Property investors put off by the recent rise in stamp duty should look towards the continent for better returns, a new report has suggested.

Property investors put off by the recent rise in stamp duty should look towards the continent for better returns, a new report has suggested.

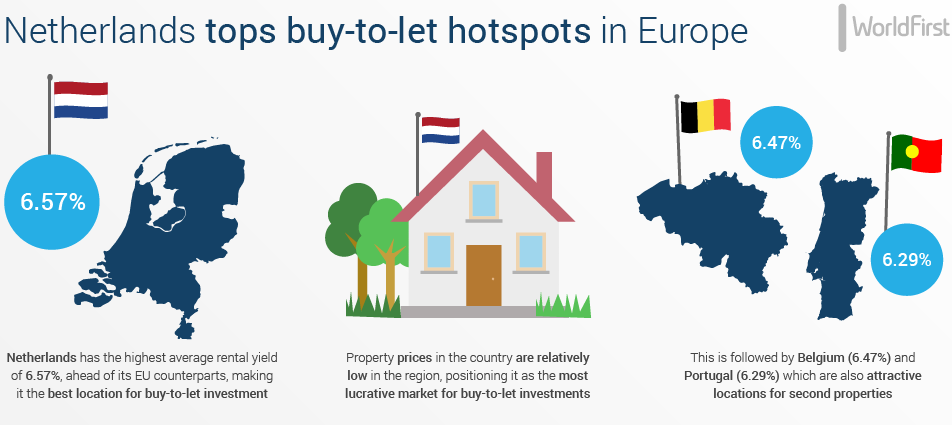

According to international currency experts World First, the Netherlands is the best location in the EU for buy-to-let investments as it offers the highest rental yields in the region at 6.57% as well as relatively low property prices.

The average one bedroom apartment in the Netherland costs just over £110,000 and a three bedroom house costs around £211,000.

World First advises investors to steer well clear of buy-to-lets in Sweden, France and Italy, which offer some of the lowest returns

Sweden, in particular, has yields lower than 3% (2.88%) due to rental controls and a market that favours tenants. This market climate will deter seasoned buy-to-let landlords looking for a decent return on their investment.

France (3.22%) and Italy (3.55%) – already established hotspots for holiday homes – also have lower rental yields than their European neighbours and whilst they may make a great retirement or summer home for sun-seekers, they may not be ideal locations for buy-to-let investors.

Currency fluctuations in the past year have significantly impacted the affordability of property on the continent.

The recent weakness of the pound has also added over 11% to the price of property in the eurozone with the average one bed apartment in the Netherlands up from £117,000 to over £130,000, while property prices in Sweden are 12% more expensive thanApril last year.

Edward Hardy, market analyst at World First, said: “With the recent changes to stamp duty tax for buy-to-let landlords, UK property investors looking to add to their portfolio might want to consider looking further afield to get the best returns. Our research shows that within the EU, the Netherlands, with relatively affordable property prices, holds the highest level of returns in Europe. On the other hand, countries that have policies in place to regulate rental prices like Sweden and Germany offer relatively low yields for investors.

“Our research also shows that locations which may be appealing to British tourists aren’t necessarily the best options for property investors to get the most from their investments. Popular tourist and expat destinations like France, Italy and Spain rank relatively low on our buy-to-let scale.

“If investors do decide to buy abroad, timing is also critical. Our research reveals that fluctuating currency movements can add over 12% to the price of a property abroad. Fluctuations in the last year alone have increased the price of a one bedroom apartment in Sweden by nearly £30,000.”

Average rental yields across Europe

| Country | Average rental yield | |

| 1 | Netherlands | 6.57% |

| 2 | Belgium | 6.47% |

| 3 | Portugal | 6.29% |

| 4 | Hungary | 6.21% |

| 5 | Turkey | 6.13% |

| 6 | Slovakia | 6.07% |

| 7 | Bulgaria | 5.99% |

| 8 | Malta | 5.90% |

| 9 | Cyprus | 5.41% |

| 10 | Ireland | 5.34% |

| 11 | Denmark | 5.16% |

| 12 | Latvia | 5.07% |

| 13 | Romania | 5.06% |

| 14 | Poland | 4.98% |

| 15 | Spain | 4.96% |

| 16 | Czech Republic | 4.69% |

| 17 | Greece | 4.51% |

| 18 | Luxembourg | 4.48% |

| 19 | Lithuania | 4.43% |

| 20 | Finland | 4.31% |

| 21 | UK | 4.28% |

| 22 | Germany | 4.23% |

| 23 | Estonia | 4.21% |

| 24 | Slovenia | 4.09% |

| 25 | Austria | 3.89% |

| 26 | Croatia | 3.58% |

| 27 | Italy | 3.55% |

| 28 | France | 3.22% |

| 29 | Sweden | 2.88% |