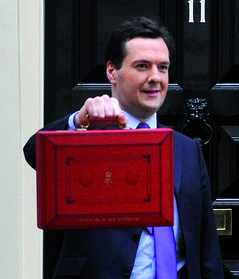

In today’s Budget 2015 speech Chancellor George Osborne said the government will expand its Help to Buy scheme by introducing a new option to open an individual savings account (ISA) for property purchases.

The Help to Buy: ISA, which is expected to launch this autumn, will be available through banks and building societies.

The Help to Buy: ISA, which is expected to launch this autumn, will be available through banks and building societies.

First-time buyers who decide to use the scheme to save up for a deposit on their first home will receive a government bonus, corresponding to 25 per cent of the amount saved.

The maximum monthly amount savers can put in their Help to Buy: ISA is £200. The government will add £50 to that.

The maximum government contribution is £3,000 on savings of £12,000.

First-time buyers will receive the government bonus when they buy their first home. It can be put toward homes that are worth a maximum of £450,000 in London and £250,000 in all other areas of the UK.

For basic rate taxpayers, this will be equivalent to saving completely free of tax for their first home. Accounts are limited to one per person rather than one per home so those buying together can both receive a bonus.

Describing the new addition to the Help to Buy scheme in his speech, Chancellor Osborne said:

“We’re going to take two of our most successful policies and combine them to create a brand new Help to Buy ISA.

“And we do it to tackle two of the biggest challenges facing first time buyers – the low interest rates when you build up your savings, and the high deposits required by the banks.

“The Help to Buy ISA for first time buyers works like this. For every £200 you save for your deposit, the Government will top it up with £50 more,” the Chancellor said.

Opening a Help to Buy ISA

To open a Help to Buy: ISA will, in most ways, be the same as to open a regular account under the existing cash ISA rules but there are some additional requirements.

*The Help to Buy: ISA will be available only to first-time buyers

*Each first-time buyers is allowed to open just one account within the scheme during the scheme’s lifetime

Rules for saving in a Help to Buy ISA

*As previously mentioned, the maximum monthly amount is limited to £200

*There is an opportunity to deposit an additional £1,000 when the account is first opened

*There are no time limitations on how long the account can remain open

*Banks and building societies will be allowed to impose their own interest rates and withdrawal rules on the Help to Buy savings accounts.

*Standard transfer rules for ISAs will apply for the Help to Buy ISA as well. This will give customers the freedom to switch lenders.

*Currently a saver is allowed to subscribe to one cash ISA per year. This rule will remain in the future, which means that people who open a Help to Buy: ISA with one provider will not be able to open another cash ISA with a different provider.

Although first-time buyers will have that limitation, they will be able to benefit from the changes to the taxation of savings the Chancellor announced today. The announced new Personal Savings Allowance of up to £1,000 for basic rate taxpayers, and up to £500 for higher rate taxpayers comes in force from April 2016.

Duration of the Help to Buy: ISA scheme

First-time buyers will have four years time to subscribe for a Help to Buy ISA after the scheme’s official launch, which is expected in the autumn of 2015.

After they open their account there is no limit to how long that account will remain open. There is also no limit on when the savers will decide to use the government bonus.

Full details about the new scheme are available online in the HM Treasury’s outline of the scheme.