Property prices near stations on the Crossrail route have been on the rise. Tamir Davies, content writer for Sell House Fast, reports

Crossrail is estimated to generate £5.5 billion in added value to residential and commercial real-estate between 2012 and 2021. What is most significant is that Crossrail as a whole is no new project to the capital.

Crossrail is estimated to generate £5.5 billion in added value to residential and commercial real-estate between 2012 and 2021. What is most significant is that Crossrail as a whole is no new project to the capital.

Despite construction beginning in 2009, the idea of Crossrail, running from East to West has been in the pipeline since 1974; first proposed by a Greater London Council Study into London’s railway capacity.

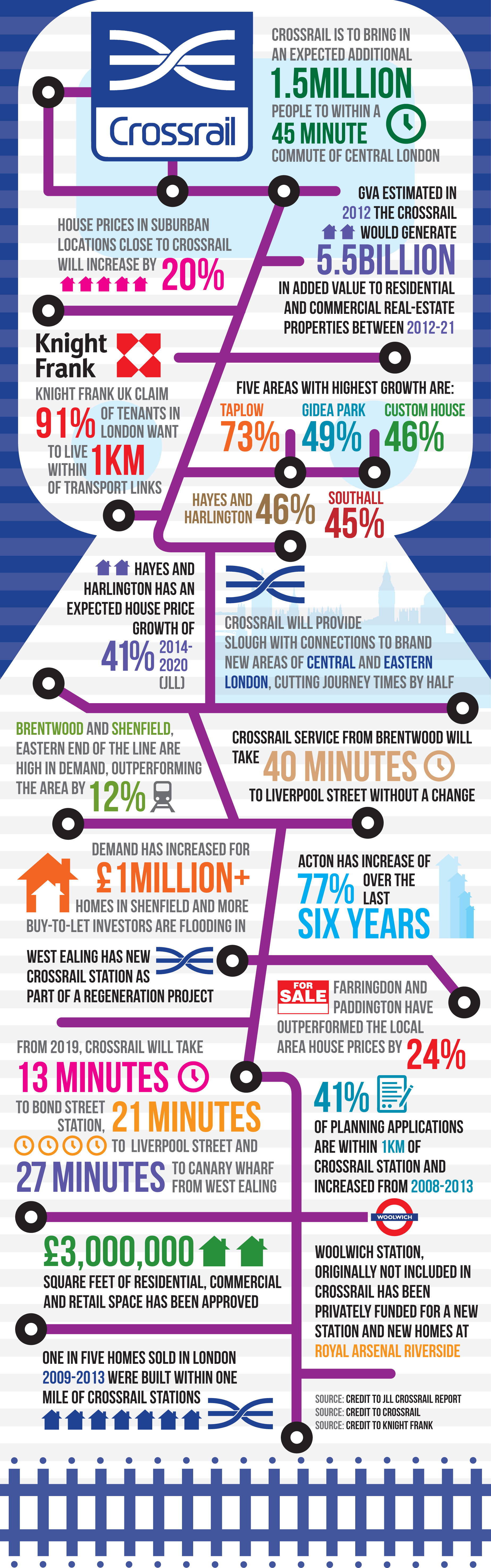

Recent research into the implementation of Crossrail has estimated that the new route will bring in an additional 1.5million people to within a 45 minute commute of Central London. The new route which spans from Shenfield to Reading was given the go-ahead in 2005. In 2008, a small number of changes were made to the route and by May 2018, Paddington Station is expected to open with a full service anticipated by December 2019.

Local housing markets surrounding 36 of Crossrail’s central stations are continuously analysed as market activity continues to shift, conducted in collaboration with www.fastsaletoday.co.uk.

Areas where commuting times have been cut by almost half, have particularly risen in value, attracting investors, buyers and sellers. Many central London stations will see journey times cut by 20 minutes, with house prices in areas of Bond Street, Tottenham Court Road, Farringdon and Whitechapel greatly benefiting from the long term prospects of Crossrail.

Areas closest to zones two and three have seen the largest and most significant housing market uplift within 500 metres of central London stations. House prices have soared by 116 per cent since 2009 compared to 52 per cent of sales across London as a whole.

Regeneration

The driving factor and catalyst for an increase in house prices in Central London is due to Crossrail and the ability to regenerate, rejuvenate and re-develop areas of London.

Developers are using Crossrail as an incentive to build major housing developments along the route, as a way of fixing the housing crisis.

Regenerating areas of East and West London is what separates the success of Crossrail from any other infrastructure project and is the largest infrastructure scheme in Europe. West London has seen housing markets price up quicker than areas of East London and developers have secured large development projects across areas of Paddington, Acton and Ealing.

Journey times from West London will be cut by half an hour on average, with between four and ten Crossrail trains running per hour at peak times of the day. Those seeking a shorter commute into London will greatly benefit from the extended travel links from West London and cut journey times, with a promise to regenerate and breathe new life into areas of West London that were once neglected.

West London

Despite completion at Ealing Broadway station, still four years away, the housing market had a large number of transactions taking place in 2013. Within 500 metres of the western side of the route, house prices increased by 36 per cent, well above the recorded growth of the area at 12 per cent.

Since 2009, house prices have increased by 20 per cent in West London and with extensive housing developments planned, there will be a greater influx of people seeking to move closer to London.

Ealing Broadway is one of the most popular choices for buyers and sellers with the average price of a flat costing £345,000 and the average price of a house starting at £849,000. Journey times from Ealing Broadway will be cut by 10 minutes, with tough competition to buy in the area coming from home and overseas investors. From 2009, the average price of properties sold within 500 metres of Ealing Broadway grew by 48 per cent, outperforming the local area by 23 per cent.

Hanwell is to see the biggest reduction in journey times, with a train from Hanwell to Tottenham Court Road set to take only 15 minutes. Since 2009, prices in the area have increased by 71 per cent and within one mile of the station house prices have outperformed the local area over the last five years. Higher house prices are to materialise greatly in the area, with average prices for flats at £265,000 and houses at £489,000.

Suburban locations

Knight Frank UK has claimed that 91% of tenants living in London want to live within 1km of transport links; highlighting a dramatic housing market shift that will see five areas in particular have the highest growth.

House prices in suburban locations such as Southall, Maidenhead, Taplow and Gidea Park will see house prices increase by at least 20 per cent.

Other areas high in demand are Brentwood and Shenfield, outperforming the area by 12 per cent; with Crossrail trains to take only 40 minutes straight into Liverpool Street with no change. East London is luring in investors who are seeking to buy properties worth £1million and more as well as many buy-to-let investors.

East London

East London is to greatly benefit from Crossrail and the main beneficiaries are zones two, three and four, including the likes of Woolwich, Abbey Wood and Stratford.

Areas such as Abbey Wood and Forest Gate have had a limited transaction growth as house prices have been focussed on a street by street basis and within a mile of these Crossrail stations, the housing market is somewhat unchanged. However, the immediate areas surrounding Crossrail stations have seen a significant increase in house prices. Areas such as Canary Wharf and Stratford, where the housing market is far more established has had a stronger growth in house prices.

Woolwich and Greenwich

Other areas include Woolwich which has had the help of private funding from the local council and Berkeley Homes to include it into Crossrail; as it was not originally named a Crossrail station. Woolwich is a fantastic area to develop as within 500 metres of the station, there are 4,592 households. Within one mile of Woolwich station there are 17,084 households and within the Greenwich area there are 101,045 homes.

Regeneration of the area has been underway since 2009 and most recently, the extension of the Docklands Light Railway opened as well as the first wave of homes completed at Royal Arsenal Riverside.

The impact of regeneration is to expand the number of privately owned housing stock and to reduce the number of homes rented from the local authority. Hamptons International has estimated a 413 per cent transaction growth in the next five years in the area for homes within 500 metres of the new station.

The ripple effect

There are designated areas that have outperformed the local average for house prices; especially in central London. However, with eastern and western areas of the Crossrail route regenerating and redeveloping, these areas are recognising a significantly high property market growth, with opportunities to uplift areas.

Since construction began, there is no doubt Crossrail is a major contender for a property market shift and will become a game changer for those looking to invest in new areas of London and its suburbs. The ripple effect has started to take effect in all areas of the route and some areas will begin to show a noteworthy transactions of property.

Knight Frank’s forecasts show a cumulative price growth of 15.2 per cent in Central London by 2018, with a growth of 18 per cent overall. It is evident that London is on a path of re-birth and Crossrail will usher in a golden era for regeneration.

Gráinne Gilmore, head of UK Knight Frank Residential Research, puts it plainly: “The arrival of a high-speed line which increases London’s rail capacity by 10% is highly anticipated. Transport links are key factors in the property market, especially in the capital.”