More house purchases were approved throughout 2014 despite the cooling of the market at the end of the year, new data from the British Banker’s Association reveal.

The number of approvals was 9 per cent higher than in 2013, even though there was a steady decline over the second half of 2014, triggered by the implementation of the Mortgage Market Review in April.

The number of approvals was 9 per cent higher than in 2013, even though there was a steady decline over the second half of 2014, triggered by the implementation of the Mortgage Market Review in April.

While high-street banks let more home buys pass through, they blocked a bigger number of remortgaging deals than in the previous year. Remortgaging approvals fell by 6 per cent.

Approvals for equity withdrawal hit rock bottom, with their lowest annual total yet, of 81,000.

The recent slowdown is not expected to linger long though. The improving financial situation of UK households will soon filter through to the market, which is indicated by growing personal lending.

“The mortgage market has been softening since the spring, but for customers taking out home loans right now there are some great deals and we expect the market to begin to grow again this year.

“Robust employment data is making many of us feel more secure in our jobs and optimistic about our futures. That’s now feeding through to personal lending and credit card data, suggesting people are happy to finally replace the car or spend on household improvements,” Richard Woolhouse, chief economist at the BBA, commented.

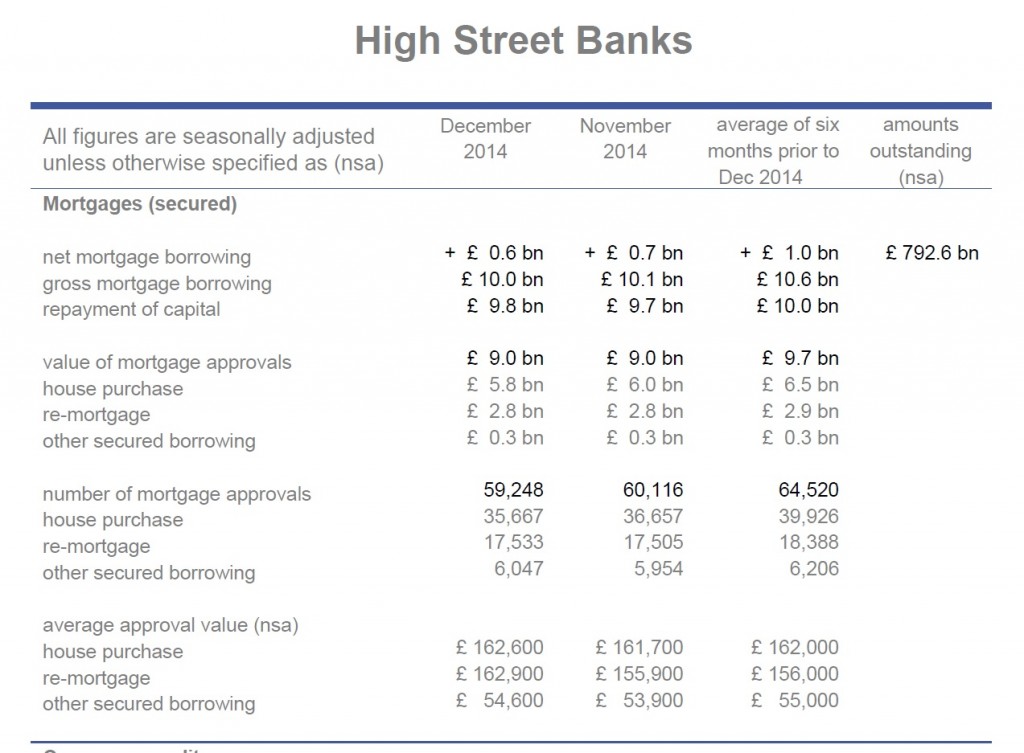

Source of data displayed: BBA