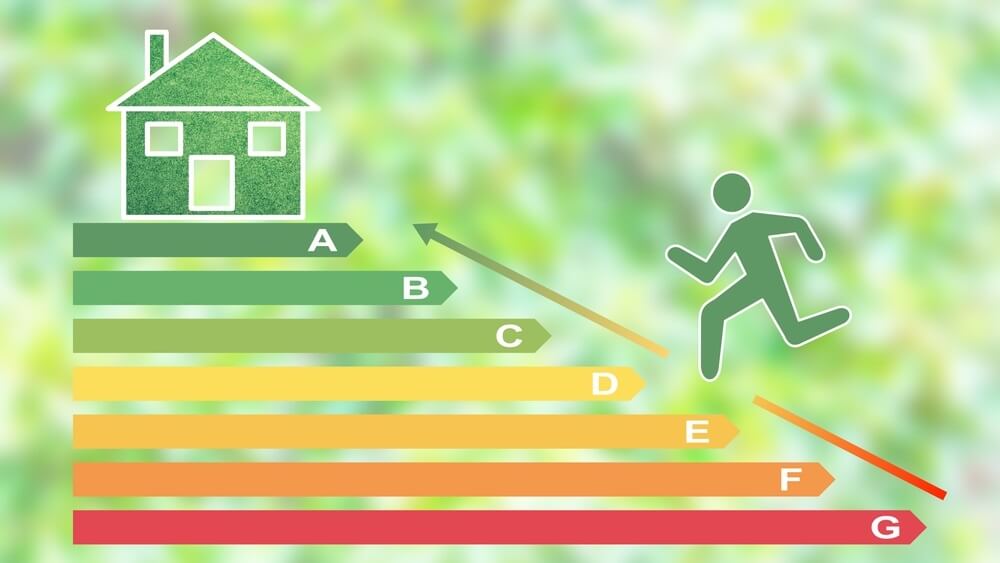

This is the message from mortgage lender Skipton Building Society which has reacted to the Labour announcement all landlords must meet an Energy Performance Certificate (EPC) rating of Band C by 2030.

This is the message from mortgage lender Skipton Building Society which has reacted to the Labour announcement all landlords must meet an Energy Performance Certificate (EPC) rating of Band C by 2030.

The building society is offering and delivering free EPC Plus assessments to all of its members to help improve energy efficiency awareness.

It said these will be available to members with buy-to-let mortgages. They can have up to 10 free EPC Plus assessments and reports for their property portfolios, irrespective of whether they only have only rental property mortgaged with Skipton.

But Skipton has also called on the government to offer more support to landlords to help them achieve the energy efficiency goals.

Charlotte Harrison, CEO of Home Financing at Skipton Group, said: “We believe that when it comes to the decarbonisation of our housing stock, the government needs to consider ways to incentivise and support landlords in forthcoming budgets to enable them to reach the new proposed target.

“Making the necessary improvements to their properties is critical to helping the country meet its net zero target and, importantly, will help to address some of the challenges that the cost of living, energy and climate crises have had on people living in the UK.”

How landlords could be incentivised

Skipton suggested the government could make energy improvement costs tax deductible, taking it a step further by offering government grants, or matching energy home improvement spending £1 for £1, for example.

Indeed, it said, to date, there had been more incentives for homeowners and social tenants to green their homes than there have been for landlords and it was time to rectify this imbalance.

Harrison added: “At Skipton Group, we are committed to playing our part in helping make Britain’s homes greener.

“Our EPC Plus offering, in partnership with Vibrant, is an important part of our support for landlords and offers hands on advice to help them understand the best options to upgrade their property, including a bespoke guide on how the landlord can achieve the rating, how much it could reduce their tenant’s energy bills by, and signposts to sources of funding potentially available.”