Tenants finances worsened in February 2015 with 7.6 per cent of all rent in arrears, compared to 6.8 per cent in January and 6.9 per cent a year ago, the latest Buy-to-Let Index from Your Move and Reeds Rains shows. The average rent across England and Wales rose 3.1 per cent as compared to February of last […]

Tenants finances worsened in February 2015 with 7.6 per cent of all rent in arrears, compared to 6.8 per cent in January and 6.9 per cent a year ago, the latest Buy-to-Let Index from Your Move and Reeds Rains shows.

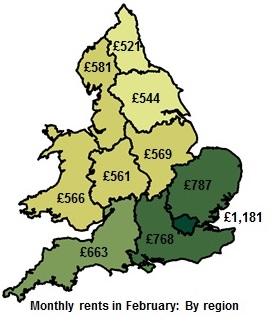

The average rent across England and Wales rose 3.1 per cent as compared to February of last year, which was the fastest year-on-year increase recorded in almost two years (since May 2013).

The average rent across England and Wales rose 3.1 per cent as compared to February of last year, which was the fastest year-on-year increase recorded in almost two years (since May 2013).

Although arrears expanded, Adrian Gill, director of estate agents Reeds Rains and Your Move, warns of reading too much into a seasonal increase like that.

“This type of uptick is a perfectly natural part of the market’s movement and has occurred many times before. The long-term message is clear – we’re seeing far less rent in arrears than five years ago, and this is a very good thing for the rental market,” he said.

The average rent in England and Wales now stand at £766 in real terms, compared to £743 last February.

“The rental sector is carrying the weight of the housing crisis. More homes are needed to house an ever-growing population. The supply simply isn’t there. The result is that landlords are catering to those who can’t afford to buy as well as those who choose renting for the flexibility it offers them – workers moving into new jobs, or people wanting to get a feel for an area before committing to property ownership and setting down roots.

“House prices rising out of reach for people at the lower end of the market makes increasing demand in the private rented sector inevitable. A serious and substantial commitment to new builds is the only way to bring supply in line with demand,” Gill comments.