Help to Buy offers aspiring homeowners the opportunity to get on the property ladder with as little as a 5% deposit. Stephen Little speaks to industry experts to find out how the government scheme can help you

With rocketing house prices and sky high deposits, getting on the housing ladder must seem like an impossible dream for many prospective buyers.

Last year, UK house prices rose 9.5% to hit a new record high of £208,286, according to Halifax, while the average deposit for a home also passed £80,000 for the first time.

It is not all doom and gloom though. While things might seem bleak for buyers, there is hope in the form of the government’s various Help to Buy schemes.

Help to Buy is a government-backed initiative designed to help people buy a property worth up to £600,000 with a deposit as low as 5% through an equity loan or mortgage guarantee.

Introduced in 2013, it is available to first-time buyers and existing home owners looking to move up a rung on the property ladder. There is also a version for the armed forces.

The Help to Buy equity scheme finishes in 2021, while the Help to Buy mortgage guarantee scheme is set to run until December 2016. The property must be your only home and you are not allowed to rent it out, so you can’t use it to get a buy-to-let mortgage.

Following its success, the government launched the Help to Buy ISA scheme last December to help first-time buyers get together a deposit and most recently unveiled Help to Buy London for those looking to buy in the capital.

Help to Buy equity loan

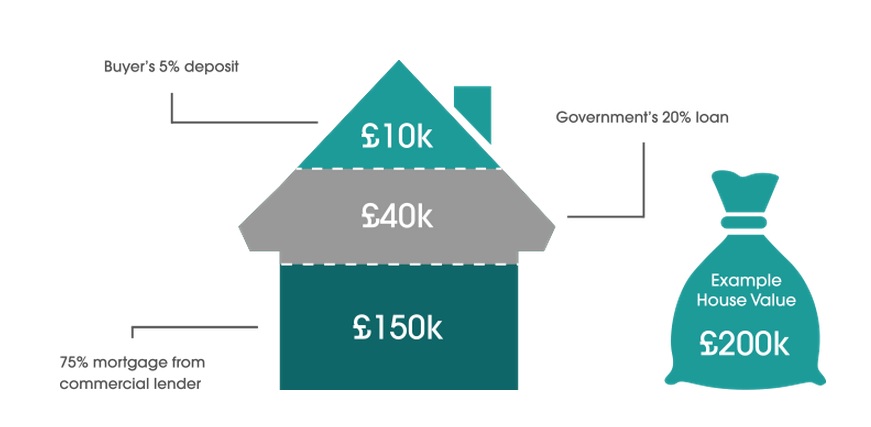

With the equity scheme loan scheme you can borrow up to 20% of the purchase price of a new-build home. The loan comes from the government and is repaid when the property is sold. The rest of the payment is made up with a deposit of at least 5% and a mortgage of up to 75%.

You can pay back part or all of your loan at any time, at a minimum of 10%. The amount you pay will depend on the market value at that time, so if the price of your house goes up, the amount you pay back goes up too.

You are entitled to sell your home at any time, but if you do so you will have to pay back the loan. It is competitively priced and for the first five years the loan is interest free. However, in the sixth year you will be charged a fee of 1.75% of the loan’s value which will then go up every year with inflation.

Ray Boulger, technical director at the mortgage broker John Charcol, thinks the equity side of Help to Buy offers really good value for borrowers as a 75% LTV mortgage gives them access to far cheaper rates than a standard 95% mortgage.

He said: “Typically, rates are about 2% lower and even 2.5% in some cases. And of course borrowers are also making lower mortgage payments on 75% of the purchase price instead of 95%. However, I think purchasers do have to watch out that they are not overpaying because of the extra tax on buying a new-build property.”

[box style=”0″]

Forces Help to Buy

The Forces Help to Buy scheme offers servicemen and servicewomen the opportunity to borrow 50% of their salary up to a maximum of £25,000 interest free.

The Forces Help to Buy scheme offers servicemen and servicewomen the opportunity to borrow 50% of their salary up to a maximum of £25,000 interest free.

It aims to address the rate of low home ownership in the armed forces and can be repaid over ten years.

The scheme is aimed at supporting first-time buyers and those who have to move house because they are assigned elsewhere.

To apply you must be in regular service and have served two years or more. You must also have at least six months left to serve at the time of application and not have owned a property within 50 miles of the proposed purchase in the last year.

Andy Frankish said: “It’s a very unique product designed to help those serving in the armed forces who are often overseas and don’t get the opportunity to put roots down. Essentially it’s an interest-free loan.

“It’s an excellent option for those in the armed forces to boost their ability to buy. Certain lenders also allow them to rent the property out if they are based overseas.”

[/box]

Help to Buy mortgage guarantee

Unlike the equity element, the Help to Buy mortgage guarantee scheme is open to those looking to buy an existing property as well as a new-build.

Under the scheme, the government acts as a guarantor on mortgage loans for 15% of the value of the property. The idea of this is that it will give banks and building societies peace of mind and therefore encourage them to offer larger loan-to-value products of between 80% and 95%.

So, with a minimum deposit of 5% of the value of the property you will need a 95% mortgage.

Despite the mortgage guarantee scheme ending this year, David Hollingworth, associate director of communications at London and Country Mortgages, does not expect a sudden withdrawal from the market by lenders.

He said: “The mortgage guarantee scheme has been extremely successful in boosting the options for those with only 5% to put down. One of the knock-on benefits is that other lenders have launched deals which have never actually relied on the government guarantee, using either a private insurer or self-insuring.

“It has been a catalyst for the growth in options that borrowers with small deposits now have, so when it is withdrawn the market will compensate. The mortgage market is very competitive at the moment and lenders are looking at how they can do more business rather than pulling away.”

Help to Buy London

House prices in London have shot up in recent years due to the shortage of supply and growing demand.

Along with rising deposits and strict affordability checks, many aspiring homeowners have been frozen out of the market in London, where it is becoming increasingly difficult to buy a home.

Recognising the limitations of Help to Buy in the capital, Chancellor George Osborne announced the London Help to Buy scheme in the Autumn Spending Review.

Recognising the limitations of Help to Buy in the capital, Chancellor George Osborne announced the London Help to Buy scheme in the Autumn Spending Review.

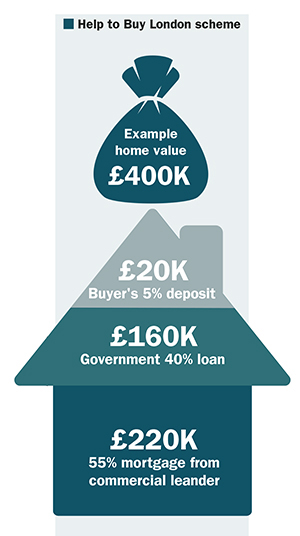

It is just like the existing equity loan scheme, but now you can borrow up to 40% of the value on a new home priced up to £600,000. This means that London buyers will need a deposit worth at least 5% and a mortgage that is 55% of the property price.

Launched on 1 February, a number of lenders have already unveiled their rates, including Leeds Building Society, Nationwide and Barclays.

Whilst there has been some criticism that the scheme will have little impact due to the excessive prices in the capital, Andy Frankish, new homes director at Mortgage Advice Bureau, believes Help to Buy London will get people on the housing ladder in the right areas.

He said: “A 40% loan on a £600,000 property really does make it achievable now for first-time buyers to buy these sorts of properties. I think that product will work very well there. More people want to live and work in London, so it will increase their options.

“The capital is an ongoing issue and more certainly needs to be done. The increase in stamp duty might be a deterrent to buyers, but the introduction of Help to Buy London might be an additional incentive.”

Boulger said that Help to Buy London provides even better value for borrowers and that taking out a 55% LTV mortgage means that they are going to qualify for the best rates from most lenders.

However, he warned that the scheme could lead to an increase in demand for homes in the capital, pushing up prices even further.

Boulger said: “Because of the long timescale for developers to increase the supply of properties it’s going to be at least 12 or 18 months before builders have got the ability to bring more properties onto the market.

“The danger is that we will see increased demand which builders won’t be able to satisfy for well over a year and that could push prices up. So I think people will need to watch that they are not paying over the odds.”

[box style=”0″]

Help to Buy ISA

First-time buyers taking out a Help to Buy ISA can save up to £200 a month tax free, which the government will top up with a bonus of 25% once they buy a home.

The maximum you can put in is £12,000, so the most you can get back from the government is £3,000.

You can open an account with a one-off lump sum of up to £1,000. Couples buying together can also combine their bonuses, giving them a boost of up to £6,000 towards a deposit. To get the maximum payout it will take around four and a half years, depending on the interest rate.

Halifax currently offers the highest interest rate at 4%, followed by Virgin Money at 3%. Other banks and building societies offering Help to Buy ISAs include Barclays, Lloyds Banking Group, Nationwide, NatWest and Santander.

To be eligible you have to be a UK resident over the age of 16 and a first-time buyer. However, you cannot save into a Help to Buy ISA and a cash ISA in the same tax year unless your ISA manager offers you a split or an umbrella-type scheme. So if you have already opened up a cash ISA, you will need to close it. The interest rates are also variable and could change.

The maximum property price you can use it to buy is £250,000 or £450,000 in London, but you can’t use it for a second home or a buy-to-let property. It’s also worth noting that there is no requirement to take out a mortgage with your Help to Buy ISA lender. You can also transfer your ISA to a different provider to get a higher interest rate.

David Hollingworth believes the Help to Buy ISA will help get first-time buyers into the habit of saving for a deposit.

He said: “For most first-time buyers, getting a deposit is a real struggle because of the amount required and rising prices of property in some areas. Borrowers will be wondering whether they can save quickly enough to keep pace with the rate of house price growth. The Help to Buy ISA will help alleviate that worry.

“A 25% add-on for savings is nothing to be sniffed at. For anyone thinking of getting on the ladder, it’s a very good way of getting the funds for that.”

Hollingworth expects lenders to offer plenty of incentives to get Help to Buy ISA borrowers to take out mortgages.

“It makes sense for borrowers to shop around and check that any incentive being dangled in front of them is actually worth it,” he said.

Ray Boulger said: “There’s nowhere in the market you can get anything remotely approaching the return on a risk-free basis, so it’s fantastic value. The only question is which provider you take one out with.

“A couple saving the maximum amount will get £30,000 back. If they’re using the Help to Buy scheme in London it will go a long way to covering their deposit.”

[/box]

[box style=”2″]

Case study: Taking out a Help to Buy ISA

Accountant Haydn Horner lives in Leeds and is looking to buy a property in the city centre.

Currently renting, he’s keen to get on the property ladder as quickly as possible and sees the Help to Buy ISA as a great way of increasing his deposit.

Haydn says: “The Help to Buy ISA will help boost my deposit and get me the money I need to buy a place more quickly. The interest is higher than you get anywhere else and then you get the bonus money from the government, which is a really good incentive.”

He has been looking to buy a property since he left university and started working full-time, but he thinks it is tough for young people to get a deposit together as rents are so expensive.

Haydn says: “Because rents are so high you don’t have any spare income each month to save. So I think the Help to Buy ISA scheme is good because it’s £200 a month, which is a realistic level for somebody who is starting to save for a deposit.”

After hearing about the Help to Buy ISA in the Budget, he decided to take one out with Halifax as it offered the best interest rate. He says: “I already have an account with Halifax, so I was able to logon to my app. I clicked a few buttons, transferred in my first funds to the account and it was as simple as that. The process is very easy and took about five minutes.”

Haydn will make payments right up until he is ready to buy later in the year. He expects to have around £2,000 saved, which will give him a bonus of £500 from the government.

He says: “I would absolutely recommend the scheme to anyone thinking of buying a property, even if they can’t afford £200 a month. There is no other way of getting that kind of return out there because you get the best interest on the market combined with a 25% bonus from the government. So I would tell all my friends to sign up to it.

“Long term, I think the monthly payments you can put in should be raised, along with the maximum cap. £12,000 is great for a deposit in Leeds, but I’m not so sure somebody in London would get very far on that amount.”

[/box]