The North-South divide for house prices is set to narrow this year, according to a new report. The latest Hometrack UK Cities House Price Index has found regional cities outside of the South East are registering greater house price growth than London. It revealed that house price inflation in Manchester rose by 8.9% in 2016 – […]

The North-South divide for house prices is set to narrow this year, according to a new report.

The North-South divide for house prices is set to narrow this year, according to a new report.

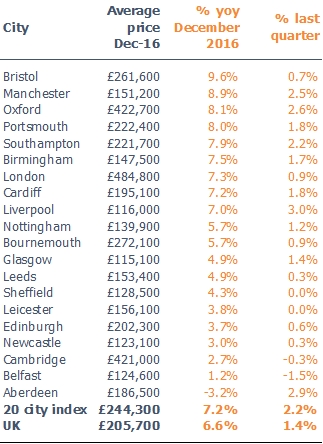

The latest Hometrack UK Cities House Price Index has found regional cities outside of the South East are registering greater house price growth than London.

It revealed that house price inflation in Manchester rose by 8.9% in 2016 – the highest since July 2005.

London is now the seventh ranked city in Hometrack’s house price growth rankings. Other cities to outperform London over the last 12 months include Oxford (8.1%), Portsmouth (8.0%), Southampton (7.9%) and Birmingham (7.5%).

In the capital house prices are now on average 14.2 times earnings, which is a record high level of housing unaffordability and points towards a period of price re-adjustment over the coming years.

The only city to surpass the growth seen in Manchester was Bristol, where prices increased by 9.6% over the last 12 months, although affordability pressures here are expected to lead to a slowdown in growth in 2017.

On average, UK city house prices grew by 7.2% in 2016, down from 7.7% the previous year.

Richard Donnell, Insight Director at Hometrack said: “This latest UK city house price index reveals how the impetus for house price growth is shifting to more affordable cities where the recovery in house prices has been more muted in recent years. Price rises are gaining momentum in cities where low mortgage rates are yet to be fully priced into housing.

“In Manchester the underlying market conditions remain strong, with the supply of homes for sale only just managing to keep pace with demand. This is keeping the upward pressure on house prices. A similar picture is emerging in other regional cities such as Birmingham and points to continued, above average price inflation in regional cities over the next 12 months.”

“2017 looks set to be a year when the North-South divide for house prices might finally start to narrow once again.”

Stephen Smith, director of Legal & General Housing Partnerships, said: “Manchester has replaced London as the UK city where house prices are rising at the fastest rate – a dubious accolade at best! Great news for homeowners in the city, perhaps – but not much help to those Mancunians trying to move up the ladder or to buy a starter home for their family.

“More widely, the fact that the average UK city house price fell by 0.5% in 2016 compared to 2015 is no immediate cause for concern to homeowners, nor will it provide much comfort to those trying to get on the ladder.

“Meaningful change will only be achieved by addressing the structural flaws in our housing market. With the promise of a Housing White Paper by the end of the month, the Government has the perfect opportunity to build on its promises of providing our country with the millions of affordable homes that we so desperately need.”

Rise in house prices