With only a couple of days left until the General Election, international real estate consultant Cluttons analyses the impact of political rhetoric on the property market dubbing London as “the scapegoat”.

“We are in the midst of one of the toughest forecasting environments in a long time. The likelihood of a hung parliament is just adding to the widespread election anxiety. Furthermore, the emergence of London as a scapegoat to win votes is having a damaging impact on the performance of the market, which could have ramifications for the rest of the country, Cluttons’ international research manager, Faisal Durrani, says.

“We are in the midst of one of the toughest forecasting environments in a long time. The likelihood of a hung parliament is just adding to the widespread election anxiety. Furthermore, the emergence of London as a scapegoat to win votes is having a damaging impact on the performance of the market, which could have ramifications for the rest of the country, Cluttons’ international research manager, Faisal Durrani, says.

The overall behaviour of the residential market, with both sales and lettings nearly flat lining as election day draws near, is similar to previous election years.

However, this time there is an “anti-London political rhetoric” which is damaging the capital’s real estate landscape, according to Cluttons.

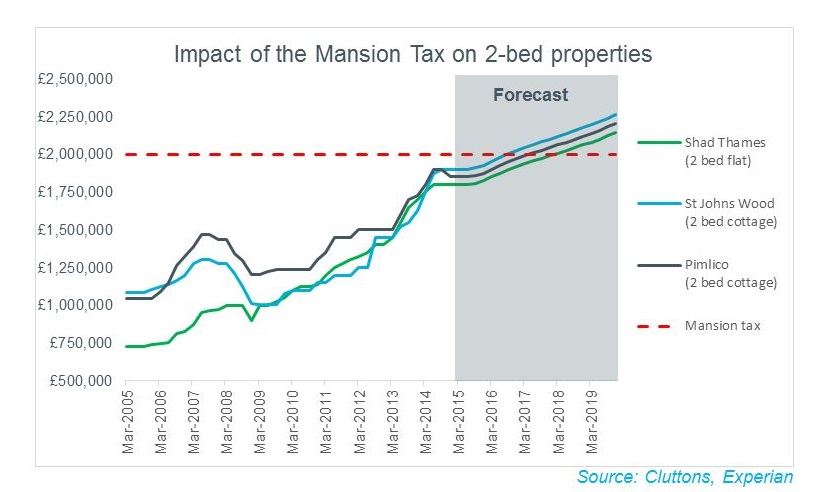

The Mansion Tax would be tax on ordinary Londoners

“27 per cent of the population resides in London and the South East and hard working families will feel the biggest squeeze from any additional tax on higher value properties. The reality is that £2 million no longer buys you a mansion in London and hasn’t for some time. Two bedroom properties in Shad Thames, St. John’s Wood and Pimlico are all in close range of the £2 million barrier and will be netted by any new ‘London housing tax’ well before the end of the next parliament. A smarter approach might be to make adjustments to council tax pay bands, which no party has been willing to look at,” Durrani comments.

Labour’s proposal about a cap on rents to have damaging effects as well

The proposal calls for an effective freeze in rents for a period of three years, with inflation-linked increases allowed during this period.

“In a deflationary environment, this is an easy promise to make, but what happens when inflation climbs above the level of rental value growth, or when rents decline? Our international experience tells us that rent caps are tough to police and artificially choke growth, creating unnatural cycles that are far removed from economic realities, ” Durrani says.