Buy-to-let landlords in seven out of 10 UK towns and cities will be forced into debt if interest rise by just 2.5%, new research has found. According to crowdfunding platform Property Partner, if interest rates rise by 2.5% over the next four years buy-to-let could become unprofitable in seven out of ten UK towns and […]

Buy-to-let landlords in seven out of 10 UK towns and cities will be forced into debt if interest rise by just 2.5%, new research has found.

Buy-to-let landlords in seven out of 10 UK towns and cities will be forced into debt if interest rise by just 2.5%, new research has found.

According to crowdfunding platform Property Partner, if interest rates rise by 2.5% over the next four years buy-to-let could become unprofitable in seven out of ten UK towns and cities, with the average investment property making an annual loss of £325.

The research assumed the property was mortgaged with a 60% LTV buy-to-let loan, fixed for three years at 3%.

It worked out that the average annual net profit of £3,419 today would fall to £2,555 by 2020, even if rates remained at 3%.

The figures are even starker if interest rates were to rise 2.5% by 2020, with the same average buy-to-let making a loss in more than two-thirds (69.8%) of towns and cities – an average loss of £325 per year.

The research showed that Salisbury would be worst hit. With a cut in mortgage tax relief and a 2.5% rise, landlords would feel the full impact with debts mounting to £2,984 per year by 2020.

In Cambridge, the average profit today is £4,257 but would plummet into the red with a £2,418 annual loss in 2020. Similarly, in Winchester an annual profit today of £5,835 would be wiped out, and landlords would be facing an annual debt of £2,169.

Dan Gandesha, chief executive of Property Partner, said: “The phased withdrawal of mortgage interest tax relief will be felt across the country, but add in a modest interest rate rise, and many investors will see their rental profits completely wiped out.

“When you factor in April’s stamp duty hike on new property purchases, it’s clear that direct investment in buy-to-let no longer adds up. Traditional landlords from Land’s End to John O’Groats need to face up to the stark reality. In a few years, the whole structure of the UK housing market will have changed.

“It’s a tipping point. Landlords will lose out but millions more will be better off, with more affordable homes for first time buyers, more high-quality accommodation for tenants, and an asset class made available for everyone to invest in.”

Case study

Buy-to-let landlord Jaye Cook, who owns five properties in Kent, is so worried about the chancellor’s tax changes that he’s planning to offload some of his existing portfolio.

“My biggest fear is that I’ll start to make a loss every month once this landlord tax kicks in as we’re going to be taxed on the revenue rather than the profit.

“These changes will force landlords to raise their rents to make ends meet or they’ll sell up and create a glut of buy-to-let properties on the market.

“I’m still a big advocate of property. Once my fixed rates on some of the properties come to an end, I’m thinking of selling and reinvesting in Property Partner. I’ve already remortgaged some of my properties and invested hundreds of thousands through the platform.“

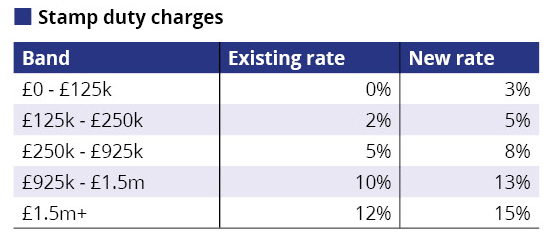

Stamp duty will rise by 3% for landlords and second home owners from 1 April as part of the government’s efforts to dampen the buy-to-let market and free up property for first-time buyers.

Under the changes, the stamp duty on a £250,000 buy-to-let property will rise from £2,500 to £10,000, while the rate for a £400,000 property will more than double from £10,000 to £22,000. The amount of tax relief landlords can claim on properties is also set to fall from April 2017.

Surveyors have reported a surge in buy-to-let investors looking to beat the April stamp duty deadline. The Royal Institute of Chartered Surveyors said in its monthly report that buyer enquiries rose for the tenth successive month in January, with the near-term pressure on prices intensifying.

Typical of dreamland politicians, in the real world renting a home is a first step to independence for young people to make their own way in the world ! Coucils cannot provide enough rented accomodation for young or old, to say nothing of the hundreds of thousands of immigrants arriving each year, policies like this only serve to drive up rents and the number of homeless ! Encouraging entrepreneurship should be every governments goal ! ! !