Buy-to-let borrowing rose by 61% for the year February, driven by landlords looking to beat the April stamp duty deadline, new figures show.

Buy-to-let borrowing rose by 61% for the year February, driven by landlords looking to beat the April stamp duty deadline, new figures show.

According to the Council of Mortgage Lenders, landlords borrowed £3.7 billion in February, with the rise in the number of loans up 47% to 23,700.

Remortgaging remained the key driver of activity in the buy-to-let sector with 13,100 loans taken out worth £2.2 billion. This accounted for 59% of gross buy-to-let lending sector.

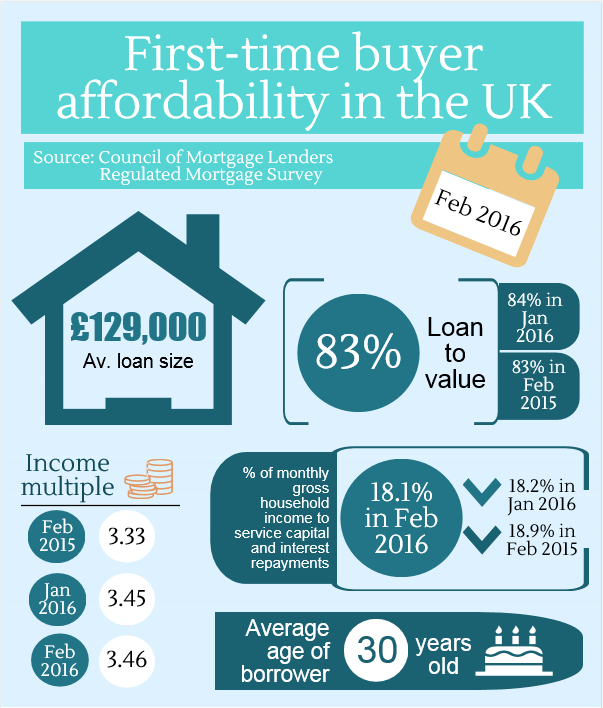

First-time buyer borrowing was up 21% on February last year to £3.4 billion. This totalled 22,000 loans, an 11% year-on-year increase.

Paul Smee, director general of the CML, said: “In 2016, there have been substantial increases in house purchase and remortgage activity year-on-year. This reflects the sluggish market in early 2015, perhaps driven by election uncertainties.

“Buy-to-let has also seen substantial year-on-year increases, with particularly strong growth in remortgaging, a pattern which we have seen in the buy-to-let sector the past six months. Activity has been boosted by landlords seeking to complete purchases before tax changes in April. We do not expect activity to show such strong year-on-year growth later in the year.”

The 3% stamp duty increase, which came into effect on 1 April, is part of the government’s attempt to curb the buy-to-let market and free up property for first-time buyers. The basic rate of tax relief landlords can claim on properties is also set to fall to 20% from April 2017.

David Whittaker, managing director of Mortgages for Business, said: “Over the next few months, I am expecting the buy to let market to quieten down somewhat as landlords take time to factor in the cost of the new stamp duty levy and, perhaps more importantly, work out new investment strategies to manage the forthcoming relief restrictions being imposed on individual higher rate tax payers.

“In this regard, we are already seeing considerable numbers of landlords moving their properties into corporate structures and whilst this can be a costly exercise now, going forward it should make their investments work better in future.

“I also expect that remortgaging activity will continue to drive growth in the mortgage market, as increasing numbers of people opt to use their first homes as a means of securing a second home for investment purposes.”