Increasing numbers of people are repaying mortgages in later life and lenders are responding with a range of innovative products to meet their diverse needs. In his latest article, Greg Cunnington, director of lender relationships and new homes at Alexander Hall, talks to us about the increase in mortgage options for later life borrowers and how an intermediary can assist.

Research by Legal & General has shown that over-55s in the UK now own over £1 trillion of housing wealth.

Research by Legal & General has shown that over-55s in the UK now own over £1 trillion of housing wealth.

Traditionally, most high street mortgage lenders would allow a mortgage term until a client’s stated retirement age, meaning that a lot of this housing equity is with no mortgage attached or with a soon-to-be-ending mortgage term.

However, for a variety of reasons, increasing numbers of individuals want to retain a mortgage or some form of property financing in later life. The good news is there are a range of different choices available to suit borrowing needs in this space.

For anyone keen to proceed with this, it is important you speak to an adviser who can look at the options in this market. A good adviser will take care to fully assess your personal circumstances and lending requirements in order to make a recommendation specifically tailored to you.

You should also speak to your financial adviser, as it is vital clients receive advice with an overview of all the options available. Pensions and savings or investments should also be reviewed, as it may be more suitable to draw capital from other sources.

What sort of borrower are you?

Typically we see two types of later life borrower:

Existing mortgage borrower

You may be looking to either improve your mortgage deal or perhaps use the equity in your home to borrow more money for a variety of purposes. You may also be on an interest-only mortgage and coming to the end of your mortgage term but do not wish to redeem the capital balance at this stage.

Lifestyle planner

Are you mortgage-free but looking to raise capital for lifestyle purposes? You may be looking to use your property’s equity to maintain your lifestyle in retirement, improve your home, or perhaps you have been advised to take out a mortgage as part of your retirement financial planning. You may also wish to gift some of the equity in your property to your children or grandchildren to help them get onto the property ladder.

Types of later life lending choices

A lot of our clients are uncertain when faced with the large variety of options available. There are three main types of lending option in the later life space, which we have clarified in brief below:

Standard mortgage – Capital & Interest repayment (C&I) or Interest-Only (I/O)

You can take out a standard mortgage as one of the later life lending options. These mortgages will have a set mortgage term, and can be on a Capital Repayment or an Interest-Only basis. If on an Interest-Only basis you would need to repay the capital on expiry of the mortgage term.

Retirement Interest-Only (RIO) mortgage

A Retirement Interest-Only mortgage is designed to enable you to use your home as way to repay the mortgage balance in the event of death, a move into long-term care or selling to purchase a cheaper property, if you have enough equity. As such, these do not have a set mortgage term.

Because they have a set monthly interest payment, unlike some equity release mortgages, the interest does not roll up onto the mortgage balance.

Equity Release lifetime mortgage

An interest roll up Equity Release lifetime mortgage is similar to a RIO mortgage but there is often no monthly mortgage payment. The interest is rolled up and added to the mortgage balance.

The loan is repaid on the occurrence of a life event leading to the sale of the property. There is typically no income-based affordability requirement for an equity release lifetime mortgage.

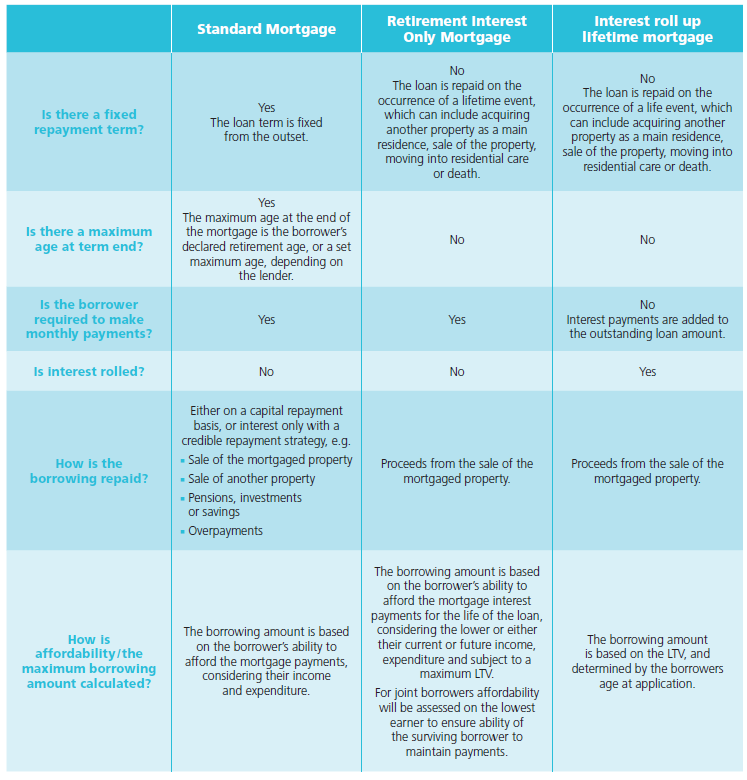

The table below highlights some of the differences in these options:

A good intermediary will cover all of the above in detail with you, ensuring you get not only the best rate but the best mortgage product and set up for your circumstances. A holistic overview of your circumstances is key.

It may be that your mortgage adviser does not directly recommend equity release options, but will refer you to a specialist partnered firm to ensure you receive an overview of all the options.

The most suitable option will be different for each client, with no specific ‘best option’, as it completely depends on your individual circumstances.

Other considerations

There are a couple of other financial planning matters that may be appropriate to consider first:

Your will and estate planning

You should consider whether you wish to include family members, i.e. those to whom you would ultimately leave your estate, in the discussions. An adviser will be happy to accommodate this if it is your wish and can do this as a face-to-face meeting or as a telephone conference call.

It is very important that you seek independent legal and tax advice as to the potential impact your mortgage arrangements have on estate planning. You can use your existing legal and tax experts, or our advisers can refer you to carefully selected firms that can advise you.

It is also sensible to ensure that you discuss your will arrangements. You can speak to your existing wills provider, or your adviser should be able to recommend a firm that can help here also.

Means-tested benefits

If you are in receipt of any means-tested state benefits or could be entitled to any means-tested benefits in the future, it is important that you understand the impact of any borrowing arrangements on these. Further information can be obtained from HMRC, The Pensions Advisory Service or the Citizen’s Advice Bureau.

Our updated website includes a section on later life lending that provides much more information – please take a look for yourself by clicking on this link.

Case Study: Later life lending advice in action

The clients

A married couple, David and Laura (names changed) live in a large property in East Yorkshire with an interest-only mortgage of £100,000. The property is valued at £500,000.

David is 70 years old and Laura is 69 years old. The mortgage term with the existing lender ends later this year and the clients have received written notification. The clients intended to sell the property and downsize with a cash purchase using the equity, which is still their intention, but they don’t feel now is the right time to sell the current property. What’s more, they also wish to carry on residing in their current home for another few years.

David has a pension income of £50,000 per annum, so affordability of the monthly payments is not an issue. However, the current lender, and their own bank when they approached them, said due to their ages they could not help here.

The solution

We approached a building society with a specialist later life lending mortgage range which will allow the mortgage term to go to a bespoke age.

We looked at capital repayment and interest-only options, but as the clients intended to sell in the next five years, downsize using a cash purchase and preferred to keep the monthly payments similar to the current payments, they wished to proceed on an interest-only option.

We also looked at RIO options and referred David and Laura to an equity release specialist adviser, who met with them and ran through these options. However, as the later life mortgage terms were the most competitive on interest rate and the monthly payment was readily affordable, this was deemed the best option for David and Laura.

David and Laura also ensured they took out independent tax and legal advice before proceeding.

The details

Property value: 500k

Loan amount: 100k

LTV: 20%

Rate: 2.5% discount variable

APRC: 5.4%

Term: 20 years

Lender arrangement fee: £699

Mortgage payment: £210

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE OR ANY OTHER DEBT SECURED ON IT