The trade body for the mortgage industry has urged the government to reform its plans to increase stamp duty by 3% on second properties to reduce the potentially negative impacts on the housing market. The Council of Mortgage Lenders said that even without the new surcharge, next year’s cut in tax relief landlords can claim […]

The trade body for the mortgage industry has urged the government to reform its plans to increase stamp duty by 3% on second properties to reduce the potentially negative impacts on the housing market.

The trade body for the mortgage industry has urged the government to reform its plans to increase stamp duty by 3% on second properties to reduce the potentially negative impacts on the housing market.

The Council of Mortgage Lenders said that even without the new surcharge, next year’s cut in tax relief landlords can claim along with the possibility of the Bank of England being given extra powers over the mortgage market will be enough to slowdown buy-to-let activity.

It warned that investor sentiment could be dampened to such a degree that the flow of available rented property could be disrupted without any corresponding increase in the ability of households to become homeowners. Landlords could also end up charging higher rents in response, actually making it harder for tenants who want to buy to save for a deposit, the CML said.

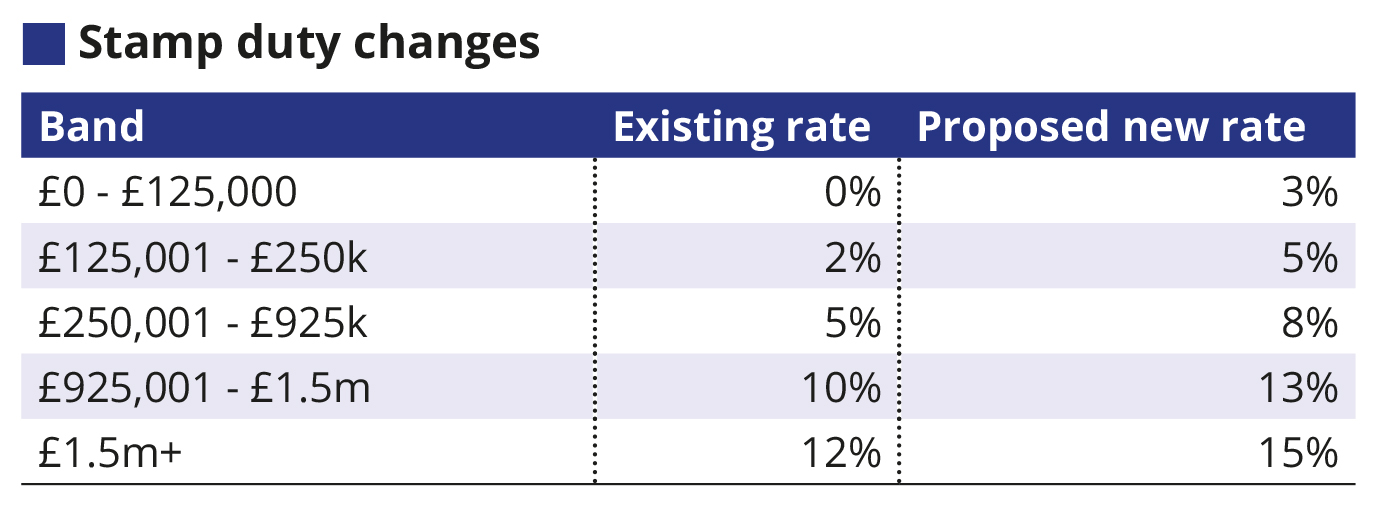

As part of the government’s efforts to dampen the buy-to-let market, landlords and second home owners will have to pay an additional 3% in stamp duty from April. The amount of tax relief landlords can claim on properties will also fall from April 2017.

CML director general, Paul Smee, said: “Our longstanding view is that stamp duty is a blunt policy lever. Given the complexity of the proposals, we also suspect that in practical terms the surcharge could cause more problems than it solves. We urge the government at least to move away from a position where people will have to pay and then potentially claim back to one where payment is deferred, and only triggered if the buyer genuinely falls into the intended target category.

“If the surcharge proposal is designed to promote home ownership, we think that there should be better evidence as to why this requires a reversal of growth in the private rented sector.”

The government issued its consultation document on how the new buy-to-let rules might operate on 28 December 2015. The consultation closes on 1 February.

The CML suggests that:

Under current proposals, some people will be caught by the requirement to pay the 3% surcharge even when they are buying their main residence (for example, if they have a short-term overlap between owning their previous home and acquiring their new one, perhaps as a result of problems in the housing chain), so it would be better to allow people to defer their payment of stamp duty for 18 months subject to conditions, rather than require them to pay it upfront and then potentially reclaim it in the form of a rebate. This would be both fairer and more efficient.

The government should clarify whether its policy intention is to favour institutions facilitating new-build activity, or new-build activity more generally. If the policy focus is on the perceived benefit arising from the economic activity, then the proposal should recognise the potential for even small-scale and individual investors to contribute to this through off-plan purchases, and should not discriminate against them.

It seems fairly clear, with the proposed exemption for bulk purchases of 15 or more properties, that the government’s policy intention is to encourage institutional new-build development, particularly in the rental sector. This has been a goal of the government since the publication of the Montague Review in 2012.

In focussing on encouraging large-scale build-to-let, however, the government is forgetting the economic benefits of small-scale investment (as CML observes). Both investment types should be encouraged if the UK housing market is to provide the variety of housing solutions that is needed across all tenures and to all demographics.