The forthcoming 3% rise in stamp duty could unfairly  penalise couples if one of them already owns another property, the Association of Taxation Technicians has warned.

penalise couples if one of them already owns another property, the Association of Taxation Technicians has warned.

The ATT said that married couples and those in a civil partnership, but not those cohabiting, will be treated as a single unit once the new rules come into effect on 1 April.

This means that if one of the couple already owns a property, any property purchased by the other partner will be subject to higher rates of stamp duty.

Yvette Nunn, co-chair of ATT’s technical steering group, said: “This ‘Cupid Tax’ is both unfair and flawed. The government’s tax on marriage and civil partnerships goes against the principle of legal ownership and risks eroding the foundation of independent taxation if it goes ahead.”

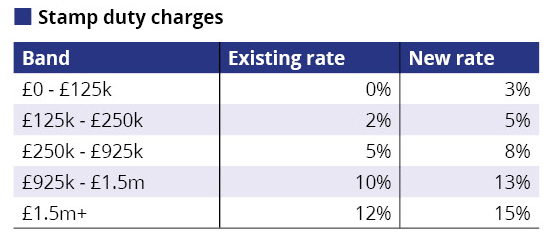

Chancellor George Osborne announced an additional 3% on the stamp duty rate for landlords and second home owners in the Autumn Statement as part of the government’s efforts to dampen the buy-to-let market and free up property for first-time buyers.

The ATT said it would be simpler and fairer if the rules for charging the higher rate of stamp duty followed the treatment of couples for income tax which taxes them independently.

It believes the proposals will have a serious impact on those in a bridging loan situation, where they have bought their new home but not yet sold their old one.

“The proposed change could mean that some decide to pull out of their purchase which would have a negative effect on the rest of the buyers in their housing chain. We have urged the government to think again on this as it has the potential to stall the housing market. This would go against the policy intention of the measure which is aimed at helping first time buyers get on the property ladder. As we see it, they are the very buyers who may lose out when housing chains collapse if someone further up the chain is caught under these rules,” said Nunn.

“Overall, we believe that the proposed design of this charge will go further and will catch more situations than was originally perceived when George Osborne first announced this measure last November. The proposals as a whole, as set out in the consultation, have too many negatives, in our view,” she added.

This measure is another sign of George Osbourne’s ‘playing to the crowd’ and devising knee jerk Tax Changes to appease the haters of landlords. It is ill thought through and will not change the fact that the only thing that will calm the housing market is a MASSIVE house building programme – increase the supply and the price will go down.

Random bombing of landlord’s finances maybe be fun for him – but it doesn’t solve the problem and is a very handy diversion from the recently revealed fact that his family wallpaper firm has paid NO TAX in seven years !!

Not fit for the job.

Osborne seems to be bigoted and is clearly demonstrating his socialist leanings despite pretending to be Conservative. Additionally, he is upsetting the qualifying expenses for operating a residential letting by not allowing mortgage interest to be deducted when it is indisputably a legitimate expense.

I own a few buy-to-lets for the purpose of providing a pension in the long term. They are all on interest only so I shall be hit badly by the new landlord tax proposals. I will either have to raise the rents to offset my losses or sell up. None of my tenants are in a position to buy a property even if house prices subsequently fall drastically, as they are either retired, students or single mothers with a part-time job. If these tenants are asked to vacate in order for me to sell, then where are they expected to rent. With fewer properties to rent for those who cannot afford to buy, homelessness will no doubt increase.

The fact that Mr. Osborne’s family wallpaper business has paid NO TAX for s e v e n years is just not acceptable. Jo Bloggs would certainly be down on if it were he. Wot can be dun bout this totally unjust situation.