The new government-backed Flood Re scheme is designed to make home insurance affordable for people living in flood-prone areas. Stephen Little finds out more The floods caused by the storms which battered the UK in January and December will surely go down as some of the worst in living memory. The devastation inflicted by Storms […]

The new government-backed Flood Re scheme is designed to make home insurance affordable for people living in flood-prone areas. Stephen Little finds out more

The floods caused by the storms which battered the UK in January and December will surely go down as some of the worst in living memory. The devastation inflicted by Storms Desmond, Eva and Frank left thousands homeless and caused untold damage to property and businesses.

The Environment Agency estimates that approximately 5.2 million homes in England and Wales are at risk from flooding, and experts predict that climate change is going to make the problem even worse.

A typical flood claim can cost £30,000 or more, while damage to a property can be so bad building repair work on a house with severe flood damage can take from 12 to 18 months. As flooding becomes more frequent, many people fear their homes may even become unsellable.

However, while things may look bleak for households vulnerable to flooding, there is hope for them with the new government-backed Flood Re scheme which launches on 1 April.

Set up by the government and the Association of British Insurers, Flood Re is a not-for-profit reinsurance fund designed to make the flood element of household property insurance more affordable for homeowners at risk of flooding.

It will cover the cost of flood damage to properties in return for a premium paid to it by insurers and a levy. The ABI estimates that the scheme could benefit between 300,000 to 500,000 homes who would otherwise struggle to obtain affordably priced insurance.

Aiden Kerr, director of operations for Flood Re, said: “Flood Re is a solution to one of the biggest problems affecting consumers in the UK. If you have whole areas that have problems getting home insurance that has a real detrimental impact on communities and households.

“Homeowners at risk of flooding will have a wider choice of insurance as well as more affordable premiums and a lower excess. Flood Re is the best long-term and sustainable solution for the UK and will give peace of mind to property owners worried about the risk of flooding.”

How does Flood Re work?

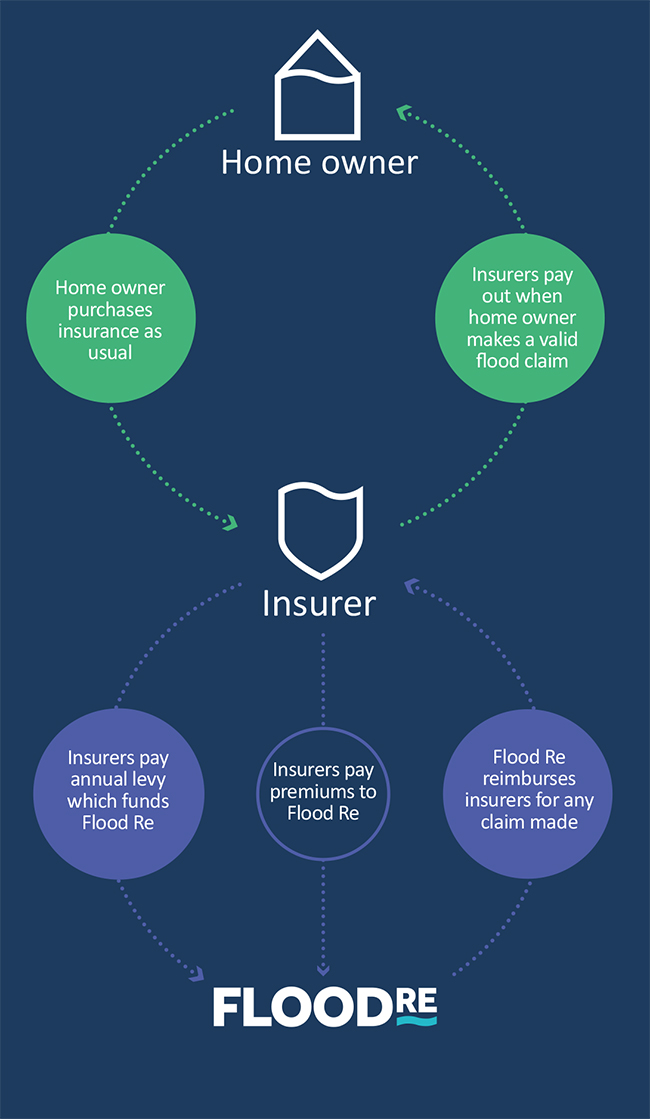

Homeowners will continue to purchase their insurance in the normal way. All claims will be handled by the insurance companies that will pass on the flood risk element of home insurance policies to Flood Re.

Homeowners will continue to purchase their insurance in the normal way. All claims will be handled by the insurance companies that will pass on the flood risk element of home insurance policies to Flood Re.

In the event of flooding, insurers will be reimbursed for the cost of the claim from the Flood Re fund, which is financed through flood insurance premiums and a levy on home insurance.

The total amount of the levy on the home insurance industry will be £180 million, which is likely to add around £10.50 to a policy. Premiums charged by insurers will be capped based on council tax bands, starting at £210 per policy per annum in Bands A and B for a combined policy and rising to £1200 for a Band H home. It is widely expected that this capped cost will be passed on by insurers to policyholders.

Exclusions

If your property was built after 1 January 2009 you will not be protected by Flood Re. This is to discourage developers building new properties on floodplains.

Businesses are not covered by the scheme and properties owned by landlords are also excluded, though tenants are able to arrange cover for their contents. Buy-to-let landlords will therefore not have their premiums capped and may struggle to find insurance.

Leasehold blocks of more than three properties are also not eligible for insurance as they are considered to be part of a commercial enterprise.

Paul Cobbing, chief executive of the National Flood Forum, said: “Most people who couldn’t get insurance will now be able to. If you live in certain postcodes you can’t get insurance from most of the standard suppliers.

“We are very supportive of the scheme as it creates a safety net for people who are struggling. It provides a window of opportunity to protect people through insurance whilst we address flood risk issues.”

Mary Dhonau, chief executive of the Know Your Flood Risk campaign, said: “Getting insurance has been a huge problem for people in flood zones. I get lots of phone calls about people saying they can’t get it. People have lost house sales at the very last minute as buyers have walked away.

“At the moment, a lot of people are locked in a deal with their provider no matter what they charge because nobody else will take on their risk. Homeowners I’ve spoken to are so relieved they can now shop around for cheaper insurance. It’s the light at the end of a very long dark tunnel.”

Getting a mortgage

Generally speaking, living in a flood zone is unlikely to stop you getting a mortgage. However, there is a good chance you will have higher insurance premiums, which can affect mortgage affordability and the amount lenders are willing to let you borrow.

When buying a property, your lender will require you to take out buildings insurance, including flood cover, as a condition of the mortgage in case it is damaged and needs repair.

However, if you live in a high risk area you may need to take out standalone flood insurance as well.

The increased severity and frequency of floods has led to a widespread rise in insurance premiums.

Those living in an area with a history of flooding can be hit with higher premiums and struggle to find affordable insurance cover, which can cause the value of a property to fall.

If you are unable get insurance this can have implications for your mortgage and also make it more difficult to sell.

David Hollingworth, associate director at London & Country Mortgages, said: “If insurance premiums keep rapidly climbing, borrowers may start to find they are struggling to meet the affordability level for the mortgage they’ve already got.

“At the extreme end of the scale, if you have to shell out £10,000 a year to insure a property that is clearly going to have an impact. People are going to have to find that from somewhere, so lenders will factor not just income but also outgoings into their assessment.

“If you can’t insure a property it becomes unmortgageable, making it more difficult to sell and substantially reducing its value.”

Dhonau said: “Premiums have gone up ridiculously high, with some people saying they have increased by up to three or four times. I think it will put some buoyancy back in the market in flood risk zones as people will be able to sell their homes again. It might give people the peace of mind that their homes are no longer blighted as they will able to claim their insurance without worrying.”

[box style=”2″]

Case study: Counting the cost of flooding

Sylvia Pilling is currently dealing with the impact of flooding after Storm Desmond wreaked havoc over Christmas.

She is 77-years-old and lives in Keswick, Cumbria, with her husband who is nearly 80. They have been flooded three times in the past ten years as well as once in 1985.

Sylvia says: “Heavy rain was forecast for the whole weekend so we decided to move as much as we could upstairs, put the floodgates on and take the car up to higher ground. Mountain rescue came the next day and we were evacuated to the hospital.

“Once the rain stopped and the flood water started to go down I went back home to find the house in a dreadful state. The water had gone up to about 2.5 feet and we lost our white goods and heavy furniture. The garden was under three feet of mud and covered in huge tree trunks, manhole covers and wheelie bins.”

Following the 2009 flood, Sylvia and her husband implemented a number of flood resilient measures, such as building a rudimentary kitchen upstairs, moving the electric sockets to shoulder height and transferring the boiler.

She is now looking to convert her home to accommodate all their living needs on the first floor in a self-contained flat once the insurance comes through.

Sylvia says: “The hardest thing is that my husband has had to go into a care home as we don’t currently have the facilities for him within our property, while I’m living temporarily upstairs.

“It has been very worrying and has affected my sleep and I wake up at three or four in the morning. It’s not the sort of thing you want to be doing when you’re at our age. You don’t want this upheaval.”

The insurance company wanted to double the premium when they were flooded in 2009, but after shopping around they managed to find a cheaper insurer.

Sylvia says: “I’m worried about getting affordable insurance when our policy comes up for renewal in May. Flood Re sounds wonderful and the premiums look like they will be very reasonable.

“I’m sure we will never sell. It would be a very desirable house but I don’t think anyone would consider buying it now. Even if we could sell we wouldn’t get the going rate.”

She remains unconvinced by the efforts of the government and feels it needs to provide greater funding to support victims of flooding.

She says: “I want my government to hear me. We need to be able to adapt how we live in our home so that we don’t have to spend money three times in a decade returning it to the same state only for the next flood to destroy it again. We need to make it secure. It is my safe haven.”

[/box]

Concerns

The Council of Mortgage Lenders has expressed concern that Flood Re leaves a significant number of leasehold and private rented homes without affordable cover.

It believes the scheme should be available to a wider range of occupiers to help the property market operate more smoothly in areas prone to flooding.

There have also been calls to extend the scheme to businesses so that they can obtain affordable insurance. Cobbing said: “What we really need is a mechanism for ensuring small businesses in high flood risk areas are covered. Likewise, we need to make sure that residential landlords are included because tenants can suddenly be left with no home to go to and that’s wrong.”

Cutbacks

The government has come in for heavy criticism over cuts made to flood defence spending since 2010 and its response to the winter storms.

A 2010 spending review by the coalition slashed over £100 million from the flood budget. While spending rose from £621 million to £811 million following the winter floods of 2013, the government slashed funding by £116 million last year.

It is committed to spending £2.3 billion on a programme of new defences over the next six years, however, this still falls way below the £750 to £800 million a year recommended by the Environment Agency in 2014.

Dhonau said: “More needs to be done. Flooding is the biggest natural peril this country faces and I feel that government has got to address this issue and keep it on the agenda. It has got to invest more in flood risk management and maintenance of flood defences. There were cuts when the coalition government came in and last year budgets to manage flood risk were cut for local authorities.”

The future

Over its 25-year lifespan, Flood Re’s aim is to transition towards a market where home insurance prices fully reflect risk. It plans to use the data it collects to help those in the industry better understand risk as well as incentivise households and insurers to take measures to reduce costs.

Kerr said: “Flood Re is not the solution to the UK’s flood threat, it just provides the opportunity for affordable home insurance to be available to those at risk of flooding. For it to achieve its aims will require action from government, insurers and homeowners to manage the risks and costs of flooding.