Going through a separation or divorce is very difficult on a personal level but there are serious financial implications attached to that as well, especially if you have a mortgage, Vanya Damyanova reports

Dissolving a long-term relationship is like moving out of a home you have lived in for years – it is hard, you have loads of baggage and you are overwhelmed by the amount of stuff you have to take care of.

One of the hardest things to go through, apart from the emotional stress, is the division of all assets you have shared with your partner over the years – bank accounts, equity and of course property.

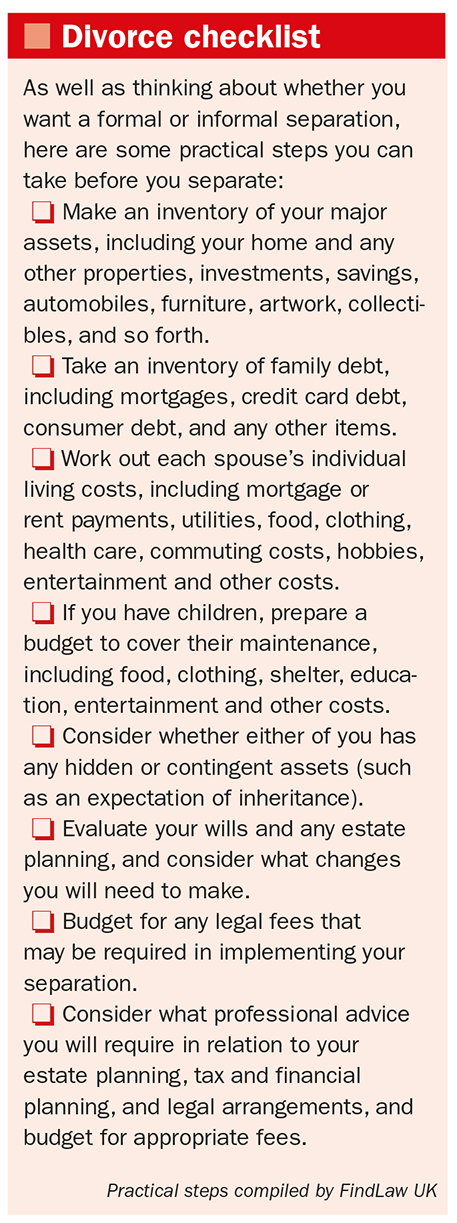

What is important to consider here is that after a separation or divorce both partners rarely end up on an equal financial basis, especially when there are children who have to stay with one of the parents. That is why it is recommended to seek independent financial advice and plan ahead. It would also be useful to get a few things in order before you proceed with the separation (See the checklist opposite).

Careful financial planning will help keeping the division of assets under control and an amicable agreement with your ex-partner is the best way to make the process easier. Our case study shows that you can save a considerable amount on costs if you reach an agreement without involving external parties. Most divorce experts also recommend to settle things among yourselves.

If you and your ex-partner share a mortgage together there are a few things you can do. These will depend on whether you want to stay in the property or not.

Sell the property and move out

In case neither of you want to stay in your old home, you can sell it for a profit and pay off the mortgage. Then both you and your ex-partner can find new accommodation.

This is the easiest way to achieve a clean break and an equal division of assets (if any are left after the mortgage is paid off), especially if you agree the terms among yourselves.

A lot of couples are going for that option because it is quicker and less complicated.

Stay in the property and transfer the mortgage

Your or your partner staying in the old marital home will require one of you to be taken out of the mortgage agreement. Then the loan has to be transferred to the person keeping the home.

In this case one of the partners will basically buy out the share of the other.

A transfer of the mortgage loan would require a new affordability check from the lender, so if you are opting for that, get in touch with your provider as soon as possible.

Usually, the lender would agree to put one of the partners as a sole mortgage holder but sometimes people get a family member to guarantee their loan.

Agreeing a transfer could be as quick and easy as selling the property but there are a few things that could complicate the process. Having disagreements about each partner’s share in the property is one of them.

Again the best way is to settle out of court.

Keep the mortgage and move out

There some rare cases in which both partners decide it would be better to keep paying their existing mortgage.

Usually people choose that option if they have a short time left to repay the mortgage or have a good deal which they do not want to change.

In this case, both partners should make sure they will be able to afford repayments after the separation or divorce.

Being on good terms is essential here, because the lender would hold one partner liable for the whole amount of the loan if it cannot get hold of the other.

Three questions about property and divorce answered

Among the top 30 frequently asked questions about financial matters in divorce and separation, there are three directly linked to property. See what legal experts of The Law Donut online have answered.

Among the top 30 frequently asked questions about financial matters in divorce and separation, there are three directly linked to property. See what legal experts of The Law Donut online have answered.

Moving out before the divorce is final. Does it make any difference?

Moving out before you are divorced will not change your rights on the property. You can move out and then move back in if you like.

However, it is advisable to seek the advice of a professional because there are other considerations. Especially if your partner and you are not on the best terms, it may be better to stay in the property until the division of assets has been agreed upon.

Forced to leave the family home. When can that happen?

If you can keep your home or not would depend mainly on how many other assets you have. This guarantees your ability to make mortgage repayments and cover other costs.

If there are children, their welfare is a priority and usually it is recommended that they stay at the family home with the parent who would care for them in the future.

If money is no issue, one of the partners could simply buy a new property but if the assets are limited, the best way forward could be to sell the family home and acquire two cheaper properties. If assets are very limited the parent who will care for the children would have to stay at the family home and may want a larger part of the assets.

Taxation. How are asset sales and transfers taxed during divorce?

Assets transferred between spouses are exempt from capital gains tax (CGT). This exemption continues to apply during the tax year in which the spouses separate (regardless of the date when any divorce is granted).

Thereafter, any transfer will normally be treated as a sale at market value and subject to CGT (if the CGT annual exemption level is exceeded). However, the transfer of the family home to the spouse who still lives in it will continue to be exempt from CGT in most circumstances.

[box style=”3″]

Case study

Rick and Michelle had their mortgage for just two months when their relationship hit the rocks. They separated not long after Valentine’s Day 2015 after six and a half years together.

The mortgage they had completed in December 2014 had an 85 per cent loan-to-value on a property which they bought for £255,000. Their deposit was £38,250. The mortgage term was 35 years and they initially opted for a five-year fixed rate with Nationwide which was 3.59 per cent. The deal provided affordable monthly payments for both for the foreseeable future.

The mortgage they had completed in December 2014 had an 85 per cent loan-to-value on a property which they bought for £255,000. Their deposit was £38,250. The mortgage term was 35 years and they initially opted for a five-year fixed rate with Nationwide which was 3.59 per cent. The deal provided affordable monthly payments for both for the foreseeable future.

After the separation the two decided that Michelle will keep the property and the mortgage will be transferred to her. Rick and her agreed she would buy his share out and he will also get back any money that he had put into the property up until the separation. Since they had originally planned to sell and move after about five to seven years Rick was also to be compensated for half of any potential profit the house may make over that period.

Rick talks about the calculation: “We looked at what we had paid for the property, which was in need of full refurbishment against how much fully refurbished properties in the local area were selling for. We also took into consideration the rate at which house prices in the area (Croydon) were rising and were expected to rise over the next five to seven years. Once we had done that we were able to agree on a figure that I would receive from my ex-partner in order to be bought out of the property.

We then began changing the terms of the mortgage. The mortgage was kept in place but I was removed from it and my ex-partner’s father was placed onto the agreement as a guarantor.

“If we had decided to sell the property, then there would have been an early redemption fee. I believe this was between 3 to 5 per cent of the remaining mortgage amount so would have been quite high. However, because we kept the mortgage product and instead managed to change the names on the mortgage, we were able to avoid that.”

Rick and Michelle did not acquire the services of a financial adviser or solicitor. “We both considered this, but made the decision to do as much of it as we could ourselves. This way we were able to keep the process relatively amicable and also avoided any legal costs,” Rick said.

Rick’s top tips

Get advice Not necessarily from a professional, but talking to friends and family can often be helpful. Your initial reaction might be to get legal advice and try to get as much as you can from the situation but this would accrue additional costs and might also backfire in the long run as it could make the situation quite hostile.

Act quickly Definitely act efficiently, but smartly and without haste. In my situation, as I knew I was being bought out it made sense for me to be taken off the mortgage as soon as possible. I didn’t want to go on paying for half of the monthly payments for a house I wouldn’t be living in. I also took my name off the utility bills as quickly as possible.

Prepare for high costs I would say prepare for additional costs, but always try to avoid them.

Keep the mortgage v get rid of it This is down to your personal situation. In our case, it made sense to keep it and for one of us to be bought out.

Pros/cons In my situation there are pros and cons. Obviously the cons are having to deal with the break up and coming to terms with not living in the property that we purchased together. The main pro for me was that I made some money out of the situation which has now left me with enough money to put down as a deposit for a place of my own.

[/box]