According to the latest UK Cities House Price Index by Zoopla, 60% of buyers in the UK are planning to continue with their search for their next home. Of that cohort, 22% of buyers said they have not been impacted by Covid-19 and expect to continue unaffected.

Meanwhile, 37% said that while they had been impacted to some extent, they were looking to continue with their purchase as soon as possible.

By contrast, 41% said they have put their plans on hold, citing market uncertainty, loss of income, and diminished confidence in future finances as deterrents.

An unprecedented, but temporary, bounce back

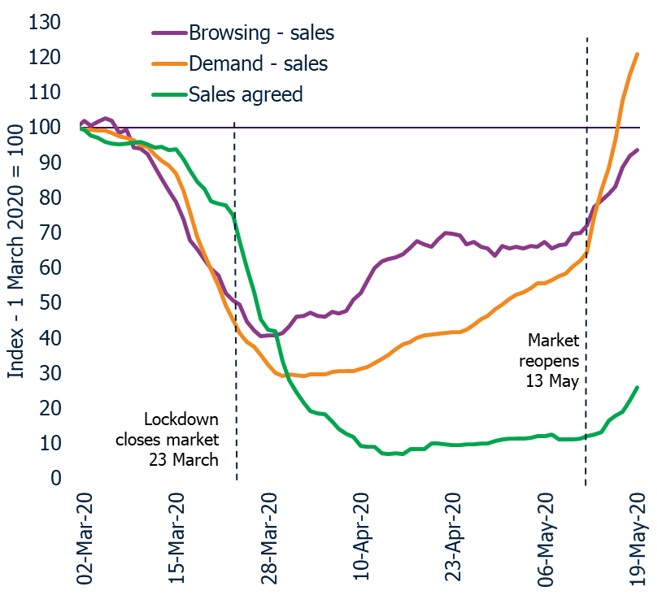

The property sales market in England reopened to a surge of pent-up demand. In the week that followed 12th May, demand jumped by 88% and was 20% higher than at the start of March [Figure 2]. But with projections for a major decline in economic growth and rising unemployment, the rebound in demand is expected to be short-lived.

After the market was suspended for 15% of the year at one of the busiest times for market activity, a return of pent-up demand was to be expected, especially given the strong start to the year.

Figure 2: Index of demand, browsing and sales agreed – rolling weekly total

Regions

The scale of the bounce back in demand over the week to 17 May varies across cities depending upon the country in which they are located. Despite a large rise in demand, London’s recovery is lagging behind, alongside cities in countries where the housing market is yet to reopen.

Scotland, Wales and Northern Ireland have not recorded any major rebound in demand like that seen across English cities. Demand for homes in London has been partly diluted as would-be buyers look to commuter towns outside the capital in response to COVID.

Zoopla’s latest data shows that demand has rebounded faster in cities along the south coast and in northern England. Portsmouth and Southampton are registering demand some 40% higher than in February this year with strong growth also recorded in Newcastle and Leeds.

Figure 3: Rebound in demand across UK Cities – daily demand in week ending 17 May compared to average for whole of February 2020

Two factors will dictate how the market performs in 2020

Looking ahead to the remainder of the year, the latest report identifies two distinct aspects for consideration.

First is how many of the 373,000 stalled sales make it to completion. Second is how much the demand for homes holds up and how much of this pent-up demand converts into new sales and pricing evidence.

These new sales will give a clearer view on pricing trends over the rest of the year and into early 2021.

House price growth

The annual rate of house price growth fell from 2% to 1.9% from March to April, representing the lowest month on month change since January 2019, and prices were unchanged in April.

We expect the slowdown in the rate of growth to become more marked over the summer months as the impact of the market suspension and coronavirus lockdown emerge in house price data for new sales.

Whether house prices fall will be determined to a great extent by the Government’s preparedness to provide ongoing support to the economy while lockdown restrictions are slowly lifted.

Comment

Richard Donnell, Director of Research & Insight at Zoopla, said: “The scale of the rebound in demand for housing is welcome news for estate agents and developers, but it is also surprising given projections for a sharp rise in unemployment and a major decline in economic growth.

“The Covid crisis and 50-day lockdown have created an unexpected one-off boost to housing demand. Millions of UK households have spent a considerable amount of time in their homes over the lockdown period and missed out on hours of commuting.

“Many households are likely to have re-evaluated what they want from their home. This could well explain the scale of the demand returning to the market. We need to see more supply come to the market to satisfy this demand.

“The economic impacts of COVID will grow in the coming months and uncertainty is building. The majority of would-be movers plan to continue their search, encouraged by low mortgage rates and continued Government support for the economy.

“However, we expect the latest rebound in demand to moderate in the coming weeks as buyers and sellers start to exert greater caution. Further support from the Government can’t be discounted and would help limit the scale of the downside risks.”