House prices in the East experienced the highest increase in July 2015 rising 8.9 per cent on the year and 2.8 per cent on the month, according to the latest Land Registry house price index. London ranked second with an annual rise of 8.3 per cent and monthly growth of 2.5 per cent. The North East […]

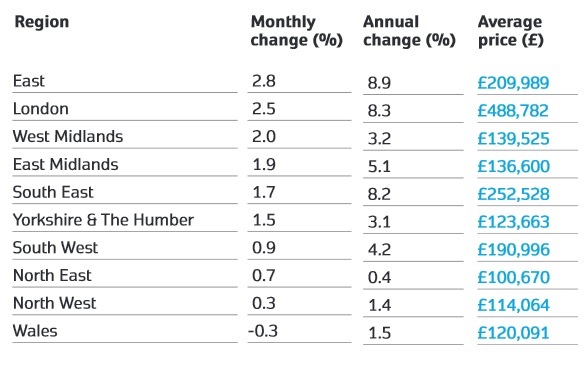

House prices in the East experienced the highest increase in July 2015 rising 8.9 per cent on the year and 2.8 per cent on the month, according to the latest Land Registry house price index.

London ranked second with an annual rise of 8.3 per cent and monthly growth of 2.5 per cent.

London ranked second with an annual rise of 8.3 per cent and monthly growth of 2.5 per cent.

The North East saw the lowest annual price increase of 0.4 per cent, while Wales saw the only monthly price decrease with a fall of 0.3 per cent.

House prices across England and Wales in July 2015 were 4.6 per cent higher than in July 2014 and 1.7 per cent higher than in June 2015.

The average home value now stands at £183,861, while the average price for a property in the capital is £488,782.

Adrian Gill, director of Your Move and Reeds Rains estate agents, comments: “The long-term trend of annual house price growth may still be sliding downhill, but in the short-term monthly growth is heading skyward. There’s still a considerable gulf between the rates of growth in the East, South East and London and other regions, but this hasn’t knocked confidence nationwide and buyer demand is digging its heels in across the country.

“More recently in July, we saw monthly first-time buyer sales hit a post-recession record. Since the financial crash, a Bank of England base rate of 0.5% is all first-time buyers have ever known, and many were keen to agree mortgage deals and complete property purchases before this changed. While an interest rate rise has been relegated into next year by the Chinese stock market crash, play won’t stop for those looking to buy a home before borrowing inevitably becomes more expensive.”