The number of property transactions completed by first-time buyers have dropped by almost a fifth in May 2015 hurt by election jitters and higher deposits, new research shows. There were 22,000 transactions this May, down 18.1 per cent compared to May 2014’s figure of 27,100, according to the latest First-Time Buyer Tracker from Your Move and Reeds […]

The number of property transactions completed by first-time buyers have dropped by almost a fifth in May 2015 hurt by election jitters and higher deposits, new research shows.

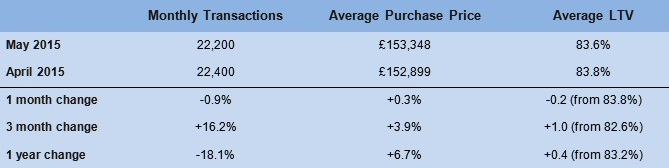

There were 22,000 transactions this May, down 18.1 per cent compared to May 2014’s figure of 27,100, according to the latest First-Time Buyer Tracker from Your Move and Reeds Rains.

There were 22,000 transactions this May, down 18.1 per cent compared to May 2014’s figure of 27,100, according to the latest First-Time Buyer Tracker from Your Move and Reeds Rains.

Compared to April, this May’s figure was 0.9 per cent lower, making the month the lowest May for first-time buyer completions in three years.

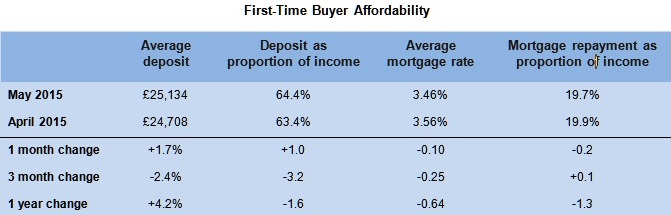

First-time buyers are now having to cope with higher deposits. As of May, the average deposit for a first-time buyer stands at £25,134, up 1.7 per cent on the previous month and 4.2 per cent on a year ago. Moreover, the average deposit as a proportion of income is on the rise for the first time in four months – up one percentage point month-on-month to 64.4 per cent of average income in May.

Adrian Gill, director of estate agents Your Move and Reeds Rains, comments:

“Despite record-low mortgage rates, a growing economy and the start of significant wage growth, the uncertainty surrounding the election seems to have triumphed, albeit momentarily. Many pundits predicted a hung parliament, and this political confusion seems to have caused many would-be first-time buyers to keep their powder dry in the run-up to May – until it became clear what the government was and what its housing policies were going to be.

“A second and more permanent root to the disappointing first-time buyer figures is the challenge of cultivating a deposit. Many first-time buyers are still on tight monthly incomes, struggling to save while savings rates stay so low. Meanwhile, deposits are rising primarily as property prices continue their seemingly unstoppable upwards march. This is wholly due to a lack of housing supply versus a stack of housing demand. If we want to see property prices stabilise and deposits fall as proportions of income, the Government must address the housing supply problem, for which there is only one solution: build more homes.

“While buyers may grumble, rising property prices are a positive sign. They demonstrate that the continuing fall in the average mortgage rate combined with the brightening economic outlook has left plenty of demand in the first-time buyer housing market. This is despite May’s threat of a highly uncertain election outcome. Schemes such as the Help to Buy ISA have encouraged all sorts of buyers to overlook temporary political uncertainties and save up to make the dream of home-owning a reality.”