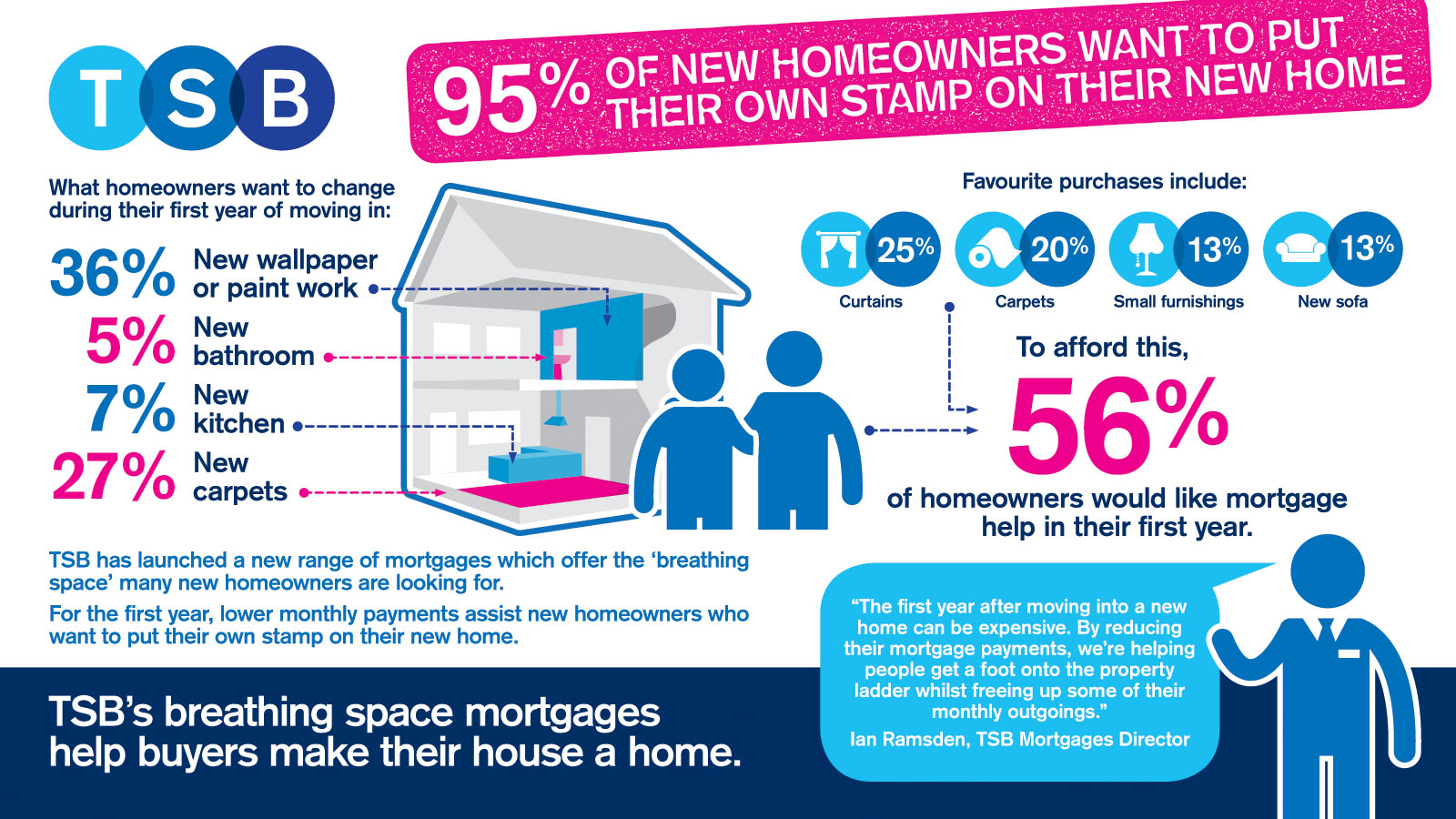

In the first year after buying a property, more than half of new homeowners (56 per cent) said they would appreciate some breathing space on mortgage payments to help make their new house into a home, according to research from TSB.

TSB has just launched a range of mortgages which it says offers ‘breathing space’. For the first year, the ‘breathing space’ mortgages have lower monthly payments to assist new homeowners and first-time buyers during their first year of ownership. This frees up funds for homeowners to spend on their home.

There’s a checklist of things people want to change in the first year after moving in, starting with changing wallpaper or paint work (36 per cent), followed by new carpets (27 per cent), installing a new kitchen (7 per cent) or updating the bathroom (5 per cent).

A quarter of consumers said they would buy curtains or blinds straightaway (25 per cent) a fifth would buy carpets (20 per cent), followed by small home furnishings (13 per cent) a new sofa (13 per cent) and white goods (9 per cent).

The lounge is the first room almost half (44 per cent) of people would change, followed by 19 per cent choosing the bedroom, then kitchen (17 per cent) with only a few homeowners opting for a new cloakroom or bathroom (5 per cent).

Ian Ramsden, TSB mortgages director, said: “We know the first year after moving into a new home can be expensive as people look to add their individual touch in creating a home. People have told us they’d welcome some breathing space in the first year after moving in to their new home which is why we’ve launched these mortgages.”

This Mortgage is available on a range of different loan to values

| LTV band | Yr 1 rate | Yrs 2 and 3 rate |

| 90-95 | 3.59 per cent | 4.69 per cent |

| 85-90 | 2.79 per cent | 3.89 per cent |

| 80-85 | 1.84 per cent | 2.94 per cent |

| 75-80 | 1.49 per cent | 2.59 per cent |

- This mortgage is for house purchase only. Buy-to-let, shared equity and shared ownership mortgages are excluded.

- £995 product fee, and £265 Mortgage Account Fee.

- Breathing Space mortgages are subject to current lending criteria and affordability assessment.

- Mortgage deal is portable for those moving to a new home.

- 3 per cent early repayment charges apply for the three year period across all Breathing Space products.

Other options

However, mortgage broker Tyler Mortgage Management is warning first-time buyers against rushing to take out this home loan, arguing that it is largely a marketing gimmick and better value deals can be found elsewhere on the market.

Simon Tyler has crunched the numbers on the 85-90 per cent LTV TSB Breathing Space loan, which offers a lower fixed rate in the first year (2.79 per cent) than in the second and third years (3.89 per cent).

“This is not a new idea and in fact the relatively high fees totalling £1,610 make this quite an expensive product for those looking to save money,” says Tyler.

There is a £995 product fee, £265 mortgage account fee and it also assumes a valuation fee of £350.

“Indeed, you find lower costs by taking a deal from Nottingham Building Society by taking a three-year fixed rate which has no fees at all and that could be the greatest saving. They may tell you that you can add most of the fees to the loan but that is not in general a smart thing to do because you will end up paying interest on that extra capital for many years.”

Tyler says, based on a £150,000 loan over 30 years, the TSB deal would cost £615 a month, rising to £706 a month in years two and three, totalling £24,324 over the three year fixed period.

But The Nottingham has a three-year fixed rate at 3.49 per cent with no fees, which costs a flat £672 a month, or £24,192 over three years – that’s £132 less over the three-year term, and saves over £1,600 in fees.

Buy-to-let

Buy-to-let