Mortgage rates are historically low at the moment but there are other costs to take into account such as arrangement fees. Should you opt for a lower rate and a higher fee or a higher rate and a lower fee? Well, that depends. Countrywide, the UK’s largest property services group, explains what you should consider […]

Mortgage rates are historically low at the moment but there are other costs to take into account such as arrangement fees. Should you opt for a lower rate and a higher fee or a higher rate and a lower fee? Well, that depends. Countrywide, the UK’s largest property services group, explains what you should consider

Buying a home is one of the biggest purchases and commitments we make in life and most homebuyers will need a mortgage in order to complete the purchase.

However, with so many types of lenders, mortgage products, mortgage rates and fees, it can be difficult to know where to start when choosing the right mortgage for you. Therefore, it is important to speak with a mortgage broker who can offer a full advice and recommendation service.

It is not just people looking to get on the housing ladder or move home who should seek advice from a mortgage broker but also those looking to remortgage. Perhaps you are coming to the end of a fixed rate mortgage or you want to see how much equity there is in your property for home improvements.

With interest rates historically low and expected to remain so for some time to come, there are a range of very competitive two and five-year mortgage deals on the market*, for example:

- HSBC – two-year fixed, 1.49%, 60% loan-to-value (LTV), £999 fee

- Woolwich – five-year fixed, 2.25%, 60% LTV, £999 fee

- Coventry – two-year fixed, 2.45%, 90% LTV, £999 fee, free valuation

- Virgin Money – five-year fixed, 3.29%, 90% LTV, £995 fee, £300 cash back

These rates are very attractive especially when you compare them to the average standard variable rate of around 4%.

People are often initially attracted to headline mortgage rates but it is not always these rates that are the best for their personal circumstances.

Many people choose a product based on the interest rate charged, the term of the mortgage or the type of product, e.g. fixed, tracker, discount. It is important that you take the time to speak with a mortgage broker who will explain the mortgage products available and the differences in mortgage rates.

Arrangement fees

Most mortgage products come with an arrangement fee and this fee is charged by the lender to set up the mortgage. In some cases, the arrangement fee can be as much as £2,000 but many products have a low fee and some have none. Most lenders will allow you to either pay the arrangement fee upfront or add the fee to the mortgage. The majority of customers of Countrywide Mortgage Services choose to add the fee to the loan. This is perhaps due to a number of other upfront fees associated with moving home that the person has to pay, such as valuation fees, legal fees, stamp duty and home removal costs.

Mortgage products with circa £999 arrangement fee are the most popular amongst Countrywide Mortgage Services customers. By adding the arrangement fee to the loan you could be paying hundreds of pounds more on your mortgage because you will be paying interest on the £999 arrangement fee across the whole term of the mortgage.

For example, on a £135,000 mortgage over 25 years and on a repayment basis, by adding a £999 arrangement fee to the mortgage you could pay back a total of £1,531 over the term of your mortgage. This example is based on a Nationwide 1.89% two-year fixed 75% LTV which reverts to a rate of 3.99% after two years.

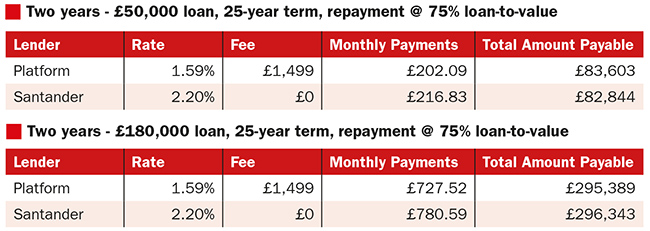

Current mortgage pricing and competitiveness amongst mortgage lenders means there is only a small difference in rate between mortgage products with a high fee, typically around £1,999, and a mortgage product with no fee. For example, Platform (a mortgage lender which is part of The Co-operative Bank) has a two-year fixed rate at 1.59% with £1,499 fee compared to Santander’s 2.20% with no fee.

For a customer with a smaller mortgage it can sometimes be more beneficial to choose a mortgage product with a higher interest rate and a lower arrangement fee versus a mortgage product with a lower interest rate and a higher arrangement fee. However, as interest rates rise, the cost of adding a fee to the loan will grow relatively.

Example

The example below demonstrates that customers with a £50,000 mortgage would pay less over the term of the mortgage on a product with a high rate and no fee, although their monthly repayments would be higher compared to a product with a low rate and high fee. A customer with a £180,000 mortgage would pay less over the term of the mortgage on a product with a low rate and high fee, and have lower monthly payments. These examples assume that the customer pays any applicable fees upfront and does not add them to the loan.

Working with a mortgage broker can help you find the best mortgage deal for your circumstances and save you money both in the short and long term. However, there are a number of things people can do to ensure they are in the best position before looking into getting a mortgage.

Peter Curran, managing director of financial services at Countrywide, said: “The UK mortgage market is extremely competitive and the process of getting a mortgage can be complex. Mortgage criteria have tightened over recent years due to regulatory changes to ensure customers are protected when interest rates rise.

Therefore it is wise to seek professional advice from a mortgage broker about your options before you get a mortgage or remortgaging.

“Given there is an increasing range of mortgage products on the market, more customers are choosing to seek advice and recommendation from a broker rather than directly from a mortgage consultant at a bank or a building society. Remortgaging to a new product could save you money so before selecting a deal speak to a mortgage professional about getting the right deal for you.”

[box style=”3″]

Countrywide’s top five tips for getting a mortgage in 2016

- Ensure you are registered on the electoral role.

- Ensure payments are kept up to date and any late payments and or mistakes are rectified as soon as possible.

- If you can raise a bigger deposit your loan amount will be reduced and you’ll be on a lower LTV. Generally this means you will pay less interest.

- Be realistic about what you can afford and consider the additional services and fees you will need to pay. For example, stamp duty, conveyancing and arrangement fees. Your mortgage broker can discuss these with you.

- Be flexible about the type of home you want and its location. Explore all the possibilities but think about the repercussions of your expenses, including purchase costs, travel and insurances

[/box]

[box style=”3″]

Countrywide’s top five tips for remortgaging in 2016

- Check with your current mortgage provider what mortgage product you have and when the deal ends.

- Check the amount outstanding on your mortgage and what your current loan-to-value is.

- Dependent on the deal you are on, it may be appropriate to pay an early repayment charge and select a new deal which offers you a shorter term or a lower rate of interest. This requires careful consideration so speak to a mortgage consultant about the best thing to do in your circumstances.

- Keep up with mortgage repayments as well as payments on credit cards and other loans.

- It may be worth considering using savings to pay off some of your mortgage as you may be able to get a better interest rate or a shorter term when you remortgage because your loan-to-value is lower. However, this requires guidance from a mortgage consultant.

[/box]

All interest rates quoted are correct as of 28 January 2016. Mortgage products can be withdrawn by lenders

at short notice.