The Help to Buy housing scheme launched by the government in October 2013 has helped almost 100,000 people to get on the property ladder, the latest official statistics show. The Help to Buy: equity loan and Help to Buy: mortgage guarantee schemes together with the Help to Buy: NewBuy scheme, which is designed to help buyers of new-build properties, collectively […]

The Help to Buy housing scheme launched by the government in October 2013 has helped almost 100,000 people to get on the property ladder, the latest official statistics show.

The Help to Buy: equity loan and Help to Buy: mortgage guarantee schemes together with the Help to Buy: NewBuy scheme, which is designed to help buyers of new-build properties, collectively have been used by 99,601 Britons.

The Help to Buy: equity loan and Help to Buy: mortgage guarantee schemes together with the Help to Buy: NewBuy scheme, which is designed to help buyers of new-build properties, collectively have been used by 99,601 Britons.

The scheme also continues to benefit first-time buyers overwhelmingly, with the vast majority of sales outside of London and at prices well below the national average.

Help to Buy is also ensuring the long-term health of the housing market by increasing housing supply, stimulating home building. Over half of the homes bought through Help to Buy are new-build properties, helping to contribute to the 41 per cent rise in private house building in England since the launch of Help to Buy.

According to the latest data from the HM Treasury, most households who completed a mortgage with the support of the scheme had a household income of £20,001 – £50,000. Take-up is lower for borrowers on higher incomes: households with an income over £80,000 made up 6 per cent of all completions.

The median household income for borrowers using the scheme was £40,260 which is slightly lower than the median household income across the market for those buying a house with a mortgage over the same period (£44,184).

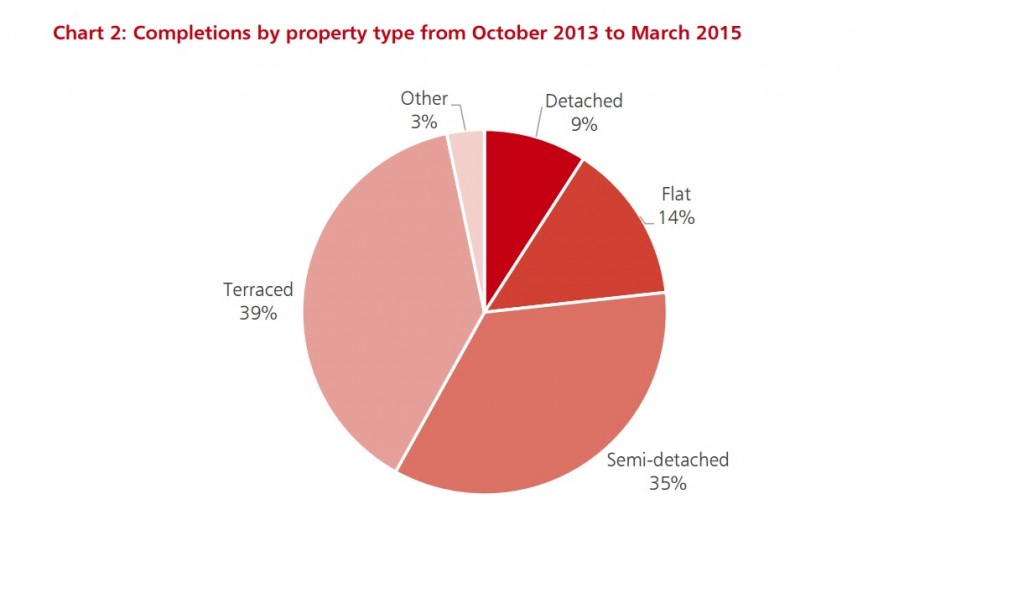

The majority of mortgage completions through the scheme were on terraced houses, making up 39 per cent of total completions. The second-most popular property type was semi-detached properties (35 per cent).

Commenting on the figures Chancellor of the Exchequer George Osborne said:

“The government’s Help to Buy scheme has now helped nearly 100,000 working people across the UK achieve their aspiration of buying a new or bigger home.

“And I’m looking forward to these numbers growing even more with the launch of the new Help to Buy ISA this autumn, which will ensure that first time buyers saving for a deposit get an additional boost from the government.

“Key to our long term plan is providing economic security for working people, at every stage in life. The security of owning your own home is a big part of this, which is where Help to Buy comes in.”

Housing Minister Brandon Lewis commented:

“Anyone who works hard and aspires to own their own home should have the opportunity to turn their dream into a reality. Today’s figures show how the government’s Help to Buy scheme is turning those dreams into reality…”