Mortgage lending to first-time buyers increased by both volume and value in July 2015 as overall lending experienced a third consecutive month of growth, according to the latest CML data.

The Council of Mortgage Lenders (CML) said this was the highest monthly first-time buyer lending level by volume and value since August 2007.

The Council of Mortgage Lenders (CML) said this was the highest monthly first-time buyer lending level by volume and value since August 2007.

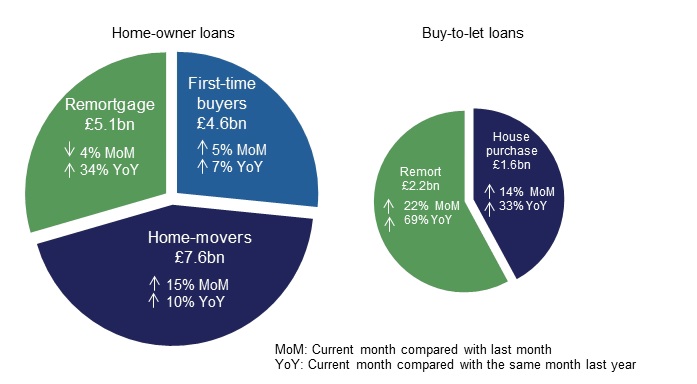

The number of loans went up to 30,200 and their value reached £4.6 billion. This was a volume increase of 2.7 per cent on the month and 4.5 per cent on the year. The value rise was 4.5 per cent higher on June 2015 and 7 per cent higher than in July 2014.

The proportion of their gross household monthly income first-time buyers had to use for mortgage repayments in July was 18.5 per cent. This was slightly higher than 18.3 per cent in June but is still lower than in July 2014 when it was 19.5 per cent, and much lower than the most recent high of 24.8 per cent in December 2007.

Lending to home movers increase 15 per cent on the month and 10 per cent on the year to £7.6 billion in July 2015.

At £5.1 billion, remortgage lending saw a small drop of 4 per cent on June but was 34 per cent higher than a year ago.

Lending in the buy-to-let sector of the market continued its strong growth with the value of loans rising by more than a half (52 per cent) to £3.8 billion on the year and 11.8 per cent on the month.

Paul Smee, director general of the CML, commented:

“The market has shown steady growth in house purchase and buy-to-let over the past few months with general improvements in economic factors across the UK allowing for more people to enter the property market. This positive direction of travel going into the autumn months reinforces our recent revised forecasts that lending levels should continue to grow gradually over the rest of the year after a subdued beginning of the year.”