The number of equity release borrowers is growing and younger people are looking into this type of mortgages as new regulations are changing the playing field for all. The number of equity release borrowers went up by 12 per cent between the first and second half of last year, which was the busiest period for […]

The number of equity release borrowers is growing and younger people are looking into this type of mortgages as new regulations are changing the playing field for all.

The number of equity release borrowers went up by 12 per cent between the first and second half of last year, which was the busiest period for equity release sector since 2008.

The number of equity release borrowers went up by 12 per cent between the first and second half of last year, which was the busiest period for equity release sector since 2008.

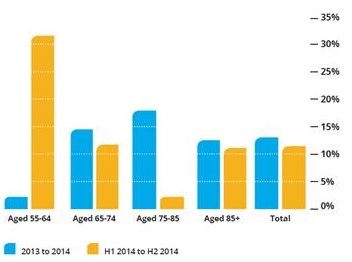

The increase from 2013 to 2014 was 13 per cent, according to the Spring 2015 edition of the Equity Release Market Report of the Equity Release Council.

The age group which saw the highest rise in the number of equity release borrowers was the 55-64 age group. There are 32 per cent more people interested in equity release mortgages in the second half of 2014 than in the first.

This surge in the number of younger borrowers is largely based on the effects of the Mortgage Market Review (MMR) introduced in April last year. The new affordability rules made it more difficult for older borrowers to get a mortgage. Lenders are especially reluctant to advance loans in cases where the term of the mortgage extends beyond the normal retirement age.

Some younger borrowers may also have used equity release in the second half of last year to meet an immediate need for extra funds, rather than accessing their pension savings ahead of 6 April 2015 when the new pension flexibilities will take effect.

Another reason for the spike in younger borrower numbers is the fact that many borrowers with interest-only mortgages are approaching their final repayment date. For those who have no or limited resources for a repayment vehicle, using equity release to pay off their existing mortgage is a common solution.

Nigel Waterson, Chairman of the Equity Release Council said:

“Equity release is helping people respond to a host of financial challenges at various points in later life, or simply enhance their standard of living so they can enjoy a more comfortable retirement. Part of the appeal lies in the option to cover off large one-off expenses. Paying off the last of an existing mortgage is often one of the biggest financial deadlines people have to face beyond the age of 55. The flexibility of equity release enables them to wipe the slate clean while also using their housing wealth to meet a range of other needs.

“The money they have put into property often proves a good investment over time. Releasing equity gives people a chance to use these funds in later life to enrich their lifestyle. Product choices are limited for older customers in the residential mortgage market, however new lenders are coming into the market to boost equity release activity – and bringing more choice and flexibilities for consumers.”

*

Geoff Charles, CEO of equity release adviser firm Bower Retirement Services, comments:

“A home isn’t comfortable if you can’t afford the heating. Mortgage regulation has recently tightened up and some older homeowners have been left stranded without a way of accessing the finance they need. The pension freedoms will go some way towards giving the older generation control over their spending, but even with this added flexibility, the cold hard truth is that the average pension pot isn’t enough to fund a comfortable lifestyle for many.

“At the same time, pensioners often have a lot of wealth tied up in their home. Equity release can play a part here, supplementing a pension pot to enable over 55s to make the most of their retirement, helping them to pay off their mortgage, or giving them the money to help family and friends. As more lenders develop equity release offerings, the choice of options is becoming ever wider – and the quality of advice on offer is becoming ever better.”