Estate agents are cutting prices in London commuter towns more than anywhere else in the UK, new research has revealed. The property price cutting capital of the UK is Reading, where the percentage of properties currently for sale which have had their values slashed is almost double six months ago. According to online estate agents […]

Estate agents are cutting prices in London commuter towns more than anywhere else in the UK, new research has revealed.

Estate agents are cutting prices in London commuter towns more than anywhere else in the UK, new research has revealed.

The property price cutting capital of the UK is Reading, where the percentage of properties currently for sale which have had their values slashed is almost double six months ago.

According to online estate agents HouseSimple.com, 44% of properties currently for sale in the Berkshire town have been reduced in price since they were first advertised.

That compares to 22.8% of properties on the market in February 2017 that had a price reduction.

HouseSimple looked at the percentage of properties dropped in price by estate agents since they were first advertised, and compared the percentage in February 2017 with August 2017.

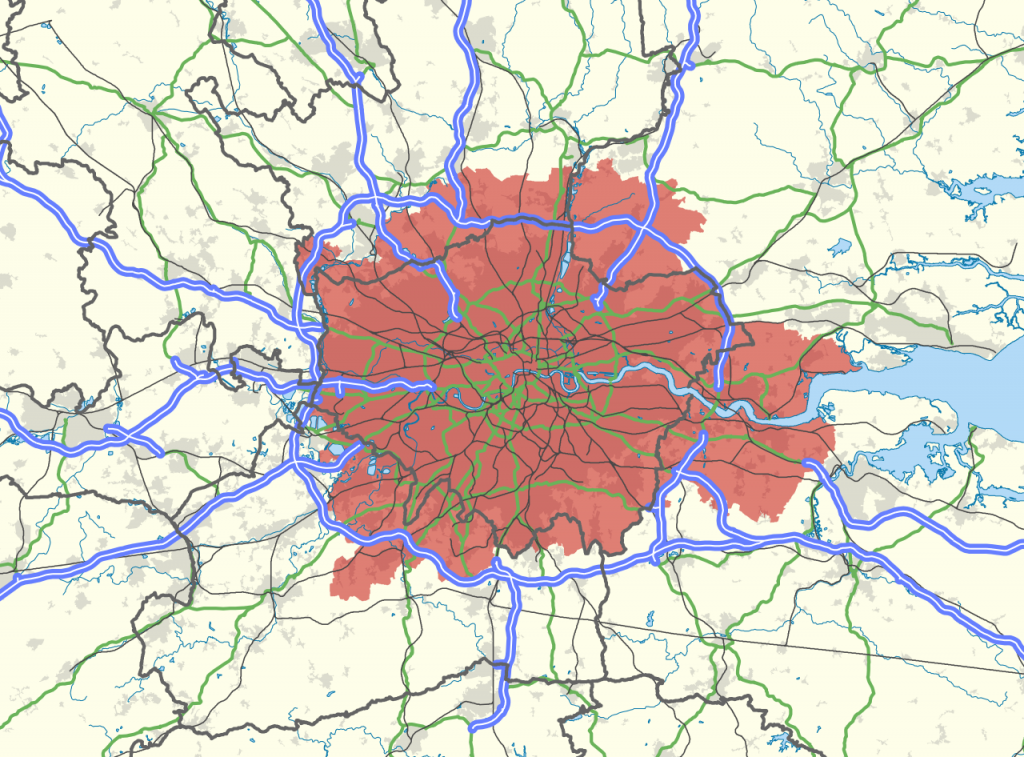

The top 10 towns or cities with the largest percentage growth in price- reduced properties, comparing February and August, are all within an hour of central London by train.

In Basingstoke, 50 minutes by train into Waterloo, 35.6% of properties currently for sale have been reduced in price since they were first marketed. That compares to 19.1% when the research was conducted back in February 2017, an increase of 16.5%.

The analysis revealed a clear North-South divide in terms of towns/cities where there is a growing percentage of price reductions by agents, with 11 out of 20 of the biggest increases in the South or South East.

While 14 out of 20 of the towns or cities where the percentage of price reductions has actually fallen when comparing August to February, are in the north or Scotland.

More than a third of properties (33.5%) currently for sale in over 100 of the UK’s major towns and cities have had a price reduction since estate agents first marketed them.

In central London, more than a third (35%) of properties have been dropped in price.

Of the three largest cities in the UK, London (35.0%) has the highest percentage of price reductions on current stock. This compares with 27.5% in Birmingham and only 16.6% in Manchester. This suggests that estate agents in the capital are finding it hard to secure a sale, due to inflated prices, and sellers are having to drop asking prices to attract buyers.

Alex Gosling, CEO of online estate agents HouseSimple.com, said: “The London commuter belt has seen a property price boom over the past decade, as Londoners priced out of the capital’s property market have moved further out to take advantage of cheaper stock and excellent local amenities including highly rated state schools.

“As a result, the gap between property prices in many of the commuter towns and prices in central London has narrowed. Anyone looking in some of the most popular commuter towns, 30 minutes from London, may now find that properties aren’t any more affordable. That is putting pressure on local property markets, as buyers may be starting to look further afield for value for money.

“For anyone selling a property, have the lowest price you’re willing to take in the back of your mind, and be prepared to negotiate if a strong buyer – someone with finance in place who can move quickly to exchange – makes an offer. Sometimes holding out for an offer that might be a few thousand pounds more, could result in your property sitting on the market for months.”

Biggest increase in percentage of properties currently being advertised that have been reduced in price

| Town/City | Region | Listings – Feb 17 | % of listings reduced in price – Feb 17 (A) | Listings – Aug 17 | % of listings reduced in price – Aug 17 (B) | % Increase between (B) and (A) |

| Reading | South East | 377 | 22.8% | 562 | 44.0% | 21.2% |

| Basingstoke | South | 324 | 19.1% | 494 | 35.6% | 16.5% |

| Basildon | East | 420 | 26.7% | 517 | 41.0% | 14.3% |

| Chelmsford | East | 229 | 21.4% | 346 | 34.4% | 13.0% |

| Woking | South East | 307 | 31.6% | 435 | 43.2% | 11.6% |

| Winchester | South | 90 | 25.6% | 154 | 36.4% | 10.8% |

| High Wycombe | South East | 390 | 22.8% | 462 | 33.6% | 10.8% |

| Watford | East | 405 | 31.4% | 545 | 42.0% | 10.6% |

| Luton | South East | 500 | 21.4% | 744 | 31.9% | 10.5% |

| Northampton | East Mid | 644 | 23.9% | 761 | 33.8% | 9.9% |

| Portsmouth | South | 399 | 27.0% | 502 | 36.8% | 9.8% |

| Brighton | South East | 578 | 32.5% | 777 | 42.2% | 9.7% |

| Chester | North West | 366 | 25.1% | 417 | 34.3% | 9.2% |

| Shrewsbury | West Mid | 112 | 29.5% | 112 | 38.4% | 8.9% |

| Hereford | West Mid | 160 | 26.9% | 174 | 35.1% | 8.2% |

| Slough | South East | 507 | 23.6% | 794 | 31.7% | 8.1% |

| Cambridge | East | 266 | 20.0% | 311 | 28.0% | 8.0% |

| Wigan | North West | 494 | 37.5% | 497 | 45.5% | 8.0% |

| Salisbury | South West | 102 | 30.4% | 112 | 38.3% | 7.9% |

| Maidstone | South East | 426 | 32.2% | 460 | 40.0% | 7.8% |