First-time buyers’ ability to purchase a home now is 11 per cent better than during the last General Election, according to the Hamptons International’s latest Ability to Buy index published today.

First-time buyers have 46 per cent of their income left after tax, national insurance, spending on essentials and a mortgage, compared to 41 per cent at the 2010 General Election. Lower mortgage rates have helped but raising a deposit is still the big hurdle for first-time buyers, especially when house prices are growing faster than earnings.

First-time buyers have 46 per cent of their income left after tax, national insurance, spending on essentials and a mortgage, compared to 41 per cent at the 2010 General Election. Lower mortgage rates have helped but raising a deposit is still the big hurdle for first-time buyers, especially when house prices are growing faster than earnings.

The ability of first-time buyers has, however, dropped by 2 per cent in the past year.

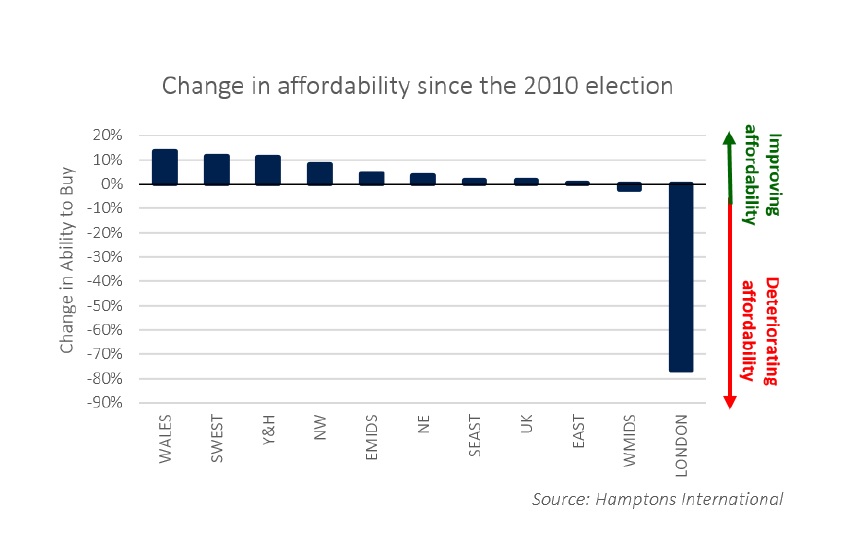

The overall ability to buy of aspiring homeowners in the UK is 2 per cent higher in 2015 than five years ago, the research shows. But again, in the past year there was a drop in people’s ability to buy, of 3 per cent.

Regional comparison

London stands in stark contrast to the rest of the country, as here people’s ability to buy has deteriorated by 77 per cent in the past five years. Affordability in the capital is being hit hard by growing house prices, increasing childcare costs and decline in personal income. In 2014 alone, ability to buy in London dropped by 73 per cent, as house prices jumped 17 per cent, childcare became 9 per cent more costly and average incomes shrank by 1.6 per cent.

The only other region where the ability to buy a home has deteriorated are the West Midlands. The ability there was 4 per cent lower at the end of 2014 than a year earlier.

The South West (9 per cent), Wales (4 per cent), Yorkshire and Humberside (1 per cent) and the North

West (1 per cent) all saw an improvement in ability to buy since last year.

The biggest improvement was in the South West, which reflects a more modest growth in prices of 5.5

per cent, the largest wage growth in the country (4.5 per cent) and lower spending on food and transport.

Ability varies based on household type

The ability to buy a home for a working couple without children was 3 per cent better than at the time of the last election. Lower house prices and interest rates means this family has 78 per cent of its income left after tax, national insurance, essentials and paying a mortgage compared with 76 per cent at the time of the 2010 General Election.

A working family with two children and one parent working part time saw ability to buy fall by 5 per cent in the last five years. This reflects higher childcare costs, rising house prices and slow earnings growth. This family is left with 41 per cent of its income after tax, national insurance, essentials and mortgage payments, 42 per cent at the time of the last General Election.

Ability to buy for both the childless working couple (minus 1 per cent) and the family with two kids (minus 6 per cent) have declined in the past year.

Ability to buy compared to peak market levels in 2007

♦

Over 80% better than peak

♦

50% to 80% better than peak

♦

Up to 50% better than peak

♦

Worse than peak