The number of residential property transactions, adjusted for seasonal effects, has been on a slight downward trend in the past few months, according to the latest HMRC data. The number of seasonally-adjusted transactions in February 2015 amounted to 100,510, provisional figures show. This is an increase of 2.5 per cent from January, but a decline of 7.9 […]

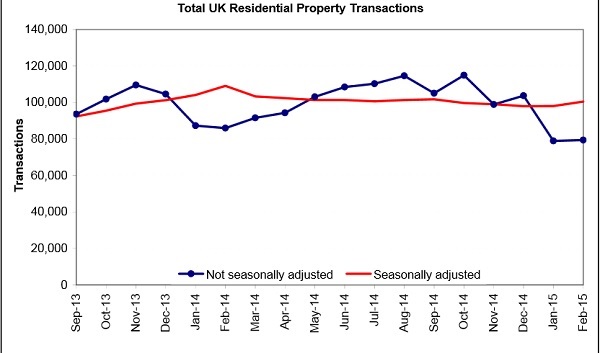

The number of residential property transactions, adjusted for seasonal effects, has been on a slight downward trend in the past few months, according to the latest HMRC data.

The number of seasonally-adjusted transactions in February 2015 amounted to 100,510, provisional figures show. This is an increase of 2.5 per cent from January, but a decline of 7.9 per cent as compared to February 2014.

While the the number of transactions after seasonal adjustment is on a growing track, the non-adjusted figures show a more moderate development of the market and a slightly bigger decline on an annual basis.

Commenting on the figures, Dev Malle, group sales director at conveyancing specialist myhomemove, said:

“The housing market has been rife with speculation about whether the general election will cause a big slowdown in the property market, and February’s figures reflect the further tapering of activity by buyers and sellers alike as uncertainty looms. However, the year-on-year comparison between this year and last makes for more encouraging viewing than many anticipated; a seasonally adjusted fall of 7.9% compared to last year certainly doesn’t suggest that the life has been sucked out of the market. We expect the number of housing transactions to continue their long-term recovery once greater certainty is in place after the election.

“Aside from the political uncertainty caused by the general election, our view is that this year looks set to be a very favourable time for buyers and sellers alike. We expect housing market activity to improve as consumer confidence continues on a positive trend, fuelled by 0% inflation, falling unemployment levels and improving real wages. Easier access to capital combined with low Bank of England interest rates mean that lenders are likely to continue with aggressive mortgage pricing.”