Three-quarters of Brits would be willing to choose a ‘digital only’ bank for a financial product, yet only one in 10 Brits would prefer to use a ‘digital only’ bank over a ‘traditional’ high street bank. This is according to a new study by MoneySuperMarket to determine the extent of the rise of ‘digital only’ […]

Three-quarters of Brits would be willing to choose a ‘digital only’ bank for a financial product, yet only one in 10 Brits would prefer to use a ‘digital only’ bank over a ‘traditional’ high street bank. This is according to a new study by MoneySuperMarket to determine the extent of the rise of ‘digital only’ banks in the UK.

Offering some explanation for the preference, it was found that roughly two in five (37%) do not trust these new banks enough to allow them to share their financial data with other providers under the new Open Banking rules, suggesting that there is much more education for these industry innovators to do before gaining the trust of the nation.

The study, conducted by leading price comparison site MoneySuperMarket, recognises a ‘digital only’ bank as one that predominantly focuses on a mobile app experience and has no physical branches. Those that Brits are most aware of include Atom (19% having heard of the bank), Monzo (10%), Loot (8%), Revolut (7%) and Starling (7%).

Being built from day one as app-based banks has enabled the inclusion of now-popular developments, including real-time spending notifications, 24/7 in-app support and the ability to instantly freeze/unfreeze a card. The research shows that these are increasingly important features for Brits, with over half considering a bank’s digital services to be a major factor when opening an account – rising to 71% of those aged between 25-34. However, this trend hasn’t gone unnoticed by the high street banks as they rally to upgrade their digital offerings with new designs and a selection of their competitors’ features.

With two-thirds of Brits signed up with more than one bank for their financial services and one in five using as many as three banks, the data suggests that people are now used to the idea of shopping around for their money needs – yet many households could be missing out on unique products, and possible savings, offered by these challengers.

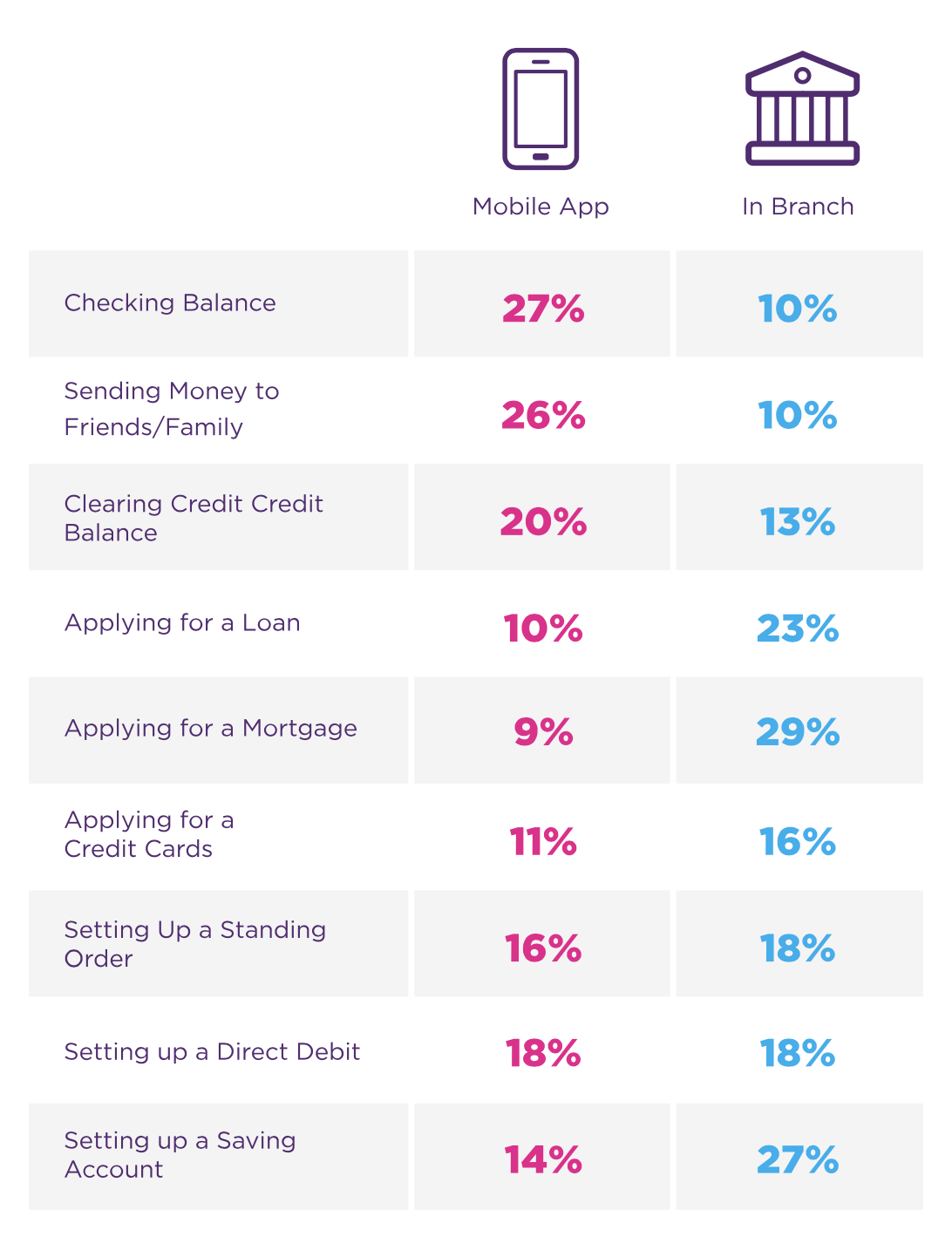

The research also discovered that Brits may not be ready for ‘digital only’ banks as they still prefer to visit their branch rather than use an app for the majority of common banking services, in addition to concerns about sharing data. Other banking preferences include (see graph):

Unlike ‘traditional’ high street banks, ‘digital only’ banks have typically worked to grow the number of people signing up with them by perfecting one financial product before expanding further. However, the research shows that Brits are more comfortable signing up with these banks for certain services over others. Current accounts are twice as likely to be experimented with compared to any other product. Second to current accounts are credit cards and then new savings or ISA accounts with app-based banks.

And, in what might be seen as a sign of the growing trust in these young ‘digital only’ banks, roughly half of Brits suggested that they’d be likely to deposit their savings into one.

Sally Francis-Miles, money expert at MoneySuperMarket, commented: “Switching banks in general is perceived to be a hassle, but digital-only banks face the added challenge of trust. New technology and data sharing are big concerns when it comes to finance, meaning consumers are still reluctant to open ‘digital only’ accounts unless they offer an incentive, stand-out product, or a level of convenience that they’re not getting from their traditional bank.

“While this means traditional banks are still dominant for now, digital-only banks are constantly asking how they can make life easier for customers, what quirks they can add and how they can innovate their products and services to make banking more intuitive. We’re already seeing traditional banks such as HSBC1 and RBS2 stand up and take notice, attempting to replicate some of the successes of the digital-only banks with improved apps and new platforms to enable innovation. As this increases choice and competition, it can only be a good thing for consumers.

“However, in a period rapid digital growth in banking, one thing remains unchanged – it pays to consider all of your options. Whether you’re looking for a credit card, current account or mortgage, comparing deals and doing your research can save you money and ensure you’re getting the best product to suit your needs.”

Dr. Markos Zachariadis, Associate Professor of Information Systems & Management at Warwick Business School, added: “In the digital age, the emphasis is on user experience, which is something these digital only banks are specialists in. Their ability to scale up their offerings at a much quicker pace than traditional banks, integrating external services and upping platforms in a modular style, means that they’re able to stay one step ahead.

“For Brits, it’s really a question of personal preference: stick with the more product-orientated high street banks or enjoy the flexibility and innovation of the digital only banks.”

For consumers curious about ‘digital only’ banks and to see the full report, visit MoneySuperMarket’s new “The Rise of Digital Only Banks” page. To understand what advantages they can offer over ‘traditional’ high-street banks and find answers to other frequently asked questions, see our guide to ‘digital only’ banks.