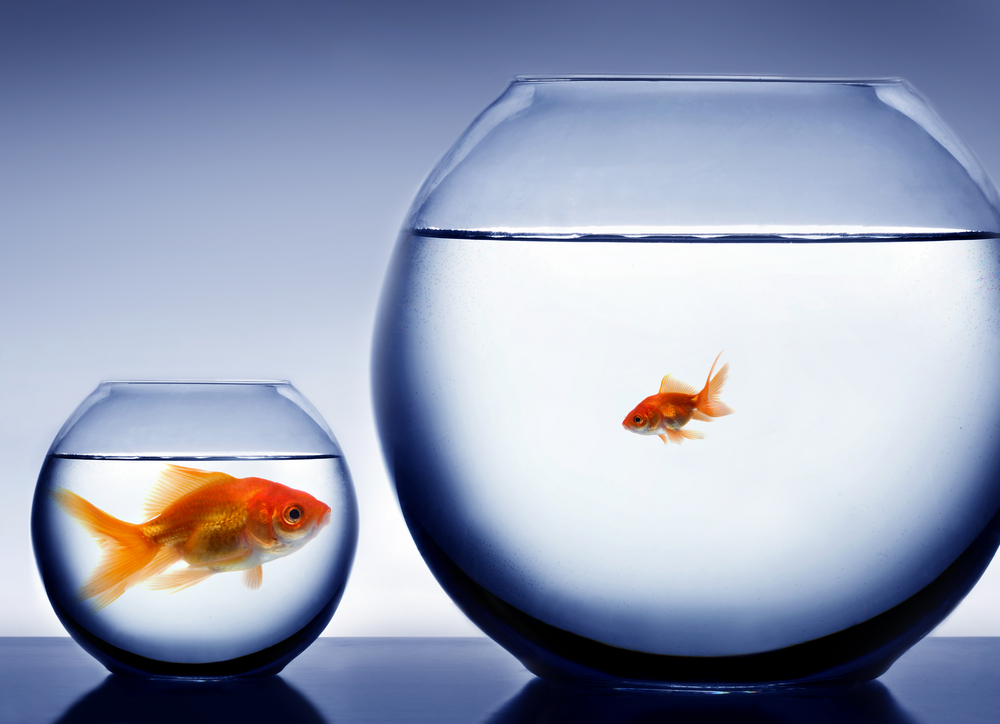

Solutions must be found for ‘last time buyers’ not just ‘first-time buyers’ if the UK’s housing crisis is to be effectively addressed, a report has found.

It identified there was not only a shortage of housing in the UK, but a deficiency of the right kind of homes and this was making it harder for many older homeowners to downsize.

It identified there was not only a shortage of housing in the UK, but a deficiency of the right kind of homes and this was making it harder for many older homeowners to downsize.

By building properties such as retirement homes and social housing there was more chance of supporting the changing needs of our society, the paper by the Centre for the Study of Financial Innovation (CSFI) found.

Report author Professor Les Mayhew of the Cass Business School, explained one of the major factors affecting the housing crisis was the growing and ageing population.

This was coupled with the fact many older people were living in homes which no longer suited them, but which they could not move from due to a lack of suitable alternatives.

He said: “By taking a long view, the research clearly shows the origins of today’s housing crisis and what can be done to tackle it. A better alignment of the housing stock with housing needs, along with improved financial incentives, would significantly alleviate housing pressures to the benefit of all.”

Passing on homes to the next generations

The report forecast, going forward, there would be a rise in households with couples in their 60s and an increase in one-person households inhabited by people in their 70s and 80s. Prices would fall in the 2020s, it predicted, as Baby Boomers began to pass on their homes to the next generations.

Yet, while this helped some problems, it did not help those getting on the housing ladder or those stuck in too-large homes, the report said.

More social housing

Building suitable properties for people to downsize into would help, said the report, as would creating more social housing for young families.

Sue Hayes, group managing director – retail finance, at challenger bank Aldermore, which also supported the study, said: “The report provides many practical and achievable recommendations on how the UK can expand the options for older homeowners and support their financial freedom.

“This will require changing mind-sets and a collective refocus from Government and the housing industry towards helping last-time buyers. The effect could have a substantial impact in tackling the wider housing crisis.”

How mortgage lenders can help

Stuart Wilson, corporate marketing director at equity release lender more2life, said the report had helped to move along the debate on solving the housing crisis.

He explained how its own research had found more than half of retirees had been unable to downsize because they couldn’t find a property which was a suitable size. Others were put off by the high cost of moving or because they were emotionally attached to their homes.

“It highlights,” he said, “that rather than just focusing on first-time buyers, we need to consider how we can help older homeowners make choices around retirement that benefit the wider society.”

Meanwhile, Nick Sanderson, CEO of Audley Group, said the report highlighted that simply building more homes was not enough.

He added: “The onus shouldn’t sit solely with the Government however, the whole housing sector, including mortgage lenders and homebuilders, must be more innovative to support older homebuyers. If done correctly the entire country will reap the societal and economic benefits.”