Drawdown lifetime mortgages remain the most liked product of equity release customers, the latest market report of the Equity Release Council shows. Two-thirds (66 per cent) of new customers have chosen this type of mortgage last year, while 34 per cent opted for lump sums. The proportion of new customers who chose home revision plans was […]

Drawdown lifetime mortgages remain the most liked product of equity release customers, the latest market report of the Equity Release Council shows.

Two-thirds (66 per cent) of new customers have chosen this type of mortgage last year, while 34 per cent opted for lump sums.

Two-thirds (66 per cent) of new customers have chosen this type of mortgage last year, while 34 per cent opted for lump sums.

The proportion of new customers who chose home revision plans was below 1 per cent.

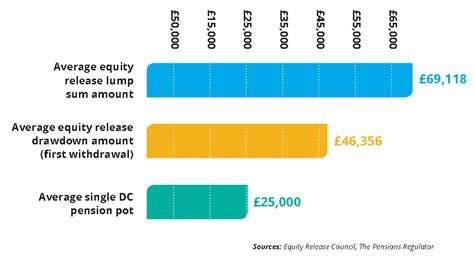

Drawdown customers typically have more valuable homes but withdrew less than a sixth of their total housing wealth as a first instalment during 2014 (£46,356). This sum is still 85 per cent larger than the average single defined contribution (DC) pension pot of £25,000.

Lump sum customers released an average of £69,118, which was 176 per cent larger than the average DC pension pot.

The comparison shows the significant contribution housing wealth can make as an extra source of funding in later life, to complement or compensate for people’s pension pots, according to the Equity Release Council.

Nigel Waterson, chairman of the Equity Release Council commented:

“The pension freedoms will encourage careful consideration about how people can best fund their lifestyle beyond the age of 55. Whether or not they choose to withdraw a lump sum from their pension at any stage, homeowners can take great comfort from the significant wealth in their homes which often far exceeds the average single DC pot.

“It is vital for people to consider all the options available to them in retirement, and make an informed decision about how best to use the various products at their disposal. Not everyone needs a lifetime mortgage, but it should always be on the checklist for consideration.”

***

What is a drawdown mortgage?

A lifetime mortgage contract where:

(a) the amount borrowed is paid by the mortgage lender to the customer in instalments during the life of the mortgage; and

(b) the size and frequency of the instalments are:

(1) agreed between the mortgage lender and the customer;

or

(2) set by reference to an index or interest rate (such as the Official Bank Rate).