afford it.

I own a property which is our main residence. My wife also own a residential property but it would be sold next month. But now we are jointly buying another property which would be our main residence, but would retain our current main residence. Do we have to pay higher rate of stamp duty as st the end of the day we will only own 2 properties as before.

I purchased a holiday let December 2013. I sold my main residence July 2015 and moved into the holiday let until I found another main residence in the area to move into. I am hoping to complete on the “new” main residence by November 2016. My understanding is that as I sold my old main residence prior to November 2015 and am purchasing another main residence within 18 months of the sale of my old main residence, that I am not obliged to pay the additional 3% stamp duty as I this will become my new main residence. Am I correct in this assumption please and how do I need to contact to legally confirm that ?

Many thanks

Margaret

Can anyone advise please…

If I am selling my main residence to buy another property but I buy the second house before I have sold the first – will I be eligible for any refund on Stamp Duty when my original residence sells? Hopefully the gap will be a maximum of a few months.

Thanks

Steve

I have two buy to let’s and consent to let on my previous home. However, due to work commitments I moved cities and ended up staying around after 5 years and have decided to buy a house to live in. I am not selling any property. I automatically assumed I would have to pay the 3% stamp duty but after reading some information I’m now a little confused. Please can anyone clearify for me?

Many thanks

I soley own my own house. My boyfriend moved in recently after selling his house. He is now looking to soley purchase his own house with a view to me moving in and renting my house out. Will he have to pay the second home tax?

I have a BTL property and I currently living in a house solely own by my husband. (Only his name on the mortgage and deed), would I be hit with the surcharge if I buy a home for myself? Because technically, I would have own one house and one buy to let by completion and I shouldn’t have to pay the extra 3%?

Hello all

My husband and I are selling our home which is in my name and buying a new home to be our primary residence.

My husband owns a home with a friend that is being rented out with no plans to sell.

The new home will incur the stamp duty surcharge because my husband owns 50% of a home and we are classed as one unit because we are married. “lovers tax”

My question is. Is it possible to pay stamp duty surcharge on the existing home that my husband owns as our new home will be our primary residence?

Many Thanks

I have inherited my mothers property 2 years ago which is currently rented ( no Mortgage loan attached) I am raising £490,000 ( property value £850,000) to pay my sister her 1/2 share inheritance.

Do I need to pay stamp duty on this transaction and at what rate?

Am I liable for CGT or will my sister need to pay CGT?

Many Thanks

You would need to take tax advice on this

My first property is leasehold and rented out as in army. Will I have to pay 3% on 2nd property which will be main residence even though first proprty is leasehold

If you own one property and buy a second, you will have to pay the extra 3% stamp duty on the second property. It makes no difference if you live in it or rent it, or if it is leasehold or freehold, the 3% rules still applies.