Lending to first-time buyers declined in April as the rest of the market slowed down as well, the latest data from the Council of Mortgage Lenders (CML) shows. Loans with a total worth of £3.3 billion were extended to first-time buyers in April 2015, which was 3 per cent less than in March and 8 […]

Lending to first-time buyers declined in April as the rest of the market slowed down as well, the latest data from the Council of Mortgage Lenders (CML) shows.

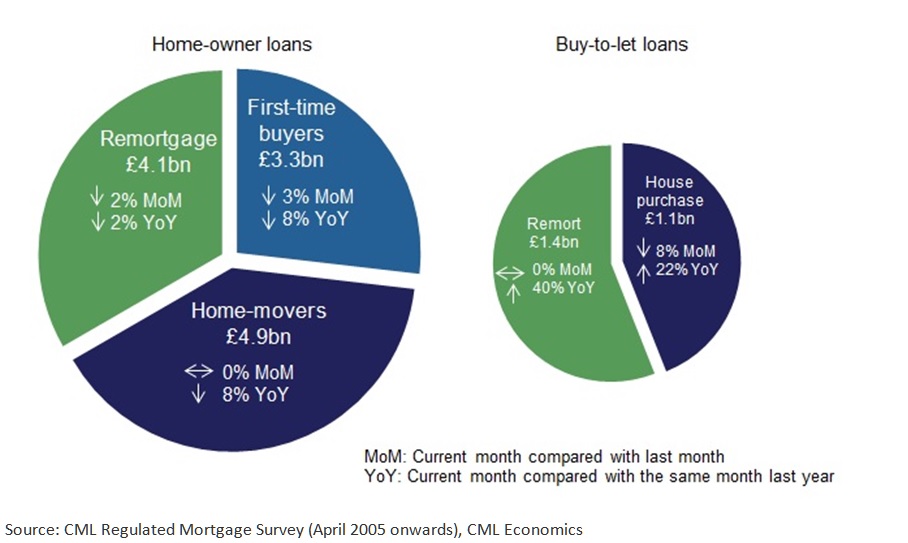

Loans with a total worth of £3.3 billion were extended to first-time buyers in April 2015, which was 3 per cent less than in March and 8 per cent less than in April 2014.

Loans with a total worth of £3.3 billion were extended to first-time buyers in April 2015, which was 3 per cent less than in March and 8 per cent less than in April 2014.

Although the sizes of the loans advanced to first-time buyers have increased since a year ago, their income has grown as well and at faster rate than the loan size. This has resulted in an actual drop in the typical loan-to-income ratio. Loan-to-value ratios have also fallen compared to a year ago.

Competitive mortgage rates mean first-time buyers are paying less to service their mortgage than at any time since the CML started their statistics in 2005.

| Loan size (£) | Income (£) | Loan-to-value | Loan-to-income | Interest payment as % of income | Capital and interest payment as % of income | |

| Apr-15 | 125,545 | 39,000 | 82.1% | 3.37 | 10.3% | 18.5% |

| Mar-15 | 123,412 | 38,505 | 80.8% | 3.36 | 10.6% | 18.8% |

| Apr-14 | 120,000 | 36,535 | 84.0% | 3.44 | 11.6% | 19.5% |

In comparison to April 2014, there was a fall across both first-time buyer numbers and home movers.

Compared to March 2015, the number of first-time buyers fell but the number of home-movers rose slightly.

Growth rate shows activity across the three categories – first-time buyers, home movers and remortgage – is down compared to April last year. The 12 month rolling sum of the number of first-time buyers has been above 300,000 since June 2014, though it has been gradually falling since October.

The buy-to-let sector of the market still fares well in comparison to the rest of the market.

Expert comments on the latest CML figures

Paul Smee, director general of the CML, said:

“House purchase lending in April was relatively subdued compared to last year, but similar to activity in March. The economy is recovering, with employment up, earnings growing, and competitive mortgage rates, so we expect activity to continue building as the year progresses.

“Buy-to-let is showing stronger growth than home-owner lending, buoyed significantly by remortgaging, which continues to remain more subdued in the home-owner market.”

*

Andy Knee, chief executive of outsourcing property services provider LMS, said:

“It’s alarming that the buy to let sector sees unabated growth while we continue to see subdued levels of lending in the residential market compared to last year. The barriers to first time buyers entering the market remain a pressing issue, as there was a decline in lending to these types of borrowers both month-on-month and annually. Even remortgage activity among existing homeowners is trailing behind growth in buy to let remortgaging, despite historically low mortgage rates.

“This imbalance is in no way ideal. Although record low mortgage rates mean first-time buyers are now paying less to service their mortgage, the typical first-time buyer loan size has increased by 5% over the past year thanks to rising house prices. Average loan-to-values have increased by just 1.9% over the same period, leaving first-time buyers saddled with higher deposit requirements.

“It may be time for an industry-wide debate on whether subsidies for BTL should continue or whether BTL owners should be taxed accordingly. At the very least, more needs to be done to provide some relief to the struggling first time buyer.”

*

Paul Hunt, managing director of Phoebus Software, said:

“It’s now clear that overall mortgage activity in April came to a standstill with little change month on month, which was exactly as was forecast before the election. Lending for buy to let on the other hand has been steady since the beginning of the year with consumers capitalising on stronger earnings and competitive mortgage rates and the promise of higher returns on investment.

“I’m confident that we will see a greater recovery in May and the following months with the election behind us. Housing was high on the incumbent government’s manifesto and there is a lot of positivity surrounding the market.”