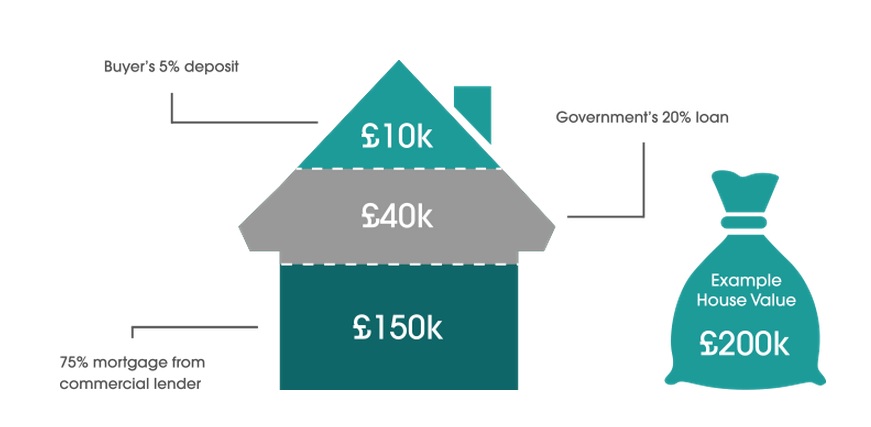

There were 56,402 properties bought with loans from the state-backed Help to Buy scheme in the 27 months since its start in April 2013 to June 2015, the latest data from gov.co.uk reveal. The total value of these equity loans was £2.42 billion,with the value of the properties sold under the scheme totalling £12.18 billion, the figures show. Overwhelmingly the scheme has helped first-time […]

There were 56,402 properties bought with loans from the state-backed Help to Buy scheme in the 27 months since its start in April 2013 to June 2015, the latest data from gov.co.uk reveal.

The total value of these equity loans was £2.42 billion,with the value of the properties sold under the scheme totalling £12.18 billion, the figures show.

The total value of these equity loans was £2.42 billion,with the value of the properties sold under the scheme totalling £12.18 billion, the figures show.“However, while the equity loan scheme is well ingrained in the sales of new homes, it won’t be around forever. The focus now needs to turn towards more permanent solutions that address the underlying problems affecting housing affordability. The issue of supply is a growing concern, particularly as new starts have flatlined in recent months while consumer demand rises. A lack of suitable properties will continue to force prices up, so it’s vital that government initiatives begin to tackle this critical imbalance.”