Despite house prices soaring across the country, surprising new research has revealed that hundreds of thousands of property owners are stuck in negative equity. According to from online estate agents HouseSimple.com, average property prices in more than half (53%) of UK towns and cities are still below average prices in 2007. This means that some […]

Despite house prices soaring across the country, surprising new research has revealed that hundreds of thousands of property owners are stuck in negative equity.

Despite house prices soaring across the country, surprising new research has revealed that hundreds of thousands of property owners are stuck in negative equity.

According to from online estate agents HouseSimple.com, average property prices in more than half (53%) of UK towns and cities are still below average prices in 2007. This means that some people that bought at this time are in negative equity and have mortgages that are worth more than the current value of their homes.

While average prices in London have risen 56% since 2007, this is not the case across large swathes of the country, particularly in the North of England.

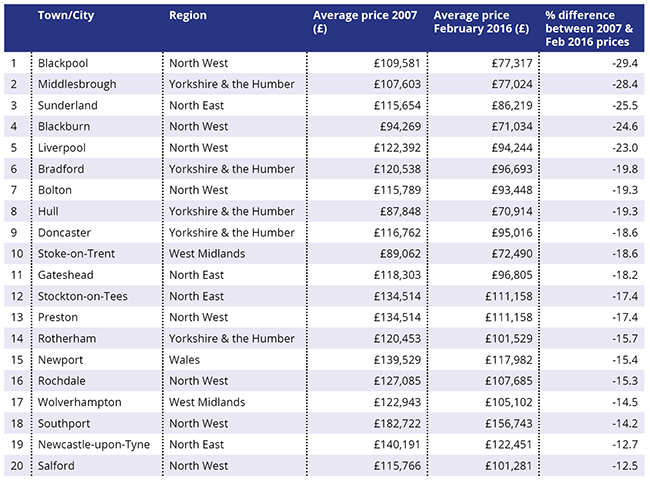

The research looked at 75 major towns and cities in England and Wales and found that 17 of the 20 most affected towns and cities since the financial crash are in the North of England.

Worst hit by post-recession negative equity was the North West, with 40% of the top 20 negative equity towns and cities in the region.

The worst affected towns are Blackpool and Middlesbrough, where house prices are still almost 30% lower than pre-crash highs.

Blackburn and Liverpool are both in the top five worst affected towns and cities, with average house prices still 25% and 23% lower respectively than before the crash.

A quarter of towns in the Top 20 list were in Yorkshire and the Humber. Average prices in Middlesbrough are still 28% below pre-2008 levels, while in Bradford and Hull, house prices are 20% and 19% lower than 2007 averages.

House price recovery has been much stronger in the South than the North, with average prices in London almost £200,000 higher than 2007 levels.

Property prices in Winchester and Stevenage also seem to be recession proof, up 44% and 39% respectively.

Alex Gosling, CEO of HouseSimple.com, said: “London homeowners have watched as their properties have risen in value substantially since 2008 but, thousands of people around the country have had to put their lives on hold, unable to move because they are trapped in negative equity.

“Unfortunately, the North of England has been slower to recover losses suffered during and after 2008. And anyone wanting to relocate for work or family reasons faces a less than appealing choice, either making a loss on the sale of their property or staying put and waiting until the price of their house at least recovers to the price they paid.”

What Mortgage has teamed up with London & Country to offer you expert advice on the right mortgage deal.

Whether you’re buying a new home, remortgaging to a new deal or buying an investment property, L&C can help – and you’ll pay no fee for their advice. To find out more, click here.