Last week the government introduced a new stamp duty holiday on properties worth up to £500,000.

We have already seen an influx of enquires from prospective buyers, showing that this holiday will likely be a real boost for the property market.

But we have also received a lot of questions around this announcement, with various customers asking for clarity around what exactly has changed and if this benefits them directly.

In this article we will aim to help you to answer some of these questions.

What was announced?

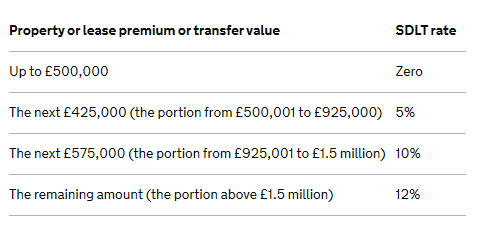

The government has announced a new stamp duty holiday where an increased ‘nil’ band has been created for purchases up to £500,000. This has been increased from the previous limit at £125,000.

This applies to all buyers, not just first-time buyers, and will take place with immediate effect. As such, if you in the process of buying a home but have not yet completed, your purchase will be applicable for the tax break.

The other stamp duty bands will also follow on from this increased ‘nil’ band. This means there is a stamp duty saving for purchases over £500,000 also.

This is in place until 31 March 2021, so you must complete on your purchase by this date to be eligible for this stamp duty holiday.

What has changed?

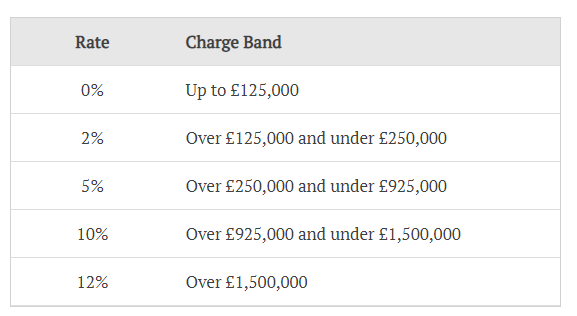

The previous ‘nil’ band was set at £125,000 with stamp duty payable at 2% for any purchase price between £125,000 and under £250,000 and then 5% for any purchase price over £250,000 and under £925,000 (see table below).

Previous stamp duty bands table

This means that previously a £400,000 purchase would have cost you £10,000 in stamp duty. This will now be zero!

To highlight how the new increased ‘nil’ band also benefits those purchasing over £500,000, for a purchase of £800,000 the stamp duty would previously have been £30,000. This will now be £15,000. So that is a £15,000 saving!

There was a higher ‘nil’ band for first-time buyers, up to £300,000, with lower stamp duty also payable up to £500,000. However, for first-time buyers purchasing between £300,000 and £500,000 these changes still represent a significant saving.

A purchase at £500,000 for a first-time buyer would have cost £10,000 in stamp duty, and will now be zero!

Does this also apply if I am purchasing a buy-to-let property or second residence?

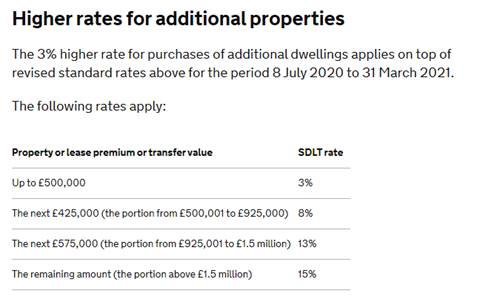

Yes. The 3% higher rate for additional properties – such as buy-to- lets and second residences – is still applicable.

However, additional homes will also be eligible for the initial new banding. As such, this will represent a big stamp duty saving for landlords and those buying second residences also.

As an example, a landlord purchasing for £350,000 would previously have had a stamp duty bill of £18,000. This would now be £10,500 – 3% of the purchase price.

This is a saving of £7,500.

As such we anticipate demand from landlords and those wanting to buy a second residence to increase in this period.

Can I still benefit if I’ve already committed to a purchase and am close to completion?

Stamp duty is payable on completion, so the good news is for those who have exchanged contracts and are currently waiting for completion you will benefit from this change.

The new stamp duty holiday began on 8 July, which means anybody who completed on a property purchase before that date had to pay the full normal stamp duty.

Helping with your deposit

There is still a lower number of availability for mortgages with a 5% or 10% deposit compared to earlier this year.

These changes may well mean you can now put down another 5% deposit using the money you had set aside for stamp duty costs.

This will also likely mean you can secure a lower mortgage rate, as rates lower the more deposit you can put down.

Click on this link to check out some of the amazing mortgage rates currently available.

We also have access to some mortgage products on a semi exclusive basic with a 10% deposit, so if you are thinking of purchasing in the near future please do not hesitate to contact us to speak to one of our mortgage advisers.

Please get in touch with us if you need any further advice. You can email us at AskAlexanderHall@alexanderhall.co.uk or use the contact us page on our website.

Greg Cunnington is director of lender relationships and new homes at Alexander Hall

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE OR ANY OTHER DEBT SECURED ON IT