Emma Cox, sales director at Shawbrook Commercial Mortgages, discusses the tax changes to purchasing second properties and how this affects buy-to-let investors

hen reviewing market sentiment with regard to the changes impacting the buy-to-let (BTL) sphere, I’m not entirely sure that anything is “certain” when it comes to tax these days. This word rarely triggers feelings of outright happiness or positivity but since April 2016, it has been sending ripples of anxiety throughout the professional investor and landlord community.

Shawbrook has been involved in several forums over the past six months, and conducted extensive training in-house to build a platform from which to deliver some insight, and develop some research to gauge sentiment.

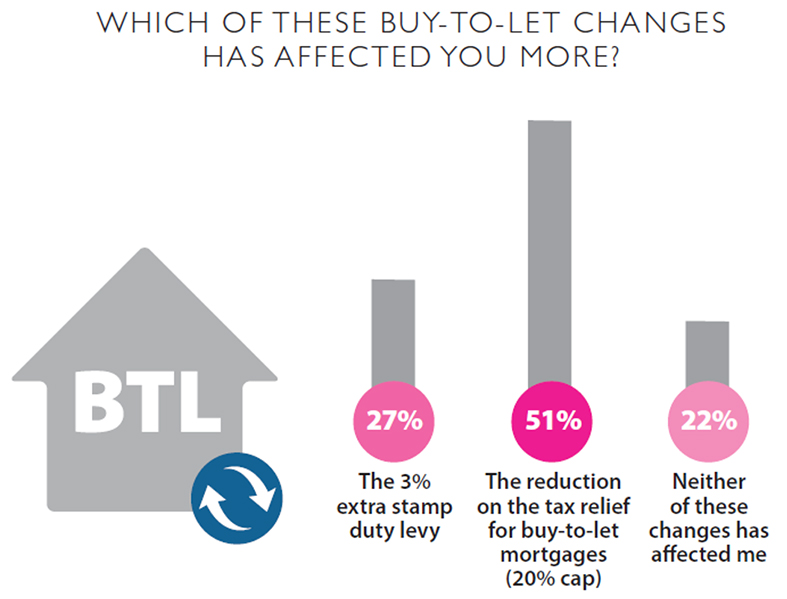

There were several key elements to George Osborne’s changes, the most significant of which are recapped simplistically within this article. Given the additional uncertainty we are facing post Brexit, it is important to have a firm understanding of what these changes are and how they are likely to impact the market – particularly considering that when asked, 26% of Shawbrook customers surveyed remain in the dark about the impact of the shift in the tax regime.

Restriction of relief on finance costs

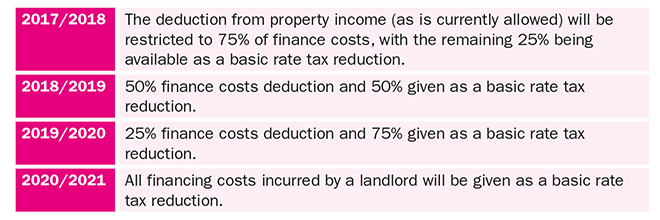

Starting with “the big one” from the 2015 Autumn Statement – the restriction of relief on finance costs was arguably the most impactful change for professional investors and landlords across the UK. Under the current tax regime landlords may deduct finance costs (i.e. mortgage interest payments) against rental receipts, which can prove to be highly advantageous for highly leveraged portfolios.

The cap on mortgage interest relief is to be phased in over the next four years, which is anticipated to generate in excess of £650 million annually from 2020 for the government.

This BTL tax change, (the like of which is not currently in place across any other business or sector), remains subject to a Judicial Review due to the severe profit implications for landlords and professional investors.

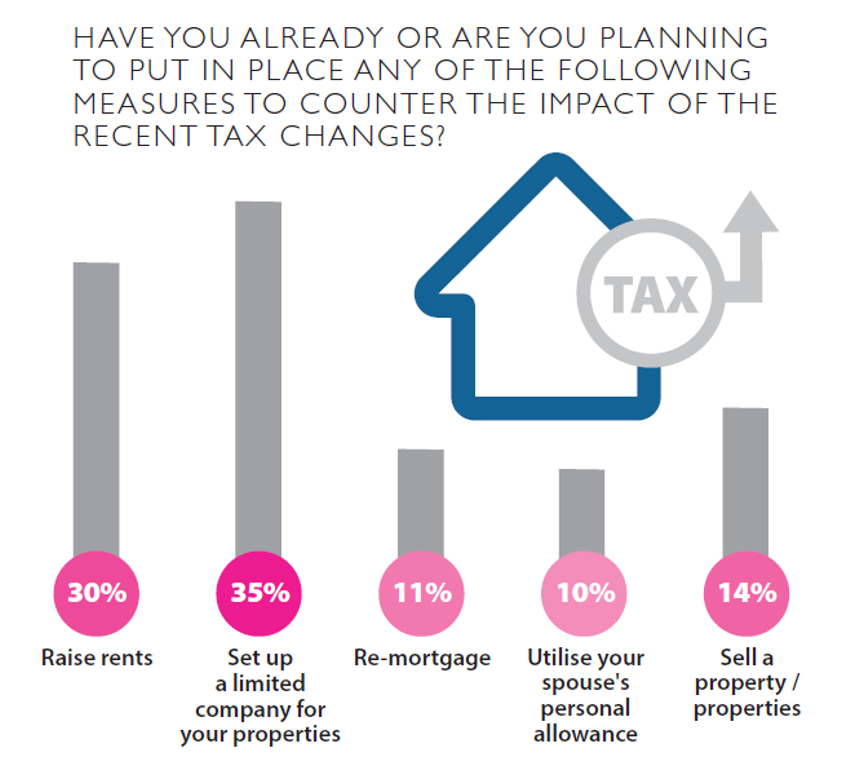

Somewhat predictably, we have seen increasing numbers of customers consider or implement limited company applications, due to this structure potentially proving more tax efficient rather than holding a property in an individual name.

Additionally, we may see landlords incorporating their BTL business and transferring over to a company.

Borrowers would therefore be able to take advantage of lower Corporate Tax rates enabling finance costs to be deducted in calculating the company profits, although there are Stamp Duty and Capital Gains considerations that borrowers must be aware of and around which they should seek bespoke tax advice.

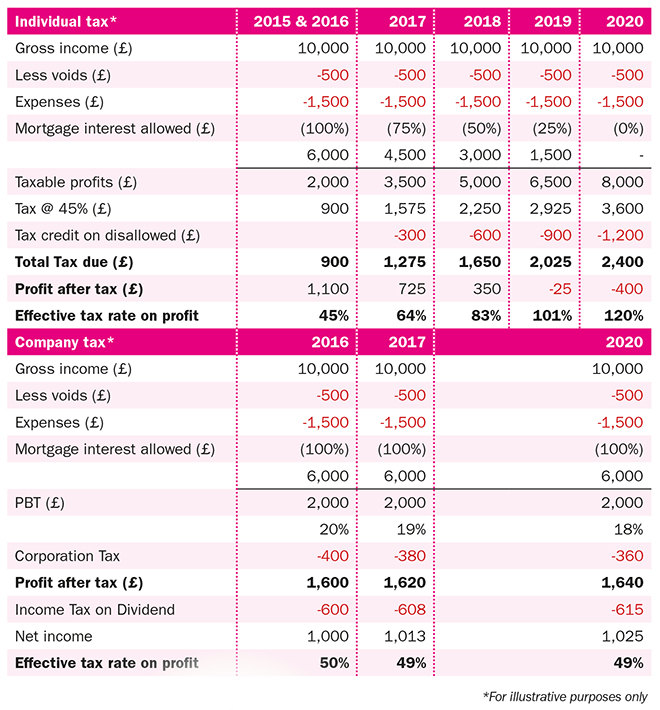

What the impact may be on the smaller portfolio landlords will continue to emerge as the cost of incorporation can be severe, but we may well see increasing numbers exit the market altogether. The tables below serve to highlight the consequences of the shifting tax regime with a snapshot of the historic rules as they compare to the implemented changes.

Assumptions*

Property value: £200,000

Gross yield: (5%) £10,000

Voids: (5%) £500

Expenses: (15%) £1,500

Debt: (75%) £150,000

Notional interest: (4%) £6,000

Profit before tax: £2,000

As we can see when comparing the numbers, the limited company tax structure yields benefits in terms of the impact on net profit but as mentioned, there are several considerations for investors looking to incorporate and they would be well placed to seek appropriate tax advice before taking this option.

Stamp Duty Land Tax (SDLT)

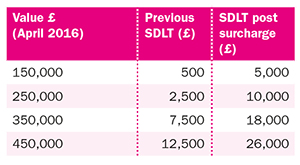

Onto the next major change which took the shape of a new surcharge on additional residential properties where the purchase of additional residential properties – second homes or buy-to-lets – incurs a 3% surcharge above the historic Stamp Duty Land Tax (SDTL) rates. These higher rates – applicable for purchases above £40,000 – are in effect for all contracts entered into on or after 26 November 2015, where completion takes place on or after the 1 April 2016, and as expected we saw a surge in completion activity prior to this date.

Onto the next major change which took the shape of a new surcharge on additional residential properties where the purchase of additional residential properties – second homes or buy-to-lets – incurs a 3% surcharge above the historic Stamp Duty Land Tax (SDTL) rates. These higher rates – applicable for purchases above £40,000 – are in effect for all contracts entered into on or after 26 November 2015, where completion takes place on or after the 1 April 2016, and as expected we saw a surge in completion activity prior to this date.

We can see from the research that professional investors are trying to absorb the increase using a variety of means highlighted below.

The stamp duty changes in action

The restriction of relief on finance costs and the stamp duty changes are the most significant for landlords and

in isolation, these initiatives might be somewhat more palatable. However in this circumstance, the whole really is greater than the sum of its parts and with additional challenges such as the withdrawal of the Wear and Tear allowance, where landlords will only be able to claim for the actual costs incurred on replacing furnishings when calculating taxable profits, the environment remains a challenging one when considered against the economic and political uncertainty of Brexit.

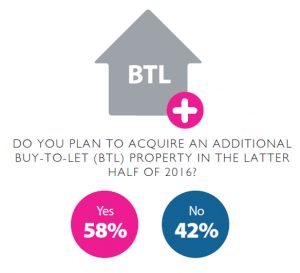

While all of this may seem a touch gloomy, it must be recognised that investor sentiment is still extremely positive and there are still opportunities for landlords to build and grow. This positivity is further evidenced by comparing the same response by Shawbrook customers from January 2016 where 56% planned to acquire an additional BTL compared with 58% in July 2016. Not a big swing perhaps, but at least it is in the right direction.

While all of this may seem a touch gloomy, it must be recognised that investor sentiment is still extremely positive and there are still opportunities for landlords to build and grow. This positivity is further evidenced by comparing the same response by Shawbrook customers from January 2016 where 56% planned to acquire an additional BTL compared with 58% in July 2016. Not a big swing perhaps, but at least it is in the right direction.

Landlords face some tough challenges across the UK credit landscape as well as increasing regulatory pressures, but from a Shawbrook perspective, we remain extremely upbeat about the future with a strong appetite to lend to this market.

If, following the EU referendum, this is purely a confidence game, then judging by the sentiment, summarised neatly to the left in our Client Barometer, we remain well placed to continue to provide desirable outcomes for borrowers throughout the remainder of 2016 and beyond.

PLEASE NOTE: No content within this article constitutes advice and therefore must not be relied upon as such. Borrowers should obtain independent legal and tax advice, along with the advice of a professional finance broker.