One in four UK adults who were considering a buy-to-let property investment have been put off by the government’s plan to increase stamp duty, new research has revealed. According to online investment platform rplan.co.uk, 9% of UK adults have given up on owning a buy-to-let property because of the new rules, while 30% are still […]

One in four UK adults who were considering a buy-to-let property investment have been put off by the government’s plan to increase stamp duty, new research has revealed.

One in four UK adults who were considering a buy-to-let property investment have been put off by the government’s plan to increase stamp duty, new research has revealed.

According to online investment platform rplan.co.uk, 9% of UK adults have given up on owning a buy-to-let property because of the new rules, while 30% are still considering whether to do so.

Around one in seven (14%) existing landlords think they will now sell one or more of their properties because of the increase.

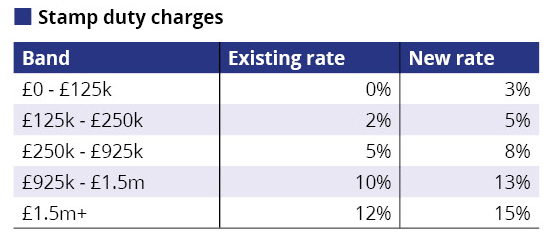

Chancellor George Osborne announced an additional 3% on the stamp duty rate for landlords and second home owners in the Autumn Statement as part of the government’s efforts to dampen the buy-to-let market and free up property for first-time buyers.

Under the changes, the stamp duty on a £250,000 buy-to-let property will rise from £2,500 to £10,000 from April, while the rate for a £400,000 property will more than double from £10,000 to £22,000. The amount of tax relief landlords can claim on properties will also fall from April 2017.

Those planning to invest in buy-to-let were going to use savings and investments worth an average of £43,592 to buy a property. Instead, 39% will now use the money to save in a cash account, 30% will invest in an ISA, 20% will put it into their pension and 13% will put it in other stock market investments.

Surveyors have reported a surge in buy-to-let investors looking to beat the April stamp duty deadline. The Royal Institute of Chartered Surveyors said in its monthly report that buyer enquiries rose for the tenth successive month in January, with the near-term pressure on prices intensifying.

Stuart Dyer, rplan.co.uk’s CIO, said: “The British have strong faith in property as an investment and many see it as a means of providing a pension income. But the government clearly has a policy to dis-incentivise BTL and the sharp increase in landlord mortgages revealed by the Bank of England credit survey will probably be a last rush before the gate slams shut.

“Having a buy-to-let property can also mean an over-exposure to one asset class for many investors, who should strongly consider the alternative of investing in a diversified portfolio for the long term, especially if this can be achieved through a tax-free ISA wrapper.”