Mortgage arrears and home repossessions, which have been on the decline lately, shrunk again in the second quarter of 2015, the latest data from the Council of Mortgage Lenders (CML). There were 132,600 mortgages in arrears of three months or more, which was just 1.19 per cent of all loans or the lowest rate since the […]

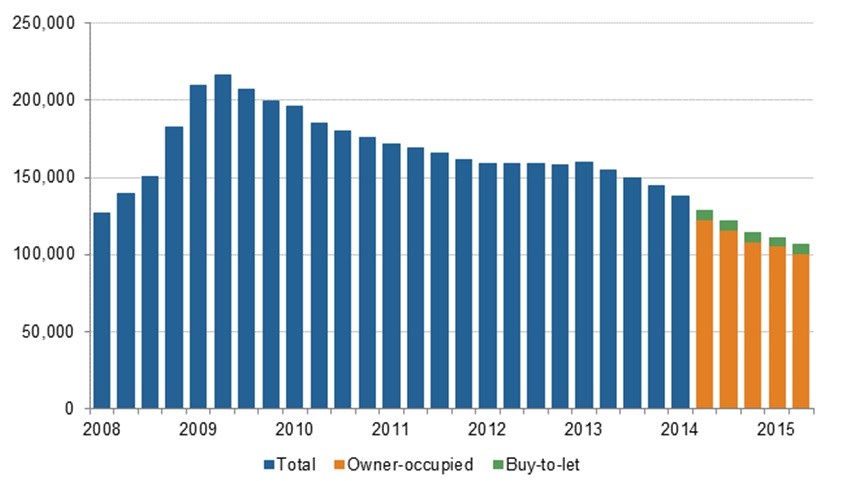

Mortgage arrears and home repossessions, which have been on the decline lately, shrunk again in the second quarter of 2015, the latest data from the Council of Mortgage Lenders (CML).

There were 132,600 mortgages in arrears of three months or more, which was just 1.19 per cent of all loans or the lowest rate since the first quarter of 2008.

There were 132,600 mortgages in arrears of three months or more, which was just 1.19 per cent of all loans or the lowest rate since the first quarter of 2008.

Mortgages in arrears in both the owner-occupier and buy-to-let markets either fell or remained unchanged during the period. This was observed across all arrears bands, none experienced a worsening, the CML said.

The repossessions rate, which has already hit the lowest level ever recorded by the CML, fell further in the second quarter with just 1 in 5,000 homes being repossessed.

The data reflects borrowers’ improved ability to keep debt repayments under control as interest rates remain low and the economy improves.

CML director general Paul Smee said:

“Across all measures, mortgage arrears and repossessions are continuing to improve. We continue to see some amplification of the downward trend in repossessions, which may bring into question our repossessions forecast for 2015 as a whole.

“This trend is very welcome. Low interest rates are acting as a significant support for home-owners in general, and are likely to be helping to stave off low level arrears for stretched households in particular. As ever, we urge borrowers to think ahead to when interest rates rise, and to contact their lender without delay if they are in difficulty – prompt action helps to prevent problems worsening.”

Brian Murphy, Head of Lending at Mortgage Advice Bureau (MAB), comments:

“A record low for repossessions and the falling number of loans in arrears have been two of the big success stories for mortgage borrowers in the post-recession era. Both measures continue to show signs of considerable improvement, and consumers are clearly finding it easier to keep their personal finances from slipping away from their control.

“The record low base rate has played a big party in helping households keep their loan commitments in check. The prospect of a higher base rate is clearly the biggest single factor that threatens this progress, but rate rises will be slow and steady – giving consumers plenty of time to adjust. The tightening of loan criteria following the Mortgage Market Review (MMR) will also help keep things on a stable footing moving forward.

“Reactions to yesterday’s unemployment figures show the timing of the first rise remains a moving target, but homeowners should still take the chance to safety-proof their finances well in advance. Locking into the current rates before the winds change is likely to prove a wise move, and there has seldom been a better time to seek a well-priced remortgage deal.”

*

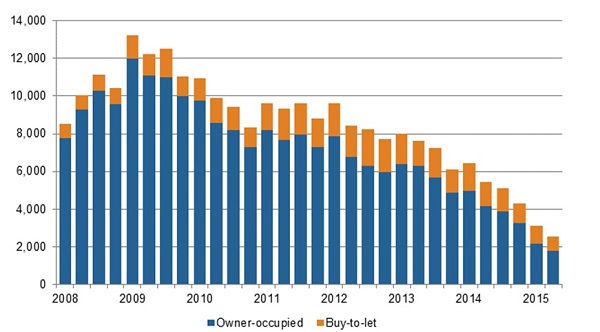

Repossessions, buy-to-let and owner-occupied markets

Arrears on mortgages, 2.5% or more of balance outstanding