House buyers are being urged to carefully check the Energy Performance Certificate (EPC) on their new property as the UK’s climate becomes more unpredictable.

House buyers are being urged to carefully check the Energy Performance Certificate (EPC) on their new property as the UK’s climate becomes more unpredictable.

According to Yorkshire Building Society there are already a number of mortgages available for properties which have high EPC ratings, highlighting the growing importance of this ratings scheme.

According to Yorkshire Building Society there are already a number of mortgages available for properties which have high EPC ratings, highlighting the growing importance of this ratings scheme.

But with this year’s weather swinging from freezing – courtesy of the Beast from the East – to this summer’s heatwave, having a home which can retain the heat in winter and stay cool in summer looks even more essential. And this is something a home with a good EPC rating can provide.

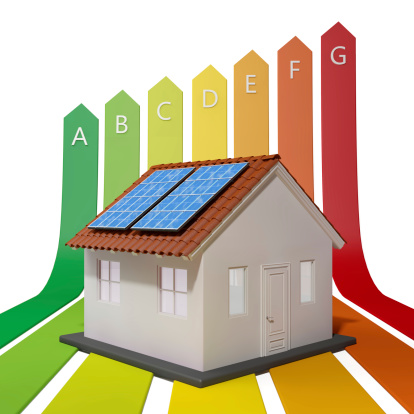

Currently, any property being sold must have an EPC, which gives the dwelling an energy performance rating from A, which is the most efficient, to G, the least. Once purchased the certificate is valid for ten years.

A high EPC rating on a property will demonstrate it has good insulation and glazing and this will ensure a home is able to stay cooler in hot weather and warmer during the cold spells.

And it will also provide an indicator of how much energy is likely to be used and how this will affect the bills.

Janice Barber, mortgage manager at Yorkshire Building Society, said: “We know that buying a house involves a multitude of decisions and sometimes things like the EPC rating can drop down the list of priorities for a move.

“However, as the UK’s climate becomes more unpredictable the ratings on properties could become more important and some providers are already offering mortgages specifically for properties with high EPC ratings.”

According to Barber many people think insulation, double glazing and the like simply help to keep their homes warm in cold weather. However, insulation actually works by slowing down the movement of heat between two spaces.

This means, during the summer, insulation will prevent your home overheating as well as retaining heat during the colder months.

Barber added: “An EPC will give you information about a property’s energy use and typical energy costs and recommendations about how to reduce energy use and save money.”