Buy-to-let investors looking for the best returns should head to Blackburn, new data suggests. According to the latest Buy-to-Let Index from online mortgage lender LendInvest, Blackburn has taken top spot in England and Wales for buy-to-let investing, with rental yields rising a staggering 37.8% in the last year. It was followed by Carlisle, which has […]

Buy-to-let investors looking for the best returns should head to Blackburn, new data suggests.

Buy-to-let investors looking for the best returns should head to Blackburn, new data suggests.

According to the latest Buy-to-Let Index from online mortgage lender LendInvest, Blackburn has taken top spot in England and Wales for buy-to-let investing, with rental yields rising a staggering 37.8% in the last year.

It was followed by Carlisle, which has seen rental yields rocket by 36.5%, with Gloucester taking third spot with a 19.4% rise in average rental yields.

The top 10 buy-to-let hotspots have all seen average rental yields rise by at least 10%.

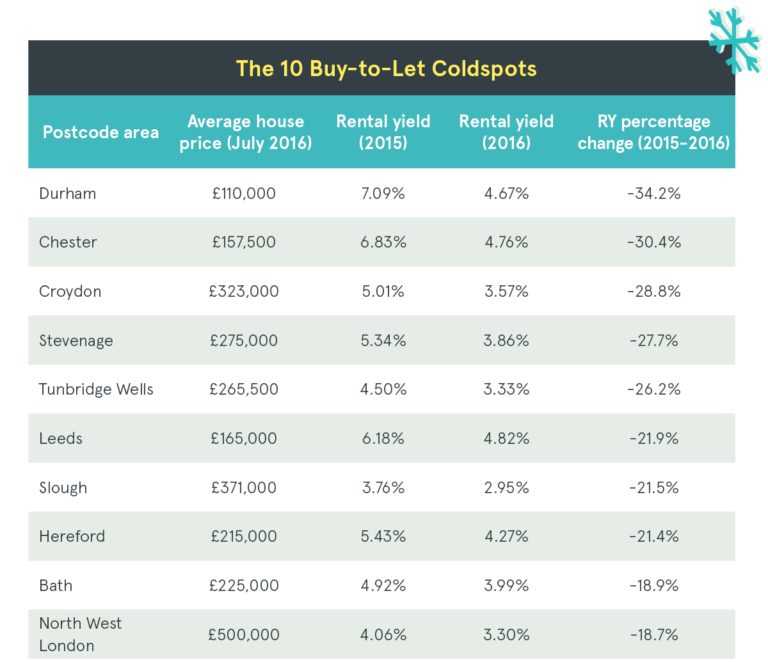

LendInvest’s new Buy-to-Let Index also highlights the buy-to-let coldspots – those postcode areas which have seen average rental yields fall the most over the 12-month period between August 2015 and July 2016.

Durham topped the coldspot table, with average rental yields having crashed by 34.2% over the 12 months from 7.09% to 4.67%, followed by Chester and Croydon.

Christian Faes, co-Founder and CEO of LendInvest, said: “Savvy property investors won’t only look out for which areas will offer the best returns right now, but are considering the best growth for the months and years to come.

“That means spotting areas which will become more popular in the future. That may be due to improved transport links, for example those towns which are due to be on the new HS2 line, or those which are due to benefit from new infrastructure projects, which will bring additional employment into the region.”